| Looking for some stock ideas as we head into 2025? Let’s dive into CGS International’s report published on 4 Dec, which is packed with insights and recommendations for over 80 stocks. But don’t worry, we’ve done some sifting for you. Using just two criteria—stocks with the highest percentage upside and those trading below 15x forecast CY25 P/E—we’ve pulled out a shortlist to get you started. Now, this is just a starting point. Some sectors have high average PE ratios, some lower for their own reasons. There are other key metrics (such as dividend yields) to weigh. In addition, high returns are never guaranteed (we’ve all seen analyst predictions go the wrong way!). Plus, property stocks and REITS didn’t make the cut here since their valuation metrics are a whole different ballgame. So, proceed with caution and do your homework. |

|

Company |

Closing Price |

Target Price |

Upside |

P/E CY25F |

| Hong Leong Asia | 0.82 | 1.20 | 47% | 7.1x |

| Sembcorp Industries | 5.82 | 7.32 | 39% | 8.9x |

|

Japfa |

0.39 |

0.53 |

38% |

4.2x |

|

Boustead |

1.03 |

1.40 |

36% |

9.3x |

|

China Aviation Oil |

0.90 |

1.20 |

33% |

6.8x |

|

Yangzijiang Shipbuilding |

2.43 |

3.20 |

32% |

9.2x |

|

CSE Global |

0.48 |

0.62 |

31% |

9.3x |

| Jumbo | 0.28 | 0.36 | 31% | 10.7x |

|

Keppel |

6.74 |

8.78 |

30% |

13.4x |

|

Pan-United |

0.56 |

0.72 |

29% |

9.1x |

| Hyphens Pharma | 0.29 | 0.35 | 23% | 7.8x |

|

ComfortDelGro |

1.47 |

1.80 |

22% |

13.1 x |

The following are what CGS' analysts say:

• Hong Leong Asia (Add, TP S$1.20, CP: S$0.82). We believe HLA is an underappreciated proxy for the SG/MY construction industry upcycle

as its share price implies c.2.4x P/E for its BMU unit.

Its Yuchai unit is also recovering from the industry downcycle.

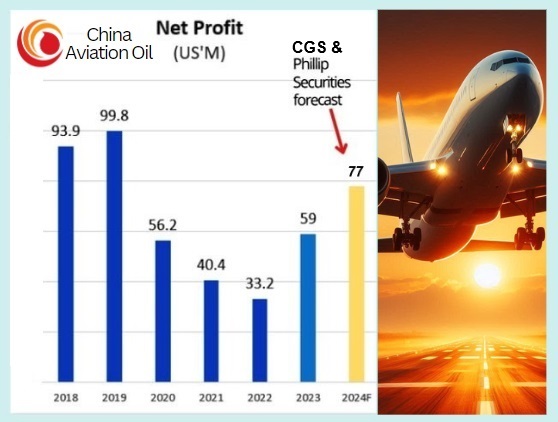

• China Aviation Oil (Add, TP S$1.20, CP: S$0.90). CAO is set for a healthy earnings recovery trajectory over the coming quarters and is an undervalued play on China’s outbound traffic recovery.

Valuation at 7x CY25F P/E has yet to price in this recovery.

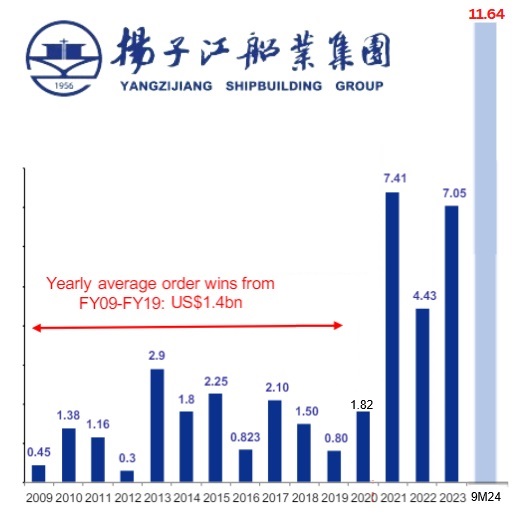

• Yangzijiang Shipbuilding: Accumulate on share price weakness. YZJ is currently trading at a c.30% discount to peers’ 12x 2026F P/E, which we think presents a buying opportunity, in view of YZJ’s strong orderbook with deliveries scheduled till 2029F and superior ROE of 27%.

We reiterate our Add call and unchanged TP of S$3.20, in line with regional peers (Singapore, Japan, Korea yards) at 11x CY26F P/E.

We note that Chinese listed yards are trading at c.16x CY26F P/E. Key re-rating catalysts include capacity expansion and stronger-than-expected order wins. We maintain our FY25F/26F order win target at US$5.5bn p.a.

Downside risks: a surge in steel costs, order cancellations, and unfavourable policy action against the Chinese shipbuilding industry by the newly elected US government.

• CSE Global: Reiterate Add, TP unchanged at S$0.62. We reiterate Add as we think CSE is well positioned to take advantage of electrification trends over the next 2-3 years.

Our TP stays at S$0.62, still based on 12x CY25F P/E (10-year historical average).

Re-rating catalysts: large infrastructure order wins, ramp-up in data centre business, consistent margin improvement from shifting project mix.

Downside risks: major project cost overruns or litigations, and a sharp decline in order wins amid a global economic slowdown.

See CGS' full report here.