|

Excerpts from Phillip Securities report

Analyst: Paul Chew

Pacific Radiance (PACRA) -- On cruise control

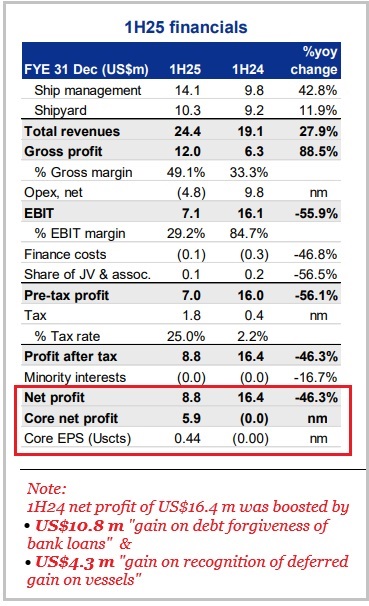

| ▪ 1H25 revenue was below expectations at 37% of FY25e forecast but adj. PATMI was a large beat at 81%. Gross margins were higher than expected, due to a larger contribution from chartering revenue. General and admin costs trended much lower than modelled as revenue scaled up—our adj. PATMI excludes S$1.8mn of deferred tax writeback.

▪ The three new vessels (accommodation barge, workboat, AHTS) deployed supported growth in 1H25 ship chartering and management revenue. |

||||

▪ We raise our FY25e PATMI by 43% to US$11mn on higher gross margins and lower general and admin costs. The target price is raised to S$0.098 (from S$0.06) as we peg valuations to an 8x PE, which remains a discount to the industry's 10x PE.

The discount is due to the high risk and reliance on a limited number of vessels.

We expect stable earnings with growth driven by higher charter rates from the AHST and workboat, as well as contributions from the sale of two CTVs and increased ship repair revenue due to the ageing global OSV fleet.

The company is in a net cash position of US$15.4mn.

The Positive

+ Margin expansion. Gross margins expanded 16% points YoY to 49%.

A higher contribution from ship chartering income at attractive rates drove margins.

General and admin expense was stable despite the increase in revenue, driven by higher operating leverage.

The Negative

- Nil

We believe Pacific Radiance has hit steady state in earnings. The key vessel, accommodation barge Crest Station 1, has locked in multi-year contracts in the UAE.  Paul Chew, analystGrowth will be muted without the acquisition of new vessels or the revival of laid-up vessels. Paul Chew, analystGrowth will be muted without the acquisition of new vessels or the revival of laid-up vessels. In 2H25, we expected a contribution from the completion and sale of two CTVs (crew transfer vessels). Demand for CTVs remains healthy, although a lull may occur in Taiwan due to the delayed construction of offshore wind farms. However, demand is expected to resume from 2027, with demand from South Korea serving as an added driver. Ship repair demand is healthy with the ageing of OSVs globally. Higher charter rates from AHTS and workboats could support growth in 2026. Maintain BUY with higher TP of S$0.098 (prev. S$0.06) |

Full Phillip Securities report here.

Article on CGS report: PACIFIC RADIANCE: Surges 24% in 1 Day After Analyst Highlights ‘Emerging Turnaround’ Story