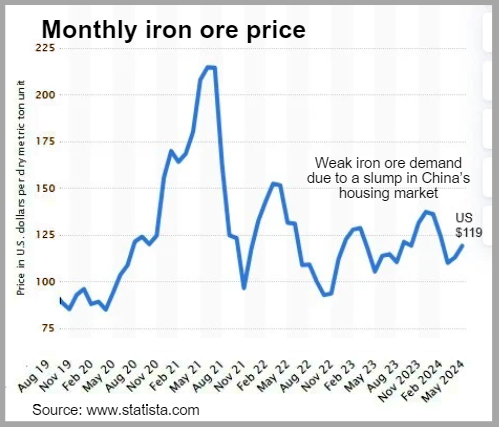

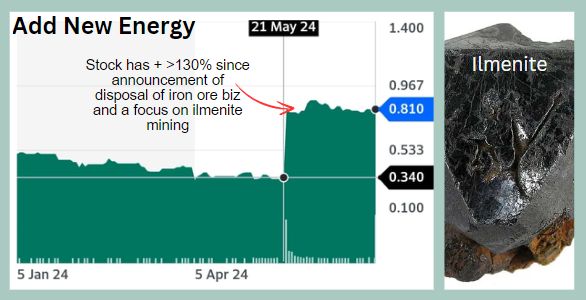

| • Once it was one of the largest iron ore producers in Shandong Province in China. But iron ore, which is used in steel production, has its cycles, and HK-listed Add New Energy has decided to dispose of its core business in the midst of a housing slump in China. • With the disposal proceeds, Add New Energy (market cap: HK$284 million) will invest in developing its other core asset -- mining for ilmenite at Zhuge Shangyu ilmenite mine, also in Shandong Province. Investors are cheering the move, pushing the stock price +130% since the May 2024 announcement.  • Ilmenite is a black mineral that is a significant source of titanium dioxide (TiO2), which is widely used in various industrial applications such as pigments, paper coatings, plastics, and other products. China is by far the largest producer of titanium dioxide in the world with demand growing steadily. • Read more below ... |

By Peter Chan, Unicorn Market Analytics

|

Add New Energy sheds light on its new ilmenite mining business Iron ore prices has had a bumpy ride year to date in 2024. |

Hong Kong-listed Add New Energy Investment Holdings Group Limited (02623.HK) has recently announced that it will dispose of its interests in the following:

| • mining rights of Yangzhuang Iron Mine (including the ore processing plant), • exploration rights of Qinjiazhuang Ilmenite Mine, • Yangzhuang Iron Mine production land (including leased and contracted land), buildings, production facilities (which are included in the fixed assets list of Yangzhuang Iron Mine and the ore processing plant) |

The total consideration: about RMB315 million in cash, a valuation that exceeds the listed company’s market capitalization.

|

Stock price |

81 HK c |

|

52-week range |

30 c – $1.21 |

|

Market cap |

HK$284 m |

|

PE (trailing) |

4.5 |

|

Dividend yield (trailing) |

-- |

|

1-year return |

40% |

|

P/B |

0.53 |

|

Source: aastocks.com |

|

According to Add New Energy, since the suspension of production of the Yangzhuang Iron Mine in October 2015, the iron core assets have been accruing maintenance costs, and it had been able to generate income from the processing production line, while the mine was struggling to operate.

Given the uncertainties in the global iron ore market due to declining demand from China, Add New Energy has made a smart move to dispose of its interests in these iron ore assets when their valuation is still good.

This will give Add New Energy the ammunition to invest in other mining assets that it has more capabilities and confidence in generating better profits.

Net proceeds from the disposal is approximately RMB289 million.

The Company intends to utilize the proceeds to invest in Zhuge Shangyu ilmenite mine -- ie increase the scale of mining and infrastructure of the production line there.

The investment in new projects in the Shangyu Mine and processing plant this year is estimated to be RMB500 million, mainly focusing on mining, ilmenite ores production line construction, living and office area construction, a science and technology center and production automation construction.

| Net proceeds from the disposal is approximately RMB289 million. The Company intends to utilize the proceeds to invest in Zhuge Shangyu ilmenite mine -- ie increase the scale of mining and infrastructure of the production line there. The investment this year is estimated to be RMB500 million. |

The existing production system of Shangyu Park is operating normally, and the construction of the second-phase crushing and sorting system and regional planning have commenced.

At present, the small-scale mining permit of Zhuge Shangyu Mine has been completed smoothly.

In the second half of the year, the construction of Zhuge Shangyu Processing Plant will be completed basically. Some ore will be mined for trial production if conditions permit.

It will become a new driver of profit growth for Add New Energy.

The Company currently possesses a mining permit of Zhuge Shangyu ilmenite mine with an approved annual mining production scale of 0.8 Mt. It has contracted for the construction of a new 10.0 Mt processing line and production line in the mine in the current year.

In 2023, about RMB97.0 million had been invested in processing and production lines in Zhuge Shangyu ilmenite mine.

|