| • A reader contributed the article below, which offers an in-depth financial and operational review of China Sunsine, the world's largest producer of rubber accelerators. The Singapore-listed company manufactures essential additives for tyre production and has a history of steady sales volume growth and profit uptrend since its 2007 IPO.  • The reader's analysis compares key financial metrics for the first nine months of FY2025 and FY2024, noting a decline in revenue and average selling price but an increase in profit. A significant part of the overview focuses on the company’s increasing productivity through automation and its exceptionally strong net cash position. • Finally, the article highlights Sunsine's future outlook, which is positive due to rising rubber chemical demand, limited competition in the rubber accelerators space, and the development of a cost-saving, environmentally-friendly MBT production method. |

The table below compares China Sunsine's 9-month performance in 2025 and 2024:

|

9-month 2025 |

9-month 2024 |

Change |

|

|

Sales vol (tonnes) |

163,999 |

159,555 |

3% |

|

ASP (RMB per tonne) |

14,957 |

16,502 |

-10% |

|

Revenue (RMB m) |

2,453 |

2,633 |

-7% |

|

Profit (RMB m) |

330 |

282 |

17% |

Source: Sunsine 3Q25 business update

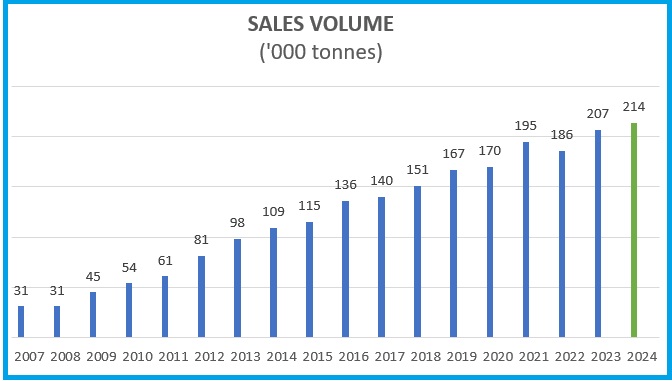

Sales volume

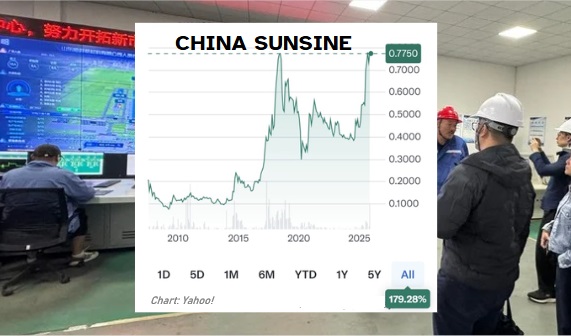

Since its IPO in 2007, sales volume has grown steadily—from 31,281 tonnes to 214,094 tonnes in 2024.

Growth in the first nine months of this year is expected to continue when new investments, comprising 50,000 tonnes of rubber chemicals and 60,000 tonnes of feedstock, ramp up production.

Average selling price (ASP)

Rubber accelerators (RAs), insoluble sulphur, and antioxidants are sold on a cost-plus basis because they are essential to tyre manufacturing.

High raw material prices, therefore, help to lift ASP. Conversely, ASP is lowered by depressed raw material prices.

Over time, ASP is stable as raw materials fluctuate through their price cycles.

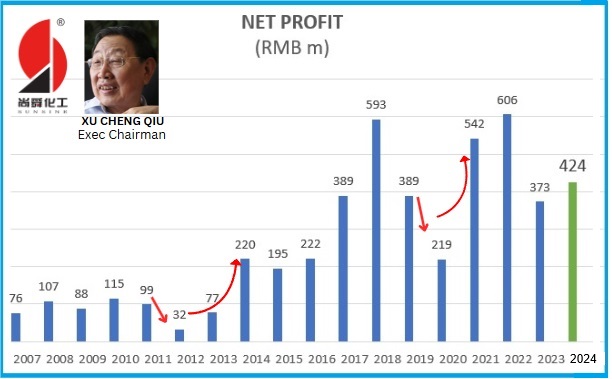

Profitability

The 3% increase in sales volume in the 9 months of 2025 helped to offset the 10% decrease in ASP.

Sunsine has remained profitable every year since listing. During the pandemic in 2020, it still earned RMB 219 million.

While profit fluctuated with raw material prices and market conditions, the long-term trend remained upward— a profit decline lasted only a year, except for the consecutive ones after 2010 and 2018.

Profit adjusted for tax credit due in 2017 but included in the 2018 financial statement, and for tax credit received in 2022 for overpayment in 2021.

Profit adjusted for tax credit due in 2017 but included in the 2018 financial statement, and for tax credit received in 2022 for overpayment in 2021.

In the short term, falling raw material prices reduce margins, but when prices recover, eventually, profit rises accordingly.

The drivers of the sustained profit uptrend were growing sales volume and rising productivity.

Productivity

Sunsine’s headcount has remained around 2,100 for many years, despite sales volume more than doubling, and taking on two businesses (steam generation and hazardous waste management).

|

Year |

Headcount |

Rubber chemical sales (tonnes) |

Per-capita (tonnes) |

|

2013 |

2,134 |

98,345 |

46.1 |

|

2014 |

2,186 |

108,973 |

49.9 |

|

2015 |

2,084 |

114,572 |

55.0 |

|

2021 |

2,249 |

195,405 |

86.8 |

|

2022 |

2,193 |

186,153 |

84.9 |

|

2023 |

2,116 |

206,996 |

97.8 |

|

2024 |

2,125 |

214,094 |

100.7 |

A main source for productivity gain has been the use of robotic arms to automate repetitive manual tasks.

