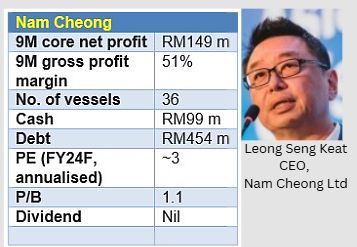

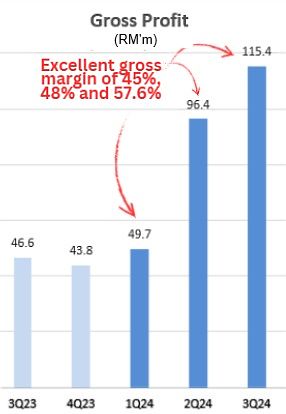

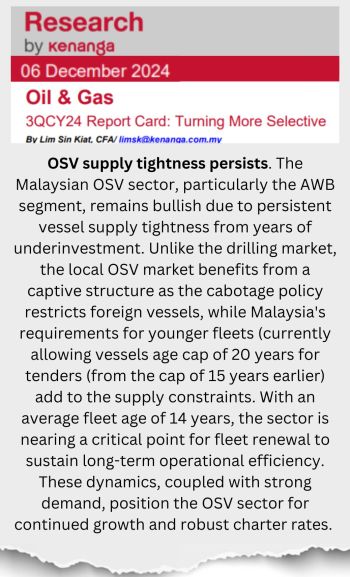

| While Nam Cheong Ltd's vessel chartering business is obviously doing well, its financial statements carry one-off items mainly as a result of a restructuring of its large debt in 1Q2024. The core earnings -- ie the ongoing business minus the one-offs -- take some accounting skills and more to decipher. That may help explain why investors price the Singapore-listed stock at a significantly lower valuation than Nam Cheong's peers listed on Bursa Malaysia.  At a recent stock price of 41 cents, Nam Cheong's market cap is S$160 million. At a recent stock price of 41 cents, Nam Cheong's market cap is S$160 million. For 9M2024, the core profit after tax, it turns out, adds up to RM149 million (S$45 million), said management at an investor briefing this week. Any investor can extrapolate the full-year earnings and conclude that Nam Cheong stock trades roughly at 3X PE. Pretty undervalued, right? Its oil & gas sector peers on Bursa trade at an average of 14X PE, according to Kenanga Research's 6 Dec 2024 report. |

As provided by CFO Chong Chung Fen, the breakdown for quarterly net profits excluding "other income" and "other expenses" is as follows:

- Q1: RM 24 million

- Q2: RM 55 million

- Q3: RM 70 million

Q4 is usually weaker in terms of vessel utilisation due to the seasonal monsoon kicking in from mid-November. The monsoon runs to early March, making Q1 the weakest quarter.

The CFO also said that Nam Cheong's fleet utilisation rates were 60% in Q1 and mid-80s% for both Q2 and Q3.

Rising charter rates played a part in boosting profits. Nam Cheong recently announced RM1.22 billion worth of contract wins for 12 of its vessels, representing one-third of its offshore suppport vessel (OSV) fleet.

Nam Cheong recently announced RM1.22 billion worth of contract wins for 12 of its vessels, representing one-third of its offshore suppport vessel (OSV) fleet.

The contracts are for three years, starting in 2025, with options for extension.

These vessels will operate under continuous utilization (365 days per year), significantly improving Nam Cheong's fleet utilization compared to spot charters which may have downtime between jobs. In the investor meeting, Nam Cheong CEO Leong Seng Keat offered his perspective of the deals.

In the investor meeting, Nam Cheong CEO Leong Seng Keat offered his perspective of the deals.

He said oil majors likely entered into those long-term contracts at current rates as they expected vessel supply would remain constrained and charter rates may rise further.

This strategic decision by the oil majors ensures stability in securing essential OSVs for their operations, avoiding potential price hikes in a tightening market.

Supply-demand dynamics have not been this good in a long time for OSV owners, underpinning the robust gross margin of 51% achieved by Nam Cheong in 9M2024.

The following are edited excerpts from the investor briefing:

Q: What are the supply-demand dynamics affecting the OSV market?CEO Leong Seng Keat: Supply constraints are significant due to limited new vessel construction and, just as important, existing vessels are aging and will not meet 20-year criteria of oil majors. |

SourceQ: The PE ratio of Nam Cheong stock (41 cents) is likely around 3X for FY24. Any comment on this valuation versus peers on Bursa Malaysia?

SourceQ: The PE ratio of Nam Cheong stock (41 cents) is likely around 3X for FY24. Any comment on this valuation versus peers on Bursa Malaysia?

A: This disparity reflects broader market trends where SGX-listed companies generally experience lower valuations compared to their Bursa Malaysia counterparts.

It is not unique to Nam Cheong but indicative of market sentiment across exchanges.

Q: How does the company view raising funds or reducing debt further?

A: The company sees value in raising funds and reducing debt but will carefully balance this with stakeholder interests and business growth opportunities.