| Singapore-listed China Sunsine Chemical, the world’s largest producer of rubber chemicals used in tyre manufacturing, is reaching an interesting point in its evolution. After years of capital investment into R&D and new production capacity, it is transitioning into a "harvest" season. In other words, its profitability and cashflow look set to accelerate.  Control room at a China Sunsine plant. Control room at a China Sunsine plant. |

1. The R&D Fall-off

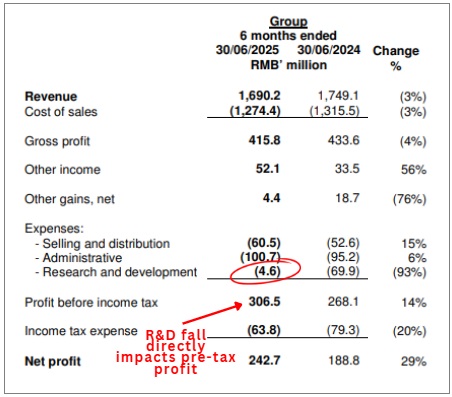

One key indicator of this transition is the dramatic drop in R&D expenses.

In its 1H2025 results, R&D spending—which had been running hot at roughly RMB 100 million annually in the past five years—dropped off a cliff (see table).

|

Fiscal Year |

R&D Spend |

|

1H2025 |

4.6 |

|

2024 |

86.2 |

|

2023 |

119.4 |

|

2022 |

142.4 |

|

2021 |

110.8 |

|

2020 |

75.3 |

Why the sudden drop?

The company's technical hurdles for the Continuous Production of Solvent MBT process have been cleared, paving the way for cost savings estimated at RMB2,000 per tonne (before depreciation).

This translates into annual savings of tens of millions of RMB.

2. Tapering Capex

Capex is following a similar downward trajectory.

By the end of 2025, heavy-infrastructure projects— notably the 30,000-tonne Insoluble Sulphur line and the 40,000-tonne Phase 2 Continuous MBT project—reached completion.

|

Project/budget |

Capacity |

Current Status (End-2025) |

|

Phase 2 Insoluble Sulphur |

30,000 tonnes |

Trial run completed; Commercial production by end-2025. |

|

Phase 2 Continuous MBT (Hengshun) |

40,000 tonnes |

Construction ending; Trial run by end-2025. |

|

MBT Project (Weifang) |

20,000 tonnes |

Under construction; Trial run early 2026. |

|

Workshop Transformation (CBS) |

20,000 tonnes |

Under construction; Trial run early 2026. |

Source: 3Q2025 business update

The total remaining capex for current projects is very low — certainly a fraction of the group's RMB 2.2 billion cash pile (as of 1H2025).

It's unlikely that Sunsine will launch new expansion projects in the near term as its total production capacity of 272,000 tonnes is sufficiently high -- at least vis-a-vis the 214,094 tonnes that it sold in 2024.

What the R&D Drop Means for Sunsine's Bottom Line

A drop in R&D spend has a direct impact on net profit.

Because R&D is an operating expense, every dollar saved flows straight to the pre-tax profit line.

In 1H2025, the R&D savings helped propel net profit up by 29% to RMB 242.7 million.

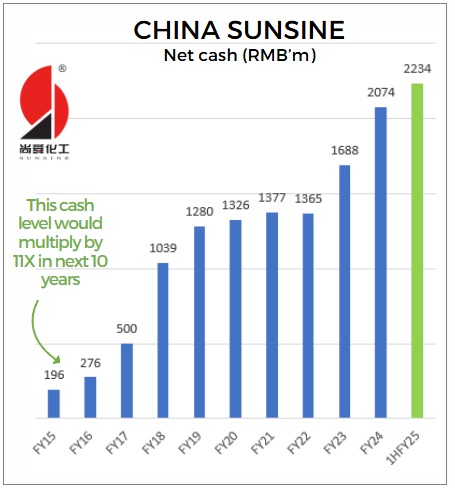

What Tapering Capex Means for Sunsine's Cashflow

While R&D savings drives profit, tapering capex will accelerate Free Cash Flow (FCF), adding to the mountain of cash (see chart).

In simple terms: the company is keeping more of the money it makes because it no longer needs to spend on advanced automation and new capacity, etc.

This expected surge in FCF is likely a key factor in the Board announcing a 40% minimum dividend payout for 2025 and 2026.

Sunsine is at an inflexion point.

The Sunsine Story has changed to a more highly charged growth story, with its business valued currently at 4X PE ex-cash.

What about the stock's upside potential if the market warms up to it even more than it has in 2025 when it gained 80%?

The risks in this business, according to Sunsine: "Locally, the oversupply situation and competition within the Chinese rubber chemicals industry continue to intensify. The prices of our main raw materials are hovering at their low-end. All these have placed significant pressure on our selling prices." |

→ See also: Charity, Rewards, and Tyres: The Story Behind China Sunsine Chairman's Stake Sale

→ See also: Charity, Rewards, and Tyres: The Story Behind China Sunsine Chairman's Stake Sale