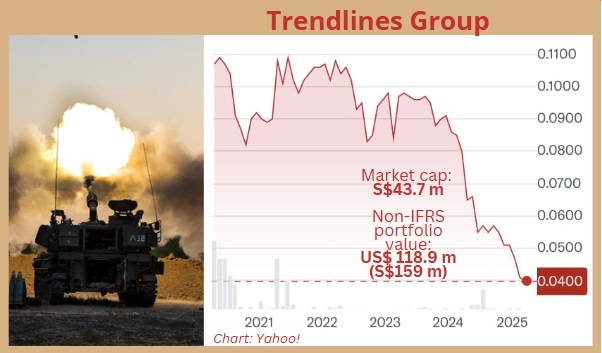

| Despite all the chaos in Israel last year caused by a war, a cool Israeli tech investment company, Trendlines Group, managed to pull off something pretty commendable. Several of its portfolio companies still raked in a whopping US$42 million, a record annual total for Trendlines, from outside investors. But that didn't spare its stock listed on the Singapore Exchange from taking a nosedive (chart below):  Picture this: The war that began on October 7, 2023 caused employees of some Trendlines portfolio companies to be called up for army duty, but many of these companies were still pushing forward with their cutting-edge stuff. We're talking about everything from food coloring to high-tech bladder treatments. |

Trendlines is an investment company focused on innovation in agrifood and medical technologies.

"We aim to continue to leverage our expertise and strategic networks to deepen our support for mature portfolio companies in bringing them to exit at higher values." "We aim to continue to leverage our expertise and strategic networks to deepen our support for mature portfolio companies in bringing them to exit at higher values."-- Haim Brosh, CEO (photo) & Nehama Ronen, Chair |

It reported a net loss of US$10.2 million in FY24, its third successive year of losses.

Its annual report 2024 highlights accomplishments and strategic moves that position Trendlines for continued growth.

Record External Capital Raised

Trendlines' portfolio companies raised a record US$42 million in 2024, which is noteworthy given the challenging security situation in Israel and in the region.

Key Investments

4 of the 5 portfolio companies that secured funding:

- Vessi Medical closed a US$16.5 million Series A round for its cryotherapy technology targeting urological tissue.

(The technolgy is designed for outpatient use, meaning it can be used in a clinic without general anesthesia, reducing risks and recovery time)VESSI MEDICAL:

In simple terms, the technology uses extreme cold to freeze and destroy abnormal or cancerous tissue inside the bladder without requiring traditional surgery. - Vensica Medical raised US$11 million to support Phase 2 clinical trials in the U.S. and Europe for its innovative needle-free treatment for overactive bladders.

(It created a device called Vibe® that uses ultrasound to deliver drugs into the bladder wall without needles) - Phytolon secured an undisclosed amout of funding from Rich Products Ventures to advance the commercialization of its sustainable natural food coloring solutions.

It previously raised US$4.1 million (in 2020) and US$14.5 million (in 2022). - Celleste Bio raised US$4.5 million to accelerate R&D and pilot production of cell-cultured cocoa ingredients, with backing from strategic investors like Mondelēz SnackFutures.

Phytolon produces high-quality natural food colors from baker’s yeast fermentation technology. Phytolon is advancing towards commercialization, and preparing for regulatory approvals in the U.S. and Europe

Phytolon produces high-quality natural food colors from baker’s yeast fermentation technology. Phytolon is advancing towards commercialization, and preparing for regulatory approvals in the U.S. and Europe

Organizational Restructuring

Trendlines implemented key organizational changes to enhance efficiency and position the company for growth.

These changes included downsizing, and task realignment, resulting in a leaner and more efficient organization.

Successful Capital Raises

The company completed two capital raises totalling S$8.1 million on the Singapore Exchange:

- A rights issue in May 2024

- A private subscription in Nov 2024

These capital raises strengthened Trendlines' financial position and demonstrated investor confidence in the company's strategy and potential.

|

Outlook for 2025 Several factors suggest a positive trajectory:

|