WILL AN ECONOMIC slowdown strongly restrain HK and mainland Chinese consumers from buying jewelry?

Sunwah Kingsway analyst Steve Chow, CFA, thinks otherwise and says that Hong Kong jewelry retailers will enjoy, on average, high-teen sales growth for the coming 12-18 months.

In particular, he expects sales to re-accelerate in 2H12 on government easing measures and base effect which could be a positive surprise to the market, he says in an initiation report on Chow Sang Sang (HKSE: 0116.HK ) and Luk Fook Holdings (0590.HK).

Hong Kong jewelry retailers have experienced de-rating since August 2011, with forward PE declining from 18x to the current level of about 9x.

A household name in Hong Kong, Chow Sang Sang (market cap: HKD12 billion), established in 1934 and listed on the HK Stock Exchange in 1973, has about 300 self-operated shops in Hong Kong, the PRC, Macau and Taiwan.

Established in 1991 and listed on the Hong Kong Stock Exchange in 1997, Luk Fook (market cap: HKD15 billion) operates approximately 700 retail outlets in the People’s Republic of China, Hong Kong, Macau, Singapore, the United States, and Canada.

The Sunwah Kingsway analyst disagrees with the consensus view that jewelry retailers are as vulnerable as other luxury plays.

“We believe investment demand and celebration demand are on a structural uptrend, which should mitigate short-term impact on decorative demand.”

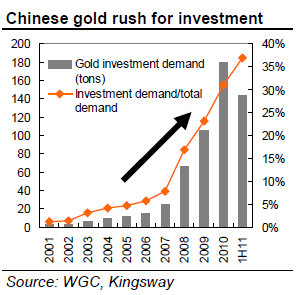

Highlighting the Chinese enthusiasm for gold, he says the investment demand for gold has increased rapidly since 2008 and represents 37% of China’s total gold consumption.

Then there is the Chinese culture -- gold jewelry is a popular gift item at weddings and births, a fact that will drive sales as marriages rise by over 10% a year in recent years.. This year will see a continued boom as this is the “Year of Dragon” which is popular for births.

Sunwah Kingsway’s stress tests found that Hong Kong jewelry retailers are less vulnerable to operating deleverage than its peers thanks to economies of scale. They are also more resilient to rental pressure due to a low rental/sales ratio.

The brokerage recommended that investors buy Chow Sang Sang and Luk Fook on weakness in coming months.

“In our view, the recent share price weakness has already factored in a near-term sales slowdown. We also believe the market may have underestimated the potential re-acceleration in 2H12.”

It said the current sector valuation of about 10x forward PE is attractive.

“We urge investors to look beyond near-term cyclical weakness and focus more on the medium term positives. We initiate BUY on Chow Sang Sang and Luk Fook with TP of HK$24.6 and HK$37.6, respectively.”

Recent story: CHOW SANG SANG, FOCUS MEDIA: Jewelry, Ads Show Recession-resistant Results

-impact of Visa restrictions on HK sales outlook 2013?

-short selling numbers High,Low or Average?

Is your TP still good?

PGL