What’s happening in the semiconductor world? Let’s break it down.

DBS Research identified 3 big themes in its brief 16 Dec report.

|

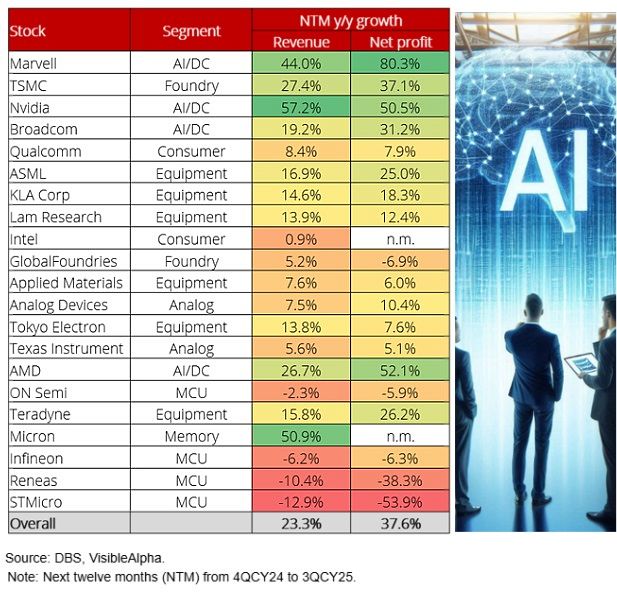

Check out this list for the companies with high NTM (next 12 months) growth:

AI: Artificial Intelligence

AI: Artificial Intelligence

DC: Data Centre

How Are the Big Players Doing?

AMD: Riding the AI Wave

AMD is having a moment. Its data center business grew by an eye-popping 122% in 3Q2024, thanks to its AI-focused chips.Analysts think AMD could see its earnings jump by a stunning 56% in 2025.

While Nvidia might still be the king of AI chips, AMD could prove it’s no slouch.

By the way, Jensen Huang and Lisa Su are cousins and the CEOs of the top 2 chip companies, Nvidia and AMD, respectively.

Texas Instruments: Playing the Long Game

TI has had a tough time lately but remains a leader in analog semiconductors used in cars and factories.Analysts have mixed views on TI's growth prospects but some project a significant cyclical recovery.

Micron: Memory Champ

Micron is making waves in memory chips, especially with its High Bandwidth Memory tech that’s crucial for AI systems.Citigroup sell-side analyst Christopher Danley recently published a bullish note, maintaining a buy rating and a $150 price target.

Teradyne: Testing Pays Off

Teradyne specializes in testing semiconductors—a less glamorous but essential part of the industry.

At a tracking website, 9 analysts out of 12 rate Teradyne a "strong buy" or "buy", with none calling for a "sell".