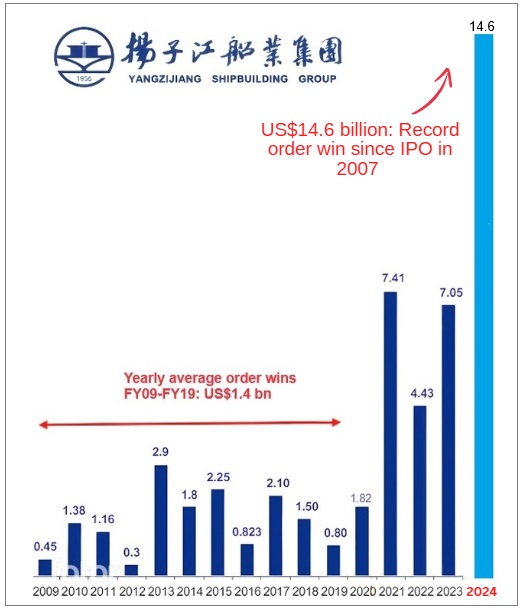

• DBS Research has just added nearly $1 to its target price of Yangzijiang Shipbuilding -- from $2.88 to $3.80. "The market has yet to fully appreciate the potential for earnings growth from its record-high order backlog as well as potential yard expansion of c.20%-30%," analyst Ho Pei Hwa wrote in a new report.  • S$12.1 billion market-capped Yangzijiang achieved order wins in 2024 that amounted to nothing short of astonishing (see chart below), and tracks the previous 3 years of strong wins.

Source: CGS, Company Source: CGS, Company• The shipbuilding industry is experiencing a structural uptrend due to the energy transition and decarbonisation megatrends. So demand for new vessels is likely to remain strong for the foreseeable future. Read more in excerpts from DBS's report below ... |

DBS analyst: Pei Hwa HO

| A promising dividend-paying growth stock |

| What's new • Favourable steel cost and forex to sustain margin expansion into 2025

• Raise FY24-26 forecast by 5%-11%; compelling 2-year 14% CAGR • More legs to run; reiterate BUY with higher TP of SGD3.80; stock offers double-digit growth with decent 3%-4% dividend yield |

||||

Investment Thesis:

Leading shipbuilder poised to ride the clean energy wave. Yangzijiang is the largest and best-managed private shipbuilder in China with a wide economic moat to compete against Chinese and Korean peers.

It has at least a 5ppt cost advantage through yard optimisation as well as superior project execution and cost control.

It successfully made a foray into the LNG carrier market and targets to improve its corporate ESG.

| Earnings growth and ESG advancement are key catalysts |

Yangzijiang’s improving corporate governance and pivot towards cleaner vessels such as dual-fuel containerships and gas carriers, which now account for ~70% of its orderbook, could draw more interest from ESG funds.

| "Yangzijiang is amongst the rare gems listed on the SGX that offer double-digit growth with decent 3%-4% dividend yield. Valuation remains undemanding at 2.1x FY25 P/Bv and 9x PE, at a 21.5% and 59% discount to industry peers, respectively. This is unwarranted given Yangzijiang’s superior financials, delivering the highest ROE of 24% (vs. industry average of 15%) and a high dividend yield." -- Ho Pei Hwa, analyst |

Securing more orders for LNG carriers allows Yangzijiang to scale up and strengthen its market positioning.

The LNG carrier market has high technical barriers to entry and could be a significant growth opportunity for Yangzijiang.

The market has yet to fully appreciate the potential for earnings growth from its record-high order backlog as well as potential yard expansion of c.20%-30%.

| Record-high order backlog boosts earnings visibility through 2027 |

Yangzijiang’s yards are full through 2027 with an orderbook of c.USD24bn.

This is expected to propel an earnings CAGR of ~14% in the next two years, driven by both revenue growth and margin expansion, as c.65% of its orderbook is made up of containership orders that command higher value and margins.

|

Key Risks

Revenue is denominated mainly in US dollars.

Assuming the net exposure of ~50% is unhedged, every 1% depreciation in the USD could lead to a 1.5% decline in earnings.

Every 1% rise in steel cost, which accounts for about 20% of cost of goods sold (COGS), could result in a 0.7% drop in earnings.

Full DBS report here.

See also: YANGZIJIANG: After a remarkable 1H2024, this S-chip is on track to make S$1 billion net profit this year