| The construction industry is buzzing with optimism as analysts anticipate a strong upcycle in 2025. Robust demand is being driven by public infrastructure and housing projects. The sector looks to be an exciting space for investors. Let’s dive a bit into the story and explore their top stock picks, including Pan-United which CGS International has just issued a report on. Why the Optimism? The construction sector in Singapore has been on an upward trajectory, with 2024 seeing a stellar performance. Construction output grew by 8% year-on-year (yoy) in the first nine months, fueled by public sector projects, improved labor supply, and the easing of safety restrictions. Analysts expect this momentum to carry into 2025, supported by mega-infrastructure initiatives like Changi Airport Terminal 5 and the Cross Island Line, alongside a ramp-up in public housing projects.  |

Notably, contract awards in 2024 exceeded expectations, surging 31% yoy by November.

This healthy pipeline of projects ensures sustained activity for years to come.

Moreover, challenges such as labor shortages and inefficiencies seen in previous years are easing, further boosting productivity.

Analysts also highlight the growing demand for ready-mix concrete (RMC) and steel bars, which reflects the sector's vibrancy.

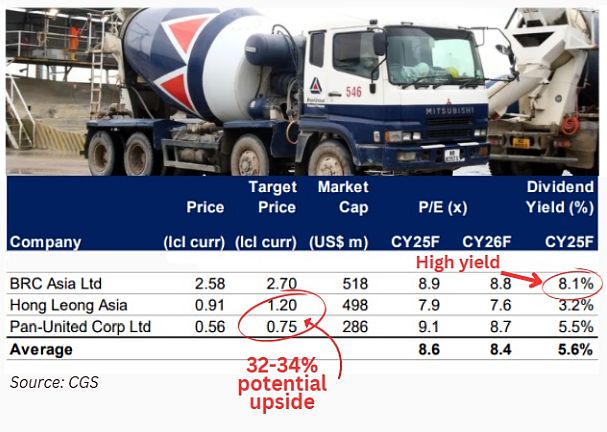

| Top Stock Picks |

1. BRC Asia (BRC)

BRC is a standout favorite of CGS, thanks to its attractive dividend yield of approximately 8.2% for FY25F and its undemanding valuation at just 8.5x forward price-to-earnings (P/E).

The company has been deleveraging its balance sheet aggressively, reducing borrowings by 35% yoy in FY24.

This financial strength positions BRC well for potential mergers and acquisitions (M&A), which could unlock further growth.

Key catalysts for BRC include improved offtake volumes and earnings-accretive M&A activities.

"We think 2024F construction output and contract awards exceeded BCA’s guidance, reinforcing our view of an industry upcycle sustaining into 2025F. "We think 2024F construction output and contract awards exceeded BCA’s guidance, reinforcing our view of an industry upcycle sustaining into 2025F. "We continue to like PanU for its 1) large exposure to public infrastructure and housing projects, 2) ESG tailwinds, and 3) attractive valuations and yield." -- Kenneth Tan, analyst |

2. Pan-United Corporation (PanU)

PanU is another top pick due to its large exposure to public infrastructure and residential projects.

The company has carved a niche in sustainable construction through its green concrete products, which cater to rising environmental demands in the industry.

CGS is impressed with PanU’s steady EBITDA margin of around 9%, driven by favorable project mixes and operational efficiency.

PanU’s valuation remains attractive at a discounted EV/EBITDA multiple of 3.6x for CY26F compared to peers.

3. Hong Leong Asia (HLA)Less well-followed by the market than BRC or PanU, HLA is seen as an underappreciated proxy for the Singapore-Malaysia construction upcycle. CGS also notes that HLA's diesel engine business, through its subsidiary China Yuchai, stands to gain from regulatory tailwinds such as new emission standards in China.

The common thread among these picks is their alignment with industry trends: strong project pipelines, improving operational efficiencies, and exposure to high-demand segments like public infrastructure. |