|

Those colorful M&M's and Skittles that kids (and adults too) gobble up might actually contain some health risks from synthetic dyes. Another US company, General Mills (owner of brands such as Cheerios and Häagen-Dazs), faced similar scrutiny but announced in June 2025 plans to remove synthetic dyes from its cereals.

|

This lines up with bigger changes in U.S. food rules on synthetic colors, which come from petroleum.

| “Today, the FDA is asking food companies to substitute petrochemical dyes with natural ingredients for American children as they already do in Europe and Canada,” said FDA Commissioner Marty Makary, MD, MPH. “We have a new epidemic of childhood diabetes, obesity, depression, and ADHD. Given the growing concerns of doctors and parents about the potential role of petroleum-based food dyes, we should not be taking risks and do everything possible to safeguard the health of our children.” -- Source |

Meanwhile, a cool 7-year-old startup in Israel, Phytolon, is developing natural food coloring with biotech for a global market that is estimated to be worth US$2 billion currently and growing by 50% in 5 years.

Phytolon uses fermentation—basically tweaking baker's yeast to produce betalains, those natural pigments from beets or prickly pears.

No farms needed.

Their lineup covers yellow, orange, red, pink, and purple vibes, holding up great against pH changes, heat, and time.

These are perfect for stuff like dairy, drinks, candies, and baked goods.

Phytolon co-founders: Dr Halim Jubran (CEO), Dr Tal Zeltzer (Chief Technology Officer). Phytolon co-founders: Dr Halim Jubran (CEO), Dr Tal Zeltzer (Chief Technology Officer).Fund-raising: • US$4.1 million in Sept 2020 (seed funding) • US$14.5 million Series A in July 2022 • Additional funding in Oct 2023 • Investment from Rich Products Ventures in Nov 2024 |

Big players have taken notice. Boston-based biotech company Ginkgo Bioworks in April 2025 teamed up with Phytolon to triple output.

Phytolon has received cash injection from Rich Products Ventures in November 2024.

Phytolon is a portfolio company of The Trendlines Group, an Israel-Singapore company listed on the Singapore Exchange that's all about boosting human life by funding and nurturing medtech and agrifood startups to real-life impact.

Trendlines owns a chunky piece—26.37% directly and 3.24% through the Agrifood Fund—and is hands-on helping Phytolon nail U.S. and Euro approvals.

Phytolon is a pre-revenue company while there already are a few producers such as Oterra.

A comparison of the two is as follows:

|

Aspect |

Phytolon |

|

|

Company Background |

Startup founded in 2018 in Israel; focused on biotech innovation. |

Established company (as part of Chr. Hansen founded in 1874); world's largest natural colors supplier, acquired by EQT Private Equity in 2021 for ~US$940M. |

|

Production Technology |

Precision fermentation using genetically engineered yeast to produce betalains (pigments identical to those in beets and prickly pears); farm-free, lab-based process. |

Traditional extraction and sourcing from plants, fruits, and vegetables (e.g., apples for brown, Colombian forests for blue); relies on agricultural supply chains. |

|

Sustainability Focus |

High efficiency: Reduces water use by 95%, land by 88%, and emissions by 90% compared to traditional farming; minimizes agricultural variability and waste. |

Emphasizes responsible sourcing (e.g., from sustainable forests) and plant-based options for clean-label and vegetarian products; focuses on circular economy but tied to agriculture. |

|

Market Focus & Scale |

Targets replacement of synthetic dyes in dairy, drinks, candies, and baked goods; pre-commercial stage, focusing on partnerships for scale-up. |

Broad focus on food & beverage, dietary supplements; serves major brands with consistent, high-volume supply; dominant market share in natural colors. |

|

Challenges |

Still in growth phase; higher initial R&D costs; regulatory approvals pending for broader markets. |

More expensive than synthetics due to complex extraction; vulnerable to agricultural supply fluctuations. |

Phytolon could be ripe for a buyout or exit that could pay off big for Trendlines shareholders.

That's especially sweet after a dry spell of major wins since 2021 when portfolio company OrthoSpin was acquired for US$79.5 million in cash.

Trendlines received US$15.8 million for its 26.9% stake.

Shareholders griped about the no-show of exits at the April 2025 AGM. (See: TRENDLINES: Shareholders at AGM pressed board on exit strategy and cash controls)

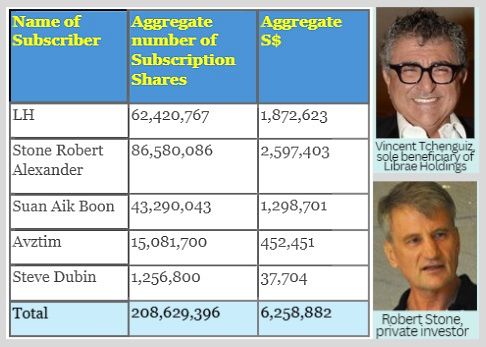

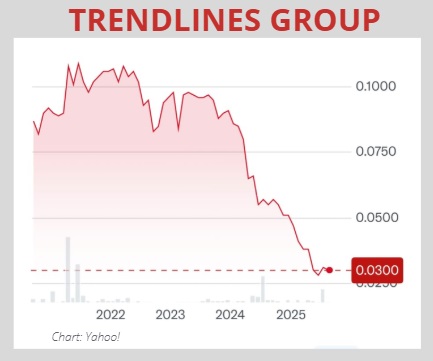

Trendlines helped pull in a record US$42 million for several of its portfolio companies in 2024, seemingly unaffected by the ongoing war between Israel and Hamas. Now, Trendlines is seeking capital for itself with a 1-for-8 rights issue (subscription at 2.85 cents/share) and a private share subscription (at 3 cents/share) with several investors. It hopes to raise up to S$3.89 million from the rights issue, and up to S$6.3 million from the private subscription (see graphic below).  • Robert Stone will invest $2.6 m via the placement and a further $185,000 to exercise his pro-rata rights shares, raising his stake from 4.75% to as high as 10.13%. • Robert Stone will invest $2.6 m via the placement and a further $185,000 to exercise his pro-rata rights shares, raising his stake from 4.75% to as high as 10.13%. • Likewise, Boon Suan Aik will raise his stake from 4.32% to 6.96%. (Their final percentages will differ if they subscribe for excess rights shares and depending on the participation rate of other shareholders in the rights issue). • Librae Holdings will maintain its stake at a whisker below 30%, the threshold for a compulsory takeover offer. Tredlines' stock is scraping all-time lows—around 3 cents on Aug 1, 2025—making it an attractive target for investors with a load of patience and betting on huge upsides from Trendlines' sale of portfolio companies.  For example, assuming 5-10X return on the US$20+ million of invested capital into Phytolon, a sale could fetch US$100-200 million, returning SGD36-76 million to Trendlines (market cap: SGD33 million).  Source: FY2024 AGM minutes Source: FY2024 AGM minutesPhytolon is but one of a number of Trendlines' mature portfolio companies — others include Escala Medical, which develops minimally invasive devices for treating pelvic organ prolapse (POP) in women. In June 2025, the company secured US$4.5 million in funding, including co-financing from the European Innovation Council Fund, to accelerate the business expansion of its device which received FDA approval in 2022. |