|

Nordic Group delivered a robust start to 2025, continuing its trend of sustainable growth and operational resilience.

For the first quarter of 2025, the Singapore-listed company's revenue reached S$41.6 million, marking a 19% increase from S$35.0 million in 1Q2024. |

||||||||||||||||

Nordic Group is a diversified group of companies providing solutions in areas of automation and systems integration; maintenance, repair, overhaul and trading; precision engineering; scaffolding; insulation services; petrochemical and environmental engineering services; cleanroom, air and water engineering services and structural engineering and construction services.

| Profitability and Margins |

-

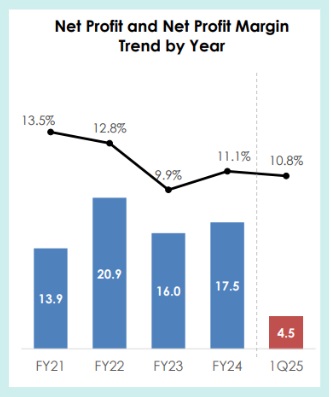

Net profit for 1Q2025 came in at S$4.5 million (+10% year-on-year).

-

Earnings per share (EPS) rose to 1.1 cents (+10%).

Earnings per share (EPS) rose to 1.1 cents (+10%). -

Gross profit margin (GPM) remained stable at 24%.

-

Net profit margin (NPM), however, dipped slightly to 11% from 12% in the previous year, mainly due to foreign exchange losses in 1Q2025 versus gains in 1Q2024.

|

To put the latest quarter in perspective:

|

High insider ownership at Nordic aligns management’s interests with minority shareholders but contributes to low liquidity for the stock.

High insider ownership at Nordic aligns management’s interests with minority shareholders but contributes to low liquidity for the stock.

(Note: Nordic Flow Control, Ensure Engineering and Starburst are subsidiaries of Nordic Group).

Balance Sheet and Financial Health

Nordic Group’s net asset value (NAV) per share: 33.5 cents (32.5 cents at end-2024).

The company further reduced its net gearing ratio to 6% (from 13% at end-2024), thanks to significant debt repayment.

As of end-April 2025, net gearing improved even further to 5.7%, underlining the group’s conservative financial management and strong balance sheet.

Order Book and Diversification

The healthy order book of S$197.8 million comprises a balanced mix of project and maintenance services.

Nordic’s revenue streams are well-diversified across industries such as onshore/downstream, marine/upstream, electronics manufacturing, infrastructure, and more.

This diversification, supported by a string of strategic acquisitions in recent years, helps reduce industry-specific risks and ensures resilience even in volatile market conditions.

|