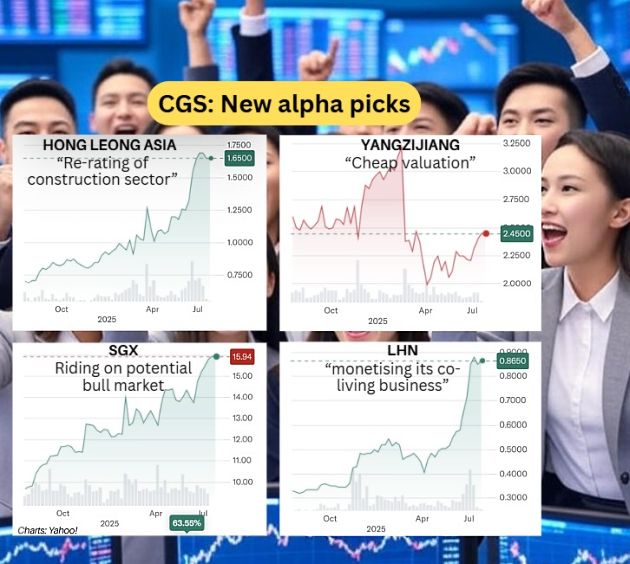

● The Singapore stock market sure is experiencing a climate change, heating up nicely with the STI setting record highs. Small and mid-caps too are having their day in the sun. ● Yesterday, the Monetary Authority of Singapore named its initial pick of 3 fund managers to inject S$1.1 billion into Singapore equities, emphasising the non-blue chips. ● CGS International has refreshed its alpha portfolio, removing the outperformers and inserting the potential future gainers. And thus investor interest will likewise rotate to laggards, the good ones. ● Actually, only 1 stock of the 4 fresh picks of CGS hasn't had a positive gain -- Yangzijiang Shipbuilding. While it has a massive multi-year orderbook, it has been weighed down since early this year by proposed US fees on Chinese-built and Chinese-operated vessels. ● Read more below... |

Excerpts from CGS report

Analysts: LOCK Mun Yee & LIM Siew Khee

Beneficiaries of value unlocking and EMDP plays

● We view the liquidity boost as positive for the stock market.

In addition to liquidity, fundamental and investible thesis remains the key focus for investors, and we see broadening of research and improving listing support, investor protection and confidence as complementary to the entire value chain.

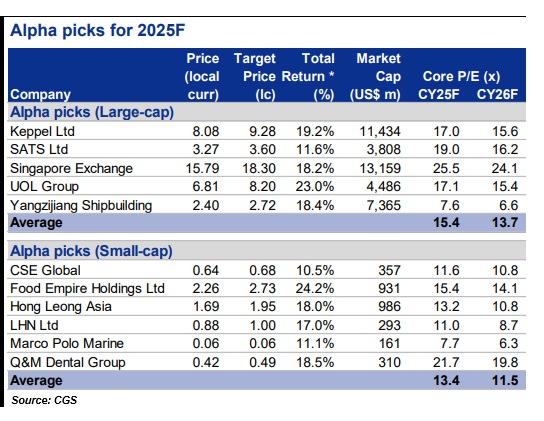

● We remove SIE (SIA Engineering), BRC, FRKN (Frencken), PAN (Pan-United) and PROP (PropNex) from our high conviction list due to share price outperformance and add SGX, YZJSGD (Yangzijiang Shipbuilding), LHN and HLA (Hong Leong Asia).

YZJSGD is a laggard in the industrials space and its valuation remains cheap relative to the SIMSCI.

We include SGX on potential virtuous cycle impact from EMDP1, HLA on re-rating of the construction sector and LHN on catalyst from potential monetisation of its co-living business.

(1 Equity Market Development Programme) Food Empire has the largest % gain potential in the portfolio, even after a 120+% rise year-to-date.

Food Empire has the largest % gain potential in the portfolio, even after a 120+% rise year-to-date.

Full CGS report here.

For more, see:

LHN: Market Cheers Its Co-Living Spin-off, New Analyst $1 Target Price Emerges

YANGZIJIANG’s Order Pipeline: Can Lower US Port Fees and Competitive Pricing Spark a Turnaround?

TIONG WOON, HONG LEONG ASIA: Undervalued Winners in Singapore’s Construction Surge