ISDN investor Cedric Yang contributed this article

| The optimal time for companies to invest in their growth and expand market share is when competitors are struggling. In times of crisis, opportunities emerge. This principle applies equally to investing in a company. It's essential to understand that investing is not merely about attempting to buy low and subsequently sell high; it's about becoming a part of the company's shareholder base, effectively owning a portion of the business. So, when should you buy shares? When the market undervalues the company, selling its shares below their true worth. |

Conviction in ISDN Holdings

ISDN recently hosted a results briefing session on August 23, 2024, which was attended by several sell-side analysts and investors.

ISDN recently hosted a results briefing session on August 23, 2024, which was attended by several sell-side analysts and investors.

Following the call, I have identified 10 key takeaways that reinforce my conviction to buy ISDN shares.

• ISDN's “NET” Strategy: ISDN has adopted a comprehensive approach to capture the breadth and depth of industrial automation and Industry 4.0 to 5.0.

This strategy encompasses key sectors such as defense, medical, aerospace, semiconductor, and general manufacturing, positioning ISDN as a one-stop-shop.

By doing so, ISDN can secure initial customers and develop a long-term technology partnership with them.

This approach also enables ISDN to stay ahead of the curve in identifying megatrends, making strategic manpower decisions, and pursuing M&A and investment opportunities.

The company's stake increase in IDI Laser exemplifies this strategy, where ISDN initially invested at a relatively low cost to enter the laser marking market, followed by incremental stake increases to deepen its technological capabilities and market penetration.

• Mid-to-Long-Term Tailwind of Industrial Automation: Four primary driving forces underpin the growth of industrial automation: Asia's technological advancements, shifting labor landscapes, national priorities in China and Southeast Asia, and the rise of sustainability industries.

ISDN is strategically positioned to capitalize on all four.

Notably, the company has managed to retain its entire customer base, ensuring it's well-prepared to thrive when the market rebounds.

• Diversification: ISDN has achieved robust diversification across multiple dimensions - customers, sectors, technologies, and geographies.

This has created a formidable competitive moat, enabling the company to reinvest in its capabilities and capitalize on market share losses by its competitors. Consequently, ISDN's revenue continues to exhibit resilient growth, even in a challenging year, underscoring the effectiveness of its diversification strategy.

China's Manufacturing Landscape: ISDN's performance is positively correlated with China's Caixin PMI, indicating that the company, despite its relatively small size in the Chinese market, is agile and capable of achieving higher growth rates than the official numbers suggest.

This is a testament to ISDN's exceptional expertise in industrial automation, earned through its long-standing presence, strategic relationships, and ability to navigate challenges.

ISDN has successfully identified niche technologies, established a strong competitive moat, and implemented effective strategies, allowing it to punch above its weight in China's highly competitive market.

Furthermore, industrial automation is a top priority for the Chinese government, providing a favorable tailwind for ISDN's continued growth and success.

• Semiconductor Recovery: In late 2023, experts predicted a semiconductor industry recovery to commence in the second half of 2024.

| "Clear growth opportunity coming" |

| "The opportunity is very clear for growth because semiconductor and electronic industry is always cyclical. The next cycle will come and I believe the next cycle will be very strong because of the demand for AI applications and with the AI trend." -- Teo Cher Koon, President & MD, ISDN Holding |

However, escalating US-China geopolitical tensions and protectionism have since altered market sentiments, introducing uncertainty and delaying the anticipated upturn.

Despite this, a recovery is unavoidable, given the global reliance on semiconductors.

The expected rebound, now forecasted for the first half of 2025, will yield a substantial, multi-year order book and high-margin profits for ISDN, as the company is well-positioned to capitalize on this inevitable upswing.

• ASEAN Manufacturing: ISDN boasts a significant presence in Malaysia, Singapore, and Vietnam. These countries are characterized by a growing middle class and increasing educational attainment.

ISDN anticipates rising manufacturing investments in specific sectors, including:

Malaysia (Penang): Semiconductor manufacturing

Vietnam: General manufacturing

Singapore: Advanced manufacturing and design

Furthermore, the ongoing geopolitical shifts are advantageous to ASEAN countries, as they become crucial nodes for global trade flows. Goods entering these countries are repackaged, reconfigured, and integrated before being exported to the rest of the world.

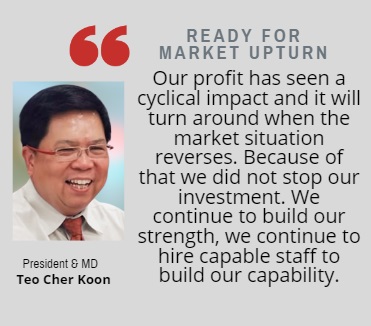

• Building for the Future During Downturns: A CEO, lacking a long-term stake in the company's success, may resort to retrenchment measures when revenue declines. This approach prioritizes short-term profit protection, but ultimately leads to talent loss, market share erosion, and employee distrust.

In contrast, ISDN's MD, CK Teo, has demonstrated unwavering commitment to his team and vision.

This leadership approach has fostered trust among management and staff, underscoring CK Teo's focus on building a lasting legacy rather than chasing short-term gains.

By making tough decisions and prioritizing long-term sustainability, CK Teo is steering ISDN towards a prosperous future. As shareholders, we should commend this visionary leadership.

• Hydropower Plants: During the call, CK Teo revealed that ISDN generates a steady $20 USD per minute from its hydropower plants, even during the dry season in northern Indonesia.

This stable income stream provides a solid foundation for the company to develop two additional projects.

As a tier 1 owner, ISDN is well-positioned to capitalize on the government's push for increased plant development, having successfully navigated the challenges of its first three hydropower projects.

ISDN is actively considering strategic options, including spin-offs or asset sales, but will only proceed at a favorable price point (potentially 15x multiples).

• China's Yuan: I never thought I'd see the day when the yuan would depreciate so sharply against the Singapore dollar (SGD).

|

Stock price |

28 c |

|

52-week range |

26 – 42 c |

|

PE (ttm) |

28 |

|

Market cap |

S$125 m |

|

Shares outstanding |

446 m |

|

Dividend |

1% |

|

One-year return |

-28% |

| Source: Yahoo! | |

However, the yuan has actually appreciated against the US dollar (USD) amidst the Federal Reserve's interest rate cuts.

Meanwhile, the SGD has strengthened against the USD due to the Monetary Authority of Singapore's (MAS) tight monetary policy, resulting in a weaker yuan versus the SGD. In my view, this trend is likely to reverse next year as monetary easing is expected for the SGD.

Nevertheless, I reckon that the yuan's trajectory remains uncertain, as the Chinese Communist Party (CCP) may opt to maintain a gradual depreciation to boost exports.

• Technical Chart Analysis: A simple technical analysis reveals that ISDN's stock price is forming a converging flag pattern, accompanied by a bullish divergence on the Moving Average Convergence Divergence (MACD) indicator.

This suggests that if ISDN breaks through the $0.32 resistance level, it may enter a positive trend, with $0.32 potentially becoming a new base support level. This could lead to a promising upside potential for the stock.

| In summary, if you're drawn to popular stocks, heavily covered by analysts and widely discussed among friends, then ISDN may not be for you. However, for those willing to look beyond the crowd, ISDN shines like a polished gem, hidden in plain sight. Overlooked by analysts fixated on larger-cap stocks, underappreciated by public investors, and targeted by short sellers, ISDN's undervalued status may soon change as its exceptional fundamentals and growth prospects come to light. |