|

The latest CGS International report titled "Make Singapore Great Again - Value Up A-Z Chart Book 2" offers a lineup of small mid-caps that rarely get analyst attention. |

|

Name |

Mkt Cap |

Price |

P/BV |

P/E |

|

Acesian Partners |

12.1 |

0.033 |

0.75 |

na |

|

Addvalue Technologies |

165.3 |

0.063 |

14.42 |

45.65 |

|

Asian Pay Television Trust |

142.8 |

0.102 |

0.26 |

9.27 |

|

Banyan Tree Holdings |

416.7 |

0.620 |

0.74 |

11.97 |

|

Beng Kuang Marine |

45.4 |

0.280 |

2.37 |

9.49 |

|

Chasen Holdings |

24.3 |

0.082 |

0.38 |

na |

|

Duty Free International |

75.2 |

0.081 |

0.83 |

5.16 |

|

GKE Corp |

60.6 |

0.091 |

0.70 |

7.91 |

|

Hafary Holdings |

166.9 |

0.500 |

1.61 |

7.07 |

|

Kencana Agri |

62.3 |

0.280 |

1.23 |

2.94 |

|

King Wan Corp |

29.2 |

0.053 |

0.53 |

19.91 |

|

Ley Choon Group |

86.4 |

0.074 |

1.54 |

8.41 |

|

Nam Lee Pressed Metal |

118.2 |

0.630 |

0.82 |

6.15 |

|

Sing Investments & Finance |

289.6 |

1.580 |

0.98 |

8.91 |

|

Thakral Corp |

157.6 |

1.620 |

0.77 |

1.62 |

|

XMH Holdings |

133.5 |

1.570 |

1.81 |

6.06 |

| • Banyan Tree Holdings: Let's start with the luxury hotel and resort operator. CGS highlights its asset-light pivot, aiming for 90% fee-based hotels by 2027, slashing capital needs from 34% in 2009. FY24 core profit hit S$69m with 27% EBITDA margins, close to pre-IPO peaks. There's strong revenue visibility from the residential segment, with S$621m unrecognized and S$262m expected in FY25. Trading at 0.74x P/BV and 12x P/E, plus a 2.1% yield.  This is a key Banyan project in Phuket: Laguna Lakelands This is a key Banyan project in Phuket: Laguna Lakelands |

• Chasen Holdings, the industrial relocation and logistics player, is seeing results from cost cuts.

It swung to S$0.87m profit in 1HFY3/26 after a FY3/25 loss (excluding one-offs), thanks to tighter expenses.

Order wins ramped up to S$70m in Nov 25, the biggest post-Covid haul, mainly in specialist relocation.

Valued at 0.38x P/BV, it's trading below book -- and 20.5x annualized P/E.

• GKE Corp, an integrated logistics play, did well with 14% revenue growth in FY25 to S$127m and 106% net profit jump to S$8.9m, plus a 0.40 cents dividend/share.

Its China infrastructure materials biz is rebounding due to new rural highway regulations boosting connectivity.

A strategic review of that segment could unlock value via corporate actions.

Order book looks solid, trading at 0.7x P/BV and 7.9x P/E with a 3.8% yield.

• King Wan Corp shines in mechanical engineering with a S$198m order book as of Sep 25 coming from the HDB, mixed-use developments, and school projects.

1HFY3/26 gross margins dipped to 2.1% due to fewer completions and pre-construction phases, but it's net cash with a S$0.6m buffer.

At 0.53x P/BV, it's a bargain below book -- but with a 19.9x P/E.

• Ley Choon Group, the underground utilities whiz, has a S$350m order book (2.7x FY25 revenue), up from Mar 25.

1HFY26 revenue and profits softened yoy from fewer completions, but it's debt-free with S$11.7m net cash and S$3.8m positive free cash flow.

Trades at 1.54x P/BV, 8.4x P/E, and a 4.1% yield.

• Thakral Corp diversifies across lifestyle (beauty, Nespresso, etc) and investments (Japan real estate, GemLife resorts).

9M25 profit exploded 767% to S$129m on GemLife IPO gains (S$146.6m one-off) and 28% lifestyle revenue growth to S$254m, making up 90% of total.

Low 0.3x gearing supports steady 4-5 cents DPS since 2021.

Book value hit S$2.28 post-IPO uplift; trades at 0.77x P/BV and 1.6x P/E with 2.5% yield.

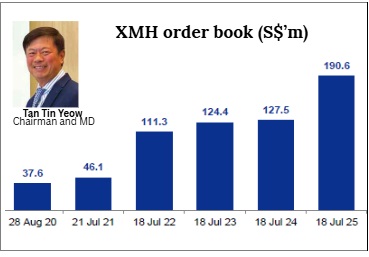

• Finally, XMH Holdings, dealing in diesel engines and marine gear, guided positive FY26 on a S$191m order book. FY25 revenue up 35% to S$167m, profit doubled to S$26m. FY25 revenue up 35% to S$167m, profit doubled to S$26m. Mitsubishi Heavy Industries Engine System Asia, a key supplier, bought a 14.8% stake buy in a subsidiary for S$12.3m, signalling confidence. Single-digit 6.1x P/E and 1.81x P/BV. |

Overall, CGS is bullish on these for their value, improving fundamentals, and flows.

With the EQDP juice, such Singapore stocks might just shine brighter. → See the full CGS report here.

→ See the full CGS report here.