|

Shareholder Chua Bock Eng’s letter to the Low Keng Huat (LKH) board, sent after the voluntary conditional privatisation offer at S$0.72 per share, reads like a calm but firm challenge to “do better” for minorities.

|

His letter does not appear out of nowhere.

| • The Offer will close at 5.30 p.m. (Singapore time) on 14 Jan 2026. • The IFA recommendation is expected to be released at 2025 year-end or early 2026. |

Earlier in 2025, Chua had already written to the board with a detailed set of questions on the FY2025 Annual Report, probing project Klimt Cairnhill’s actual IRR, the company’s edge in property development, and the persistence of weak ROA and ROE versus peers.

He also drilled into related‑party exposure in the supply chain and raised the uncomfortable question of whether professional management might deliver better returns than the founding family.

(His questions and the management's answers can be found on the SGX website)

| The deep asset backing – and the RNAV gap |

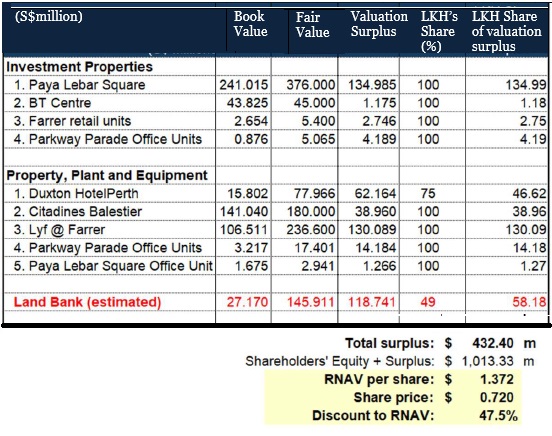

In his post‑offer letter dated 2 Dec 2025, Chua highlights LKH’s portfolio of high-quality, largely legacy assets – including Paya Lebar Square, lyf Farrer and Duxton Hotel Perth – and argues that their carrying values sit well below market.

On his estimates, the revalued net asset value (RNAV) adds up to S$1.37 per share, which means the S$0.72 offer is barely half of the underlying asset worth.

This RNAV angle is not new for him.

In his earlier analysis of the FY2025 AR, he had broken down individual properties such as Paya Lebar Square, Citadines Balestier and lyf Farrer, calculated the valuation surpluses and arrived at an RNAV of about S$1.32 per share versus a market price near S$0.305 – roughly a 77% discount then.

Clearly, the privatisation offer leaves a very large slice of value on the table for LKH offeror, which is Consistent Record Pte. Ltd., a special purpose vehicle controlled by LKH managing director Marco Low.

| Where Ben Paul’s BT piece fits in |

Senior journalist Ben Paul’s Business Times article on 4 Dec 2025 provides some context to why Chua is pushing for a higher price.

On the surface, the offeror argues that LKH’s future profits from its property assets will be irregular, variable and slow to realise, and the recent numbers do look ugly – a S$10.2 million loss in the six months to Jul 31, with revenue tumbling 85% to S$38.7 million as Klimt Cairnhill reached completion.

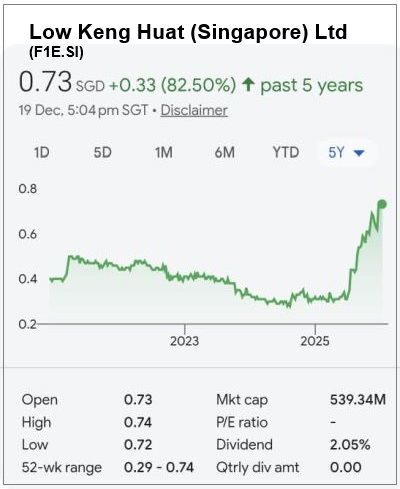

Chart: GoogleYet, according to the BT writer, over the 15 years to Nov 28, LKH actually delivered a total shareholder return of about 201.6% (with dividends reinvested), beating the STI’s 153.4% and outdoing big names like UOL and Hongkong Land.

Chart: GoogleYet, according to the BT writer, over the 15 years to Nov 28, LKH actually delivered a total shareholder return of about 201.6% (with dividends reinvested), beating the STI’s 153.4% and outdoing big names like UOL and Hongkong Land.

The BT article also recalls astute moves by management, such as the 2014 Westgate Tower deal that was later recycled into more retail exposure at Paya Lebar Square, and the AXA Tower investment that yielded a significant gain.

Against that backdrop, the “weak prospects” story being used by the offeror to justify a modest offer looks more like a convenient narrative.

| What Chua is asking for |

Chua wants the independent financial adviser (IFA), Zico Capital, to clearly highlight RNAV in its circular so shareholders can see the full asset picture.

| "We strongly urge the Board to target a revised price in the S$0.90 to S$1.00 range to bridge the gap and demonstrate that the Independent Directors have actively sought to safeguard the minority shareholders’ interest." -- Chua Bock Eng |

And he urges the independent directors to actively engage the offeror for a higher price.

With RNAV estimated around S$1.37, he proposes a compromise range of S$0.90–S$1.00 per share – still leaving substantial upside for the offeror while giving current shareholders a fairer deal.

The 72-cent offer is conditional upon the offeror receiving acceptances that would result in it holding not less than 90% of the total voting rights, excluding shares already held by the offeror and its concert parties. Pre-offer, the LKH MD had a total interest of about 54.13% of the company’s shares. Taken together, Chua’s AR questions and his post‑offer letter and the BT article paint LKH as an asset‑rich, conservatively but astutely run developer and hospitality owner whose stock price has long lagged its underlying value. |

→ See also another undervalued asset play: STAMFORD LAND: This Company is Cash-Rich, Owns Undervalued Hotels, and Offers Margin of Safety

→ See also another undervalued asset play: STAMFORD LAND: This Company is Cash-Rich, Owns Undervalued Hotels, and Offers Margin of Safety