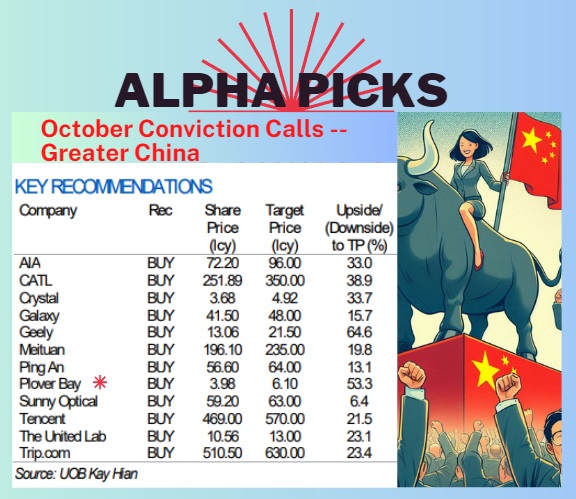

• Thanks to China's new stimulus measures to boost its economy, Chinese and HK stocks have been roaring loudly. UOB KH has just put out its alpha picks for the Greater China markets.  • One of them is notable: Plover Bay Technologies, which boasts high gross margins (~55%), is asset light and is on a growth trajectory. A key aspect of its business is being an authorised technology provider of Starlink, which belongs to Elon Musk's SpaceX. Starlink is a satellite internet constellation designed to provide high-speed, low-latency broadband internet across the globe, particularly in remote and underserved areas. Starlink's network consists of thousands of small satellites in low Earth orbit, which allows it to offer reliable internet services. • So what does Plover Bay do? Among other things, through its brand Peplink, it creates devices and software that can combine multiple internet connections, including Starlink's, to make them faster and more reliable. This is especially useful for businesses and people on the move, like those on ships or in remote locations. (For more, see this investor's analysis -- and UOB KH's take below). |

Excerpts from UOB Kay Hian report

Analyst: Greater China Research Team

• The HSI and MSCI China surged 17.5% and 23.1% mom respectively in September, buoyed by the PBOC’s policy easing and supportive statements from the Politburo meeting. |

ACTION

• Add CATL (300750 CH) to our BUY list due to the strong growth in monthly EV battery shipments and drop in lithium carbonate prices which will lead to better 3Q24 earnings.

• Add Geely (175 HK) to our BUY list due to its upbeat monthly sales.

• Add Plover Bay (1523 HK) to our BUY list as its growth momentum has continued into 8M24, with revenue growth in July and August further accelerating from 28% yoy in 1H24, mainly driven by strong demand in the US and Australia.

• Take profit on COLI (688 HK), Desay (002920 CH) and KE Holdings (2423 HK).

• Cut losses on Li Auto (2015 HK) and Xpeng (9868 HK).

• Maintain BUY on AIA (1299 HK), Crystal (2232 HK), Galaxy (27 HK), Meituan (3690 HK), Ping An (2318 HK), Sunny Optical (2382 HK), Trip.com (9961 HK), Tencent (700 HK) and The United Lab (3933 HK).

| Plover Bay Technologies (1523 HK) (Analyst: Kate Luang) We held an update call with Plover Bay. Its solid growth momentum continued into 8M24 with revenue growth in July and August further accelerating from 28% yoy in 1H24, mainly driven by strong demand in the US and Australia. Management expects full-year 2024 revenue to grow by 25% yoy despite a relatively high base in 2H23. The company is positive on achieving a high gross margin in 2H24 (1H24: 55.4%), thanks to stable raw material costs and a favourable product mix. We expect Plover Bay’s full-year gross margin to reach 56.5% in 2024, vs 54.0% in 2023.  We are seeing increased deployment of Peplink routers in the maritime vertical. Following the deployment of Peplink routers on their cruise ships, Royal Caribbean Group also debuted Starlink Internet in communities in Alaska in late-August (where their cruise ships make stops at) so that passengers can remain online while onshore. We maintain BUY and raise target price to HK$6.10. We increase our 2024-26 revenue forecasts by 1%/1%/1% respectively to reflect stronger growth momentum, and raise our 2024-26 net profit forecasts by 8%/8%/9% respectively to factor in higher gross margins. We believe the 19% share price pullback since late-July provides windows to accumulate shares as the company is trading at attractive valuations of 11.2x 2025F PE and 7.8%/8.5% dividend yield in 2024-25 respectively. Catalyst: Further collaboration(s) with Starlink announced. Valuation: Trading at 11.8x one-year forward PE, which is slightly below its historical mean of 12.6x in 2018-24. |

Full report here.