|

Excerpts from CGS International's report

Analyst: William Tng, CFA

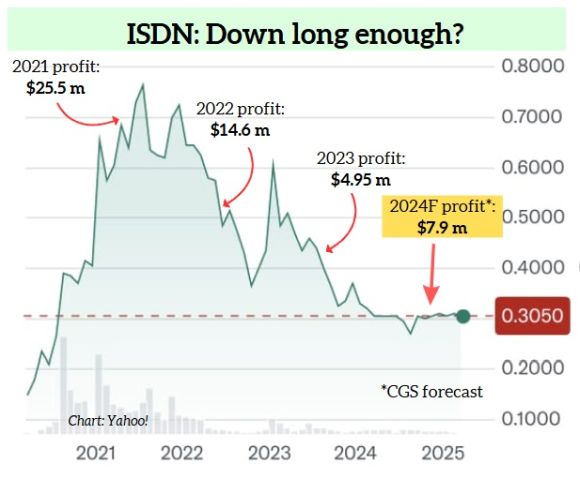

■ ISDN Holdings Ltd (ISDN) could report its FY24F results on 28 Feb 2025. We expect net profit to climb 60.4% yoy to S$7.9m in FY24F. ■ Although geopolitics (trade tariffs) remain a key dampener, we think ISDN is seeing some recovery in its key China business. ■ We roll over our valuation to FY26F, leading to a higher TP of S$0.35. We upgrade ISDN from Hold to Add as EPS growth resumes over FY25-26F. |

Ref: ISDN: Stock is at 3+ year low -- but it's primed to ride a semicon upcycle

Ref: ISDN: Stock is at 3+ year low -- but it's primed to ride a semicon upcycle

FY24F net profit up 60.4% yoy

In its 1H24 results commentary (press release on 14 Aug 2024), management noted that 1H24 was characterised by stabilising demand in cyclical industries, which allowed for some cautious optimism that the industrial downcycle may be ending and headed for a recovery.

| "Clear growth opportunity coming" |

"The opportunity is very clear for growth because semiconductor and electronic industry is always cyclical. The next cycle will come and I believe the next cycle will be very strong because of the demand for AI applications and with the AI trend." -- Teo Cher Koon, President & MD, ISDN Holdings |

ISDN will also be increasing its efforts to build its presence in Malaysia and Taiwan to help expand the distribution of the group’s services and products, said management.

ISDN continues to believe that the prospects for Industrial Automation (IA) in China remain strong as IA is, in management’s view, the solution to labour shortages and demographic decline in the country, as efficiency and productivity are boosted by smart manufacturing and advanced technology adoption.

Our 2HFY24F forecasts concur with management’s view of a recovery in its key IA segment.

We think 2H24F net profit could be S$4.2m (+10.1% hoh, +1,019% yoy as 2H23 net profit was depressed by lower revenue, foreign exchange loss and impairment of financial assets) while FY24F net profit could have grown 60.4% yoy to S$7.9m due to 2H24F revenue recovery.

Continuing efforts to diversify and grow revenue

We believe that ISDN is continuing to explore avenues to diversify and grow its revenue.

|

ISDN |

|

|

Share price: |

Target: |

On 1 Nov 2024, ISDN announced that its subsidiary, Servo Dynamics, secured exclusive rights to distribute Dafang’s state-of-the-art robots for the construction industry in Singapore and Malaysia (Dafang is an artificial intelligence company specialising in the design and production of robots for the construction industry).

Dafang’s solutions are approved by the Housing and Development Board (HDB) and can reduce labour costs by 50-80% and material waste by 15-50%, thereby, boosting construction efficiency and cost-effectiveness according to ISDN.

| Upgrade to Add We upgrade ISDN from Hold to Add as we expect 12.0-43.1% yoy core EPS growth for FY25-26F, supported by recovery in its IA business. Our FY24-26F earnings forecasts are intact.  William Tng, CFA, analystWe roll over our valuation to FY26F, leading to a higher S$0.35 TP, now based on 12.2x FY26F P/E (10% discount to ISDN’s 10-year (2016-25) average P/E of 13.6x). William Tng, CFA, analystWe roll over our valuation to FY26F, leading to a higher S$0.35 TP, now based on 12.2x FY26F P/E (10% discount to ISDN’s 10-year (2016-25) average P/E of 13.6x). We previously valued ISDN at its 10-year (2014-23) average P/E of 11.0x. Re-rating catalysts include higher-than-expected net profit contribution from its hydropower business segment and a faster pace of economic growth as China tries to re-stimulate its economy. |

Downside risks include weak customer demand if the global economy continues to slow, and the possibility of bad debts as economic conditions worsen.

Full report here