Translated by Andrew Vanburen from a Chinese language piece by Victory Securities in Sinafinance

NOT EVERYONE was wringing their hands when the global financial system went south in a hurry back in 2008.

One clear beneficiary was Mainland China’s domestic tourism and hospitality sector.

Shortly after the grand spectacle that was the Beijing Games three summers ago, central economic planners began championing the market right under their noses, i.e. the 1.3 billion consumer-strong domestic marketplace.

In fact, they had little choice as traditional export markets in North America and Europe simply were not financially capable of carrying China’s economy to the same extent as the PRC’s trading partners had been doing for several decades.

So it was only natural that the country began looking inward for new customers.

Pro-growth policies for domestic tourism and hospitality industries were implemented.

And despite there being no apparent slowdown in cash-rich Chinese tourists hopping planes to traditional spots like New York, LA, Paris and Sydney, these same travelers also began to take their own country much more seriously as a tourist destination.

Last year, receipts from domestic tourism in China rose by nearly a fifth to 2.2 trillion yuan.

And all indicators point to continued strong growth momentum for the domestic tourism industry.

This is simply too tempting a pot of gold to overlook.

The end result is that all these travelers crisscrossing Mainland China do need a place to hang their hat, after all.

Therefore, listed PRC-based hotels -- especially Shanghai Jin Jiang International Hotels Group Co Ltd (HK: 2006) – owner of Star Hotels, Peace Hotel and Kunlun Hotels -- and Home Inns & Hotels Management Inc (Nasdaq: HMIN) are likely to be hot properties.

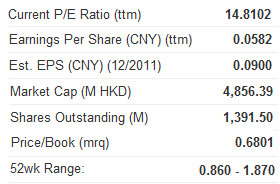

Compared to Hanting Inns & Hotels (Nasdaq: HTHT), Jin Jiang’s share price is significantly undervalued.

Additionally, Jin Jiang will benefit from its heavy presence in the Disneyland theme park complex in Shanghai, a profitable perch that will surely stimulate revenue growth going forward thanks to the expected enduring love affair with the Disney experience for years to come.

The American theme is recurrent to the Jin Jiang resurgence.

Not only is the vaunted hotel brand piggy-backing on the anticipated throngs of families set to stream through Mainland China’s first Disney venue, but the firm has been doing well in the US itself with its New York-listed Home Inns assets.

The original Jinjiang Hotel in Shanghai traces its history back to the 1930s, originally serving as a complex of serviced apartments, boutiques, eateries, gardens and a community hall.

Back in the early 1970s, the hotel made history, housing the US delegation and serving as the site of the signing of the Shanghai Communique, which effectively normalized Sino-US relations.

Then came the roaring 80s and 90s when China went on a major high-rise hotel building frenzy, which led to the site’s significant renovation in 1998.

The company owns or manages more than 460 hotels and Inns with nearly 80,000 rooms/suites and is ranked 17th among the world's top 300 hotel companies.

Jin Jiang Hotels is the largest Asian owned hotel company.

So now the firm, which has nearly half a thousand PRC hotel venues under its umbrella ranging from two stars to five, is now benefitting from China’s shift away from exports to the US and toward a concerted effort to pry open the billfolds of the home country’s 1.3 billion consumers.

See also:

SHENZHEN: Home Rentals Range From Cheap To Steep

OCT ASIA, SUNAC CHINA: Chasing Hot Properties