|

ISDN Holdings, like many companies exposed to the semiconductor downcycle in 2023, didn't have good numbers to report for that year. No surprise there. |

As for some big clues to its future, ISDN added a graph which is an eye-opener from top-tier research house Gartner:

See how 2023 semiconductor revenue for SEA, ie Southeast Asia, tumbled from the 2021 peak.

The semiconductor downcycle is a major reason why ISDN's net profit plunged (attributable to shareholders) 66% in 2023 to S$5 million.

But there's light on the horizon: The Gartner chart forecasts a 15 percentage point upswing in 2024. Pretty sharp.

The narrative elsewhere is that the 2024 recovery will be evident in 2H of the year.

The long-term fundamentals are getting better: A Financial Times article, republished in The Straits Times a few days ago, tells how Malaysia (Penang in particular) is enjoying a boom in its semiconductor industry.

Not just Malaysia. Singapore also derives significant semiconductor revenue.

You can make a simple conclusion: If the Southeast Asia market is coming back in 2024, ISDN will ride up with it, supplying its industrial automation solutions to semiconductor companies.

Southeast Asia aside, the other key market for ISDN is China, where ISDN's revenue actually grew (+6.6% on a constant currency basis) in 2023.  Teo Cher Koon, President and MD of ISDN."We are active in Singapore, Malaysia, Vietnam and we are also exploring South Asia countries like India. We have the right capability, we built this over the last 37 years. We will be able to benefit from long-term growth," said CK Teo, President and MD of ISDN, at the investor briefing.

Teo Cher Koon, President and MD of ISDN."We are active in Singapore, Malaysia, Vietnam and we are also exploring South Asia countries like India. We have the right capability, we built this over the last 37 years. We will be able to benefit from long-term growth," said CK Teo, President and MD of ISDN, at the investor briefing.

"China’s policy is favorable for our automation business and its changing demographics and China-US tension -- all this create opportunities for us."

Here's more on why the outlook for industrial automation in China is robust:

| • Ageing population and low fertility rates: China’s population is on a declining trend with an ageing population, thereby leading to a shrinking labor force. • Relocation to countries with lower labour costs: Manufacturing set-ups are increasingly shifting to Southeast Asia countries due to lower labour costs. • US-China tension: Strengthened the determination of China’s policymakers to advance domestic manufacturing. • Skilled labour shortage: Attracting and retaining skilled workers has become more challenging as some jobs remain unfilled and high turnover rates persist. |

ISDN's current market cap is S$136 million.

ISDN's current market cap is S$136 million.

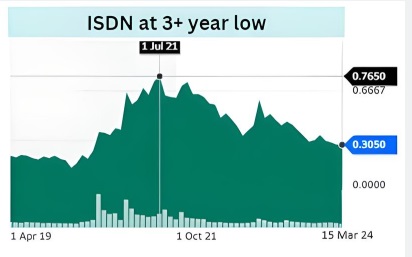

Chart: Yahoo!Has ISDN hit the bottom in its profitability in 2023?

Certainly, its stock price has reached its lowest since around Aug 2020 and it's about 60% lower than the peak reached in July 2021 (see chart).

If a multi-year business recovery is not too far away, when will the stock will re-rate?

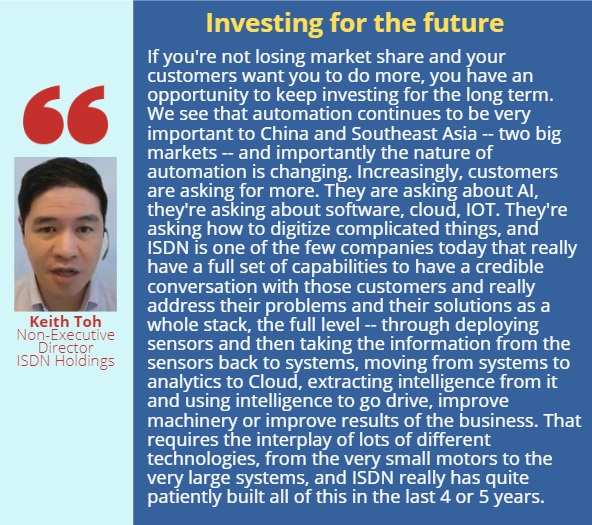

Meantime, here's Keith Toh, non-executive director of ISDN, making the case for why ISDN continued to invest in capabilities during the difficult 2023 year. Keith Toh speaking at an investor briefing on 13 March 2024.

Keith Toh speaking at an investor briefing on 13 March 2024.

Many investors are familiar with another business of ISDN -- hydropower.

ISDN's 3 hydropower plants in Indonesia started contributing in 2023. We gather that everything's doing fine and the business provides stable and recurring revenues/profits.

You can easily update yourself on this business through ISDN's recent announcements.