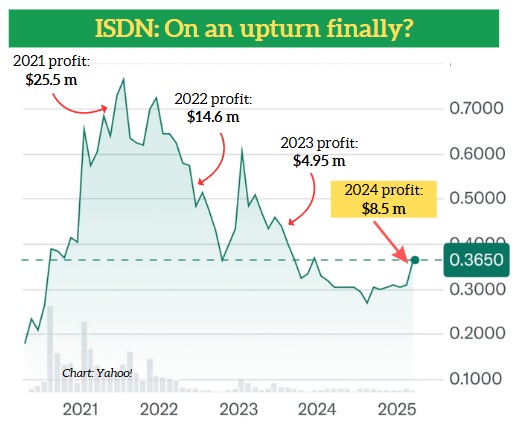

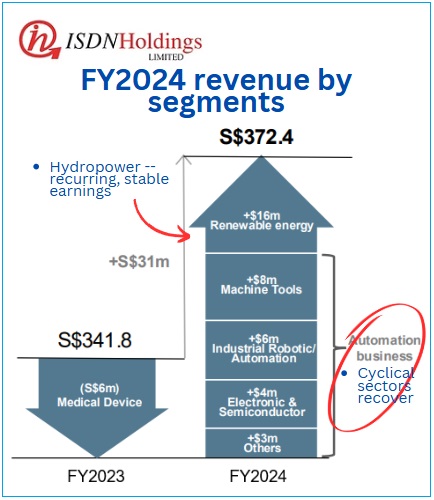

| From industrial automation to renewable energy, ISDN Holdings is making moves to set itself up for some serious growth in the coming years. And based on the FY2024 results, the outlook for 2025 and beyond looks positive -- after two years of a downturn (see chart below):

ISDN has been around for 38 years, and has come a long way from being just a component distributor. Today, it is a one-stop shop for everything from hardware to software, and even cloud solutions. The core focus? Industrial automation. As the world move towards AI and ever smarter factories, ISDN is sitting in a pretty sweet spot. |

The Big Picture: Automation and AI Are the Future

ISDN is diving deep into the semiconductor industry, which is booming thanks to the AI revolution.

|

Stock price |

36.5 c |

|

52-wk range |

26 – 37 c |

|

PE (ttm) |

19 |

|

Market cap |

S$164 m |

|

Dividend |

1.29% |

|

1-yr return |

17.7% |

|

P/B |

0.79 |

|

Source: Yahoo! |

|

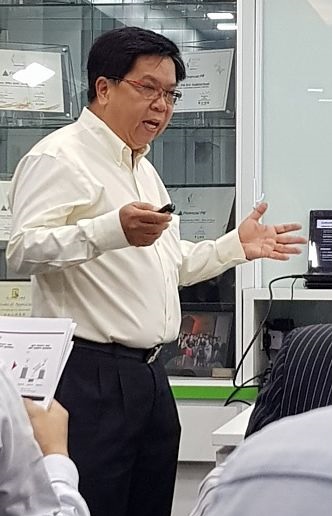

MD Teo Cher Koon said at a FY24 results briefing that ISDN has set up new factories in Taiwan and Penang, Malaysia to cater to this demand, and is even developing its own linear motors and precision stages for semiconductor manufacturing.

ISDN recognises that Southeast Asia is rapidly rising as a manufacturing hub in the global semiconductor industry.

The company has also been investing in AI capabilities, in areas like drone inspections and robotic integration.

ISDN is already seeing demand for these solutions in places like Singapore and Hong Kong.

“We see that the AI boom is getting more and more, and of course, Malaysia, with all the investments pouring in, the government targets to attract RM500 billion in semiconductor investment into Malaysia. So, this is why I say we are in the right place, the right market.” “We see that the AI boom is getting more and more, and of course, Malaysia, with all the investments pouring in, the government targets to attract RM500 billion in semiconductor investment into Malaysia. So, this is why I say we are in the right place, the right market.”-- MD Teo Cher Koon |

China + ASEAN: The Heart of ISDN’s Strategy

ISDN’s strategy is clear: focus on China and Southeast Asia.

China is the world’s second-largest economy, and despite some headwinds like an aging population and lower fertility rates, the country is pushing hard on advanced manufacturing and AI.

ISDN's investments in precision manufacturing are bearing fruit, particularly through metal injection molding (MIM) technology.

Mr Teo said the company has secured contracts with leading electric vehicle (EV) manufacturers in China and renowned brands across various sectors—including luggage manufacturing, satellite technology, mining machinery, and medical equipment.

Meanwhile, Southeast Asia is becoming a hotspot for manufacturing, especially with companies relocating from China due to trade tensions.

Malaysia, in particular, is seeing a surge in semiconductor investments, and ISDN is well-positioned to capitalize on that.

ISDN has set up new companies in Penang and Johor Bahru to cater to this demand, and has even invested in laser technology for semiconductor applications.

“We are focusing in Asia, and this year we just set up a small office in India to look for opportunities. Surprisingly, we immediately got a good inquiry for some production lines. We are in the right place, right market.” “We are focusing in Asia, and this year we just set up a small office in India to look for opportunities. Surprisingly, we immediately got a good inquiry for some production lines. We are in the right place, right market.”-- Teo Cher Koon |

Renewable Energy: A Steady Cash Cow

While automation and AI are the flashy parts of ISDN’s business, the renewable energy arm is quietly becoming a reliable source of income.

ISDN has three hydropower plants running in Indonesia, and is already seeing steady cash flow from them.

Plus, it is building two more plants, which will add 20 megawatts to its portfolio for a total of 44.6 megawatts.

Indonesia’s goal is to have 50% of its energy come from renewable sources by 2030, and ISDN is right in the middle of that action in a sector that has high barriers to entry.

Setting up these plants isn’t easy but ISDN has a solid team that’s been able to deliver.

And ISDN has plans to spin off this business in the future but first it seeks to attract partners to accelerate its growth to a bigger size.

“Our hydropower plants are running healthily, and we are expecting returning cash flow about $8-9 million. We are now constructing two more plants. The demand is very strong, and we are determined to grow this area much faster.” “Our hydropower plants are running healthily, and we are expecting returning cash flow about $8-9 million. We are now constructing two more plants. The demand is very strong, and we are determined to grow this area much faster.”-- Teo Cher Koon |

2025 Outlook: Double-Digit Growth?

ISDN is confident that the momentum from 2024 will carry over into the new year.

The second half of 2025 is expected to be particularly strong, with new projects in automation, AI, and renewable energy coming online.

Of course, there are challenges. The global economic environment is still uncertain, and currency fluctuations (especially with the weakening RMB) could impact ISDN's bottom line.

“My gut feel is 2025 should be much better than 2024. We are ready in the right business, in the right market, at the right time.” “My gut feel is 2025 should be much better than 2024. We are ready in the right business, in the right market, at the right time.”“AI is irreversible, and that will create a lot of opportunities in the high-end industry—precision, PCB, semiconductor, or anything data center related. We have a lot to offer.” -- Teo Cher Koon |

Non-executive director Keith Toh: "From the board's perspective, we're quite cautiously pleased that the end-industries for ISDN have begun to turn the corner. We have been in a protracted downturn in the last 18 months and it was not an easy decision to continue to invest in the future. "It was probably the right decision because we're seeing the benefits of continuing to push our market presence and we were reassured to see that the growth inflection at ISDN in the second-half of last year was quite broad based across our core businesses." |