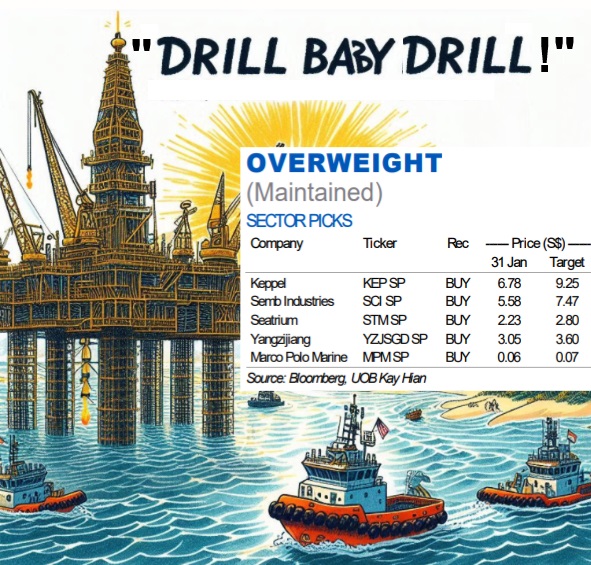

• Day rates for rigs and Offshore Support Vessels are likely to face upward pressure as oil drilling picks up under the Trump's "drill baby drill" directive. • For more, see excerpts of UOB KH’s report below..... |

Excerpts from UOB Kay Hian report

Analyst: Adrian Loh

Offshore Marine – Singapore

A New Year And A Rehash Of An Old Mantra

| The new Trump presidency and its rehashed mantra of “drill baby drill” should benefit the Asian O&M sector, assuming that higher levels of global offshore activity lead to tightness in the market that thus push up rig and OSV day rates. In our stock universe, we highlight that Seatrium has shipyard assets in the US and thus could see better-than-expected order wins given the pro-America sentiment in the US at present. Maintain OVERWEIGHT on the sector. Top picks are Seatrium and Marco Polo Marine. |

• Anaemic capacity growth in the O&M fleet should push rates higher. According to Clarksons Research, the global offshore support vessel (OSV) fleet, comprising of tugs, supply vessels and offshore drilling units, saw a 1.1% yoy growth in 2024.

|

Marco Polo Marine |

|

|

Share price: |

Target: |

While growth is projected to be stronger in 2025 at 1.7% yoy, half of this forecast is from mobile drilling units, and thus the likely anaemic capacity growth in vessels should underpin a better earnings outlook for the sector.

When applying a broad definition to offshore vessels and including vessel demand derived from the offshore wind industry, Fearnley Offshore believes that 2025 should see “the highest vessel activity level ever”.

• Brazil and FPSOs will be key growth drivers for Seatrium. STM is currently building eight of Petrobras’ 11 FPSOs that will be deployed offshore Brazil between 2H24 and 2028.

|

Seatrium |

|

|

Share price: |

Target: |

Apart from these, we highlight that there are another seven to 11 new FPSO requirements offshore Brazil that Petrobras has planned to come on-stream after 2029 but has yet to contract out.

Assuming medium-sized FPSOs, these projects could be worth US$20b-30b and will need to be awarded in the next 12-24 months if production timelines are to be met.

ACTION Adrian Loh, analyst• Maintain sector view at OVERWEIGHT. Adrian Loh, analyst• Maintain sector view at OVERWEIGHT. We like Seatrium (STM SP/BUY/Target: S$2.80) as we believe that the company will benefit from stronger offshore marine dynamics in 2025 as well as demand for offshore vessels and structures related to the renewables industry. We also like Marco Polo Marine (MPM SP/BUY/Target: S$0.072) as its vessels are exposed to potential upside in charter rates in 2025 and beyond. |

Full report here.