In 2021, Sunsine reported that out of its 254,000-tonne total capacity, 122,000 tonnes had yet to be equipped with robotic arms.

In April, the company foresaw scope for further productivity improvement.

https://chinasunsine.com/wp-

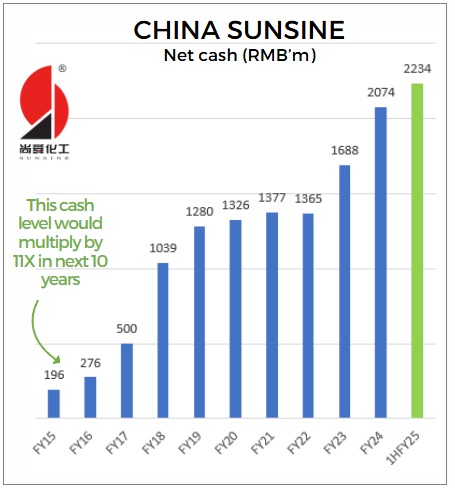

Cash

The business update did not reveal the amount of cash as of the end of September 2025.

Sunsine went public in 2007, raising RMB 264 million in net proceeds.

Without further equity injections, 210,000 tonnes of rubber chemical capacity were added to the original 44,000 tonnes, through organic growth.

By mid-2025, it had RMB 2,234 million in cash, with no borrowings, after dividend payments of RMB 1,094 million, the result of well-planned expansions and prudent financial management.

The RMB 2,234 million cash at end-June 2025 is sufficient to cover RMB 2,097 million of inventory purchases for 2024.

With its strong financial position, Sunsine pays suppliers promptly (on average, six days in 2024), securing favourable terms and cementing relationships with suppliers, while granting tyremakers up to 90 days of credit.

Cash will continue to grow if the bulk of cash flow is retained instead of being paid out as dividends.

Unless Sunsine has acquisitions in mind, which is unlikely given its record of organic growth, retaining cash very much in excess of operational needs is unnecessary.

It should be noted that the current ratio at the end of 2024 was an exceedingly high of 7.6 times (current assets of RMB 3,574 million vs current liabilities of RMB 470 million )

Over the years, ROE has been decent.

|

Year |

Profit (RMB m) |

Equity (RMB m) |

Net Cash (RMB m) |

ROE (%) |

|

2016 |

222 |

1,361 |

276 |

16.3 |

|

2017 |

389* |

1,743 |

500 |

23.3 |

|

2018 |

593* |

2,326 |

1,039 |

23.5 |

|

2019 |

389 |

2,562 |

1,280 |

15.2 |

|

2020 |

219 |

2,721 |

1,326 |

8.0 |

|

2021 |

542** |

3,176 |

1,377 |

17.0 |

|

2022 |

606** |

3,682 |

1,365 |

16.4 |

|

2023 |

373 |

3,927 |

1,688 |

9.5 |

|

2024 |

424 |

4,209 |

2,074 |

10.1 |

* Profit adjusted for tax credit due in 2017 but included in the 2018 financial.

** Profit adjusted for tax credit received in 2022 for overpayment in 2021.

Cash accumulation resulted in 49% of the equity being cash by the end of 2024.

Slowing down cash buildup, through higher dividends, will lift the ROE.

On 19 November, Sunsine unveiled a minimum total payout ratio of 40% for half year and full year dividends, for financial years 2025 and 2026.

The previous payout ratio, announced in 2017, was a minimum 20% for financial years 2017 and 2018.

Downstream demand

Rising car ownership in developing countries and the growing demand for new-energy vehicles—which require larger tyres to support battery weight—will continue to drive demand for rubber chemicals.

Competition

Sunsine is the world's largest RA producer with a 117,000-tonne capacity and a 23% global market share. Its RA capacity will be 135,000 tonnes with expansion.

Sunsine’s main RA competitors are Tianjin Kemai and Shenzhen-listed Yanggu Huatai.

Tianjin Kemai has failed in three attempts to go public.

Yanggu Huatai, the world’s largest producer of anti-scorching agents, scrapped its plan to produce 10,000 tonnes of rubber accelerator TBBS (known as NS in China).

https://vip.stock.finance.

Recently, it ventured into the semiconductor business.

https://min.news/en/economy/

Feedstock MBT

MBT is the feedstock for most RAs. The traditional MBT production process generates fair amounts of waste.

In 2020, the Shandong government tasked Sunsine with developing a cleaner MBT production method to enable the province to produce more tyres.

Helped by Tsinghua University and supported by a RMB 24 million government grant, Sunsine succeeded, and 80,000 tonnes of “new MBT” capacity is being added to its existing 45,000 tonnes of traditional MBT capacity.

The “new MBT” process cuts production costs by RMB 1,800–2,000 per tonne.

20250424 - AGM 2025 QA-Final (wo Chinese) cln question 4

After depreciation, savings remain at RMB 1,250–1,450 per tonne (based on RMB 440 million of capital expenditure and a 10-year lifespan).

20221011 Business Update - MBT Phase 1 and IS Phase 2 projects (Final)

20250430 Business Updates - 1Q2025

The "new MBT" will strengthen Sunsine’s leadership in the RA sector.

Rapid growth has not resulted in financial strain. |