|

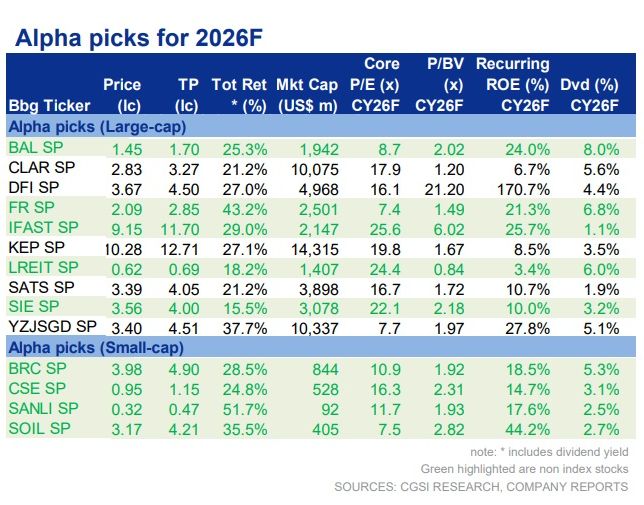

CGS International covers about 35 small-cap stocks below US$1 billion market cap, of which 4 made it to its top picks for 2026. As for the general market outlook, CGS views it as positive, helped along by the liquidity boost from MAS’s Equity Market Development Programme (EQDP) funds, which aims to broaden investor interest beyond large-cap names. |

In its 111-page report on the stock market in 2026, why CGS is bullish on these four "alpha picks"?

| 1. BRC Asia: The Construction Kingpin |

Pegging a price target of S$4.90, CGS sees BRC benefiting immensely from Singapore’s multi-year construction upcycle.

What makes BRC stand out?

Its sheer dominance, commanding 55–60% share of Singapore’s reinforcement steel market as of FY9/25.

This dominant position means that as BRC’s order book grows, it enjoys better margins and profitability, helping raise the core net profit margin from 5.9% in FY25F to a 6.4% in FY27F.

Even better news for shareholders is the expected balance sheet strength: CGS anticipates the company will flip from a slight net debt position to net cash in FY26F.

The projected FY27F dividend yield is 5.5%.

| 2. CSE Global: Riding the Data Centre Wave |

CSE Global gets a target price of S$1.15 as CGS is excited about CSE capitalizing on the global technology boom, specifically the hyperscaler growth cycle. CSE is one of just three qualified vendors providing critical electrification systems for AWS data centres in the US.

CSE is one of just three qualified vendors providing critical electrification systems for AWS data centres in the US.

This partnership visibility means data centre electrification is expected to jump from just 5% of group revenue in 2024 to a significant 20–25% by FY26F.

To handle this demand, CSE is aggressively scaling up its capacity, notably through a new 241k sq ft facility and acquiring a 70-acre site in Houston for future expansion.

While this expansion requires front-loaded operating expenses (think hiring staff and renting space), causing temporary margin compression, CGS expects utilization and production scale to ramp up strongly from FY26F onward.

The strong multi-year visibility from the AWS program, estimated at US$1.5bn over five years, provides a reliable foundation for projected 22.5% EPS growth in FY26F.

| 3. Sanli Environmental: Mega Water Wins |

Sanli Environmental, a recent addition to CGS’s top small-cap list, specializes in water and waste management—a sector with strong government backing in Singapore.

The target price is S$0.47. Sanli CEO Sim Hock HengSanli is currently sitting on a record outstanding order book of S$781.5m, providing strong revenue visibility for the next five years.

Sanli CEO Sim Hock HengSanli is currently sitting on a record outstanding order book of S$781.5m, providing strong revenue visibility for the next five years.

This figure includes two massive, newly awarded contracts: a S$281m LTA contract for the Cross Island Line and a S$205m PUB contract for the Changi NEWater Factory development.

To manage the execution and financing of these mega-projects, Sanli is strategically entering into joint ventures, holding a 51% majority stake, which helps mitigate operational risk.

This successful strategy is anticipated to drive strong earnings growth, with a projected S$5.6 million profit for FY26 (ending March) and S$10.1 million for FY27.

| 4. Soilbuild Construction: Industrial Growth Engine |

Soilbuild, another fresh face on CGS’s top picks list, is given a target price of S$4.21.

As an industrial-building specialist, it’s not just building anything; it specialises in high-tech, green-certified facilities. CEO Lim Han RenThe company currently boasts an order book of S$1.19bn (as of Jun 25), guaranteeing 2–3 years of earnings visibility.

CEO Lim Han RenThe company currently boasts an order book of S$1.19bn (as of Jun 25), guaranteeing 2–3 years of earnings visibility.

We are talking about large projects such as the landmark S$647.5m PSA Supply Chain Hub @ Tuas project, which is expected to contribute an outsized 30–45% of FY26-27F revenue.

Beyond the construction pipeline, there are two exciting catalysts.

Firstly, Soilbuild's precast division grew 77.3% in 1H25, and management is exploring a potential spin-off and listing of this business.

Secondly, Soilbuild is projected to shift to a net cash position starting in 2H25F, supporting a higher dividend payout ratio moving forward.

Trading at an undemanding 7.5x FY26F P/E compared to its peers' average of 9.2x, CGS views any recent share price weakness as an attractive entry point.

CGS sees this quartet of small-cap companies tapping into powerful thematic drivers—infrastructure spending, technological demands (data centres), water security, and construction expansion. They've got compelling order books, exciting catalysts, and, in the case of BRC and Soilbuild, stronger balance sheets leading to better shareholder returns. That should translate into solid financial performance and significant shareholder returns in the coming years. |

→ The 111-page CGS report is here.

→ The 111-page CGS report is here.

→ See also: HONG LEONG ASIA: Concrete, Cash and Dividends in Singapore’s Building Supercycle -- At Just 4.8x ex‑Cash PE