| Trendlines Group shareholders have enjoyed an unexpectedly good run recently. Not only is the Singapore-listed stock (5.6 cents) up a whopping 81% in the past 1 week, likely triggered by a ceasefire in the Israel-Hamas war, there's news of a groundbreaking development from Celleste Bio, a portfolio company of The Trendlines Group. The portfolio company, Celleste Bio, said in an Oct 15 press release it has achieved a world first -- producing chocolate grade cocoa butter using cell-cultured technology. Instead of traditional cocoa farming, Celleste Bio takes cocoa bean cells and grows them indoors to produce both cocoa powder and cocoa butter. This milestone, unveiled at the EIT Food's Next Bite Summit in Brussels on Oct 15, 2025, marks a significant step toward a more sustainable and resilient cocoa supply chain.  The credibility of the process is further underscored by an investment in Dec 2024 from Mondelez International, an American MNC that produces a wide range of food products including Cadbury and Toblerone. |

| Understanding Cell Culture Technology |

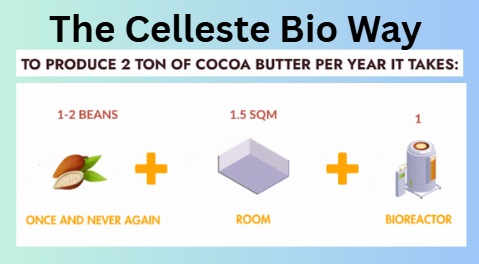

Cell culture, the technology behind this breakthrough, involves growing plant or animal cells in a controlled environment, such as a bioreactor, to produce specific compounds.

Celleste Bio's method allows for precise, scalable production while bypassing agricultural challenges like weather or land use. Source: Company

Source: Company

Founded in 2022 by a team including Chief Technology Officer Hanne Volpin, PhD, and CEO Michal Berresi Golomb, the company uses naturally occurring cocoa cells—without any genetic modification—to create bio-identical cocoa ingredients.

This innovative approach addresses longstanding challenges in traditional cocoa farming, such as deforestation, climate vulnerability, child labor, and high carbon emissions.

The new cocoa butter is chemically and functionally identical to that extracted from cocoa beans, boasting the same fatty acid profile, melting point, and smooth texture essential for premium chocolate.

Celleste's process generates zero waste and enables scalable production independent of agricultural constraints.

This is particularly timely amid recent cocoa market turmoil: in 2024, global shortages led to a 500% price surge (from ~US$2,000 to ~US$12,000 a tonne between Oct 2022 and Apr 2024). The current price: US$6,000.

| Trendlines’ Strategic Support |

Celleste Bio's achievement underscores the value of Trendlines' investment strategy, which focuses on agrifood and healthcare innovations.

Supported by Trendlines since its inception, Celleste has raised US$5.6 million from investors including Mondelēz International, Supply Change Capital, and Barrel Ventures.

The company is now building a pilot facility to accelerate R&D and scale production, promising to stabilize cocoa supplies for global chocolatiers.

| Trendlines’ Stock Surge and Investor Gains |

This news coincides with positive momentum for Israel-headquartered Trendlines itself.

The company's stock price has surged, closing at S$0.056, compared to S$0.031 a week ago.

|

Stock price |

5.6 c |

|

52-wk range |

2.6 – 5.9 c |

|

PE (ttm) |

-- |

|

Market cap |

S$68.8 m |

|

Shares outstanding |

1.23 B |

|

Dividend |

-- |

|

1-yr return |

5.7% |

|

P/B |

0.44 |

|

Source: Yahoo! |

|

This upward movement is likely influenced by the recent Israel-Hamas ceasefire, which has brought stability to the region where Trendlines, an Israel-based firm, operates.

(The stock traded at ~9 cents just before Hamas attacked Israel in Oct 2023, sparking a 2-year war).

Particularly benefiting are shareholders who participated in Trendlines' recent non-underwritten rights issue, which closed oversubscribed in August 2025, at an issue price of S$0.0285 per share.

These investors now enjoy substantial gains as the stock trades 100% above the subscription price.

Looking ahead, Trendlines is actively pursuing exits for several mature portfolio companies, a strategy that has historically delivered value to shareholders.

While no new exits have been announced since 2021, the company's H1 2025 financials reported a US$5.9 million increase in the fair value of certain portfolio holdings, signaling strong potential. |

Trendlines press release is here.

Trendlines press release is here.

See also: TRENDLINES: Shareholders at AGM pressed board on exit strategy and cash controls