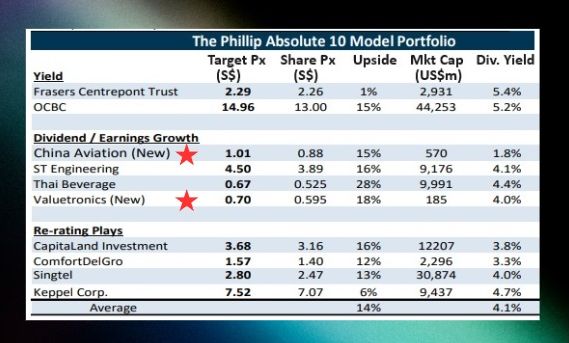

| • What's your approach to investing? If you like hard fundamentals, Phillips Securities has 2 names for you -- and, boy, do they have nice attributes on paper. • They have "attractive valuations and dividend yields, cash-rich balance sheets and good earnings visibility," says Phillips Securities in a new year report. • These 2 are China Avaiation Oil and Valuetronics. And, wait, there's another 8 stocks that the brokerage has in its model portfolio (see table below). As for the 2 new additions, read on for what the analysts say .... |

| CHINA AVIATION OIL |

• International passenger traffic in China surged 12-fold in the first 11 months of 2023.

|

CHINA AVIATION OIL |

|

|

Share price: |

Target: |

The recovery still has legs. Nov 23’s volume was just 55% of Nov 19’s level and estimated to reach 71% in Mar 2024.

Demand could be turbocharged with the easing of visa restrictions for Chinese tourists in some Asian countries. Peggy Mak, research manager• Major Chinese airlines have returned to profitability in 3Q23 and booked positive operating cash flows in 1H23.

Peggy Mak, research manager• Major Chinese airlines have returned to profitability in 3Q23 and booked positive operating cash flows in 1H23.

They have resumed taking deliveries of aircraft on order. China Eastern and Air China recently placed new orders for passenger jets, scheduled for delivery in 2024.

• Maintain BUY with a TP of S$1.01, derived from DCF model.

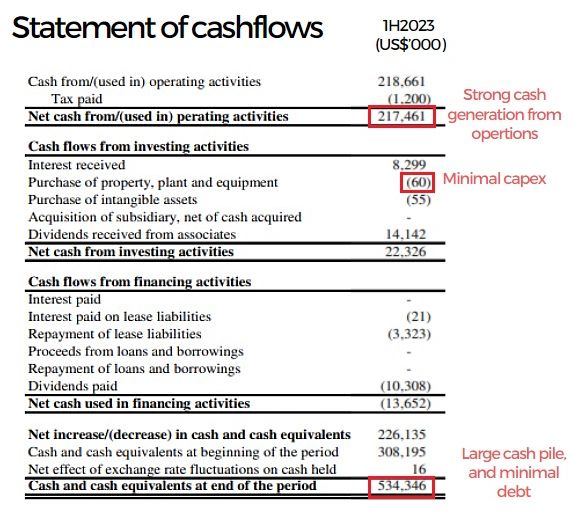

We expect net profit to double over the next two years. About 56% of the market cap is in net cash of US$308mn (as at end 2022). Screenshot of a section of CAO's cashflow statement for 1H23. The cashpile of US$534.3 m is the equivalent of S$711 million, or 96% of its current market cap.

Screenshot of a section of CAO's cashflow statement for 1H23. The cashpile of US$534.3 m is the equivalent of S$711 million, or 96% of its current market cap.

| VALUETRONICS |

|

VALUETRONICS |

|

|

Share price: |

Target: |

• 1H24 PATMI grew 42% YoY to HKD82.1mn, and above our expectations. Revenue and PATMI were 42%/62% of our FY24e estimates.

The revenue decline was due to lower component prices. The company announced a special dividend of HKD4 cents in addition to interim HKD4 cents.  Paul Chew, Head of Research• Earnings growth was driven by

Paul Chew, Head of Research• Earnings growth was driven by

(i) gross margin expansion from lower component prices and a weaker renminbi;

(ii) an increase in interest income; and

(iii) lower operating expenses, especially depreciation.

• We maintain our BUY recommendation with a target price of S$0.70. We peg our target price to the industry valuation at 11x PE.

With the current cash hoard of HKD1.14bn (or S$199mn), around 82% of the market capitalisation is net cash.

There is visibility of earnings growth over the next two years as Valuetronics’ four new customers ramp up production.

The company trades at a dividend yield of 5.8% and has an outstanding share buyback plan of approx. 47mn shares.

Full report here.