| A Hot Start on the Stock Market

|

IPO Pricing: Bargain or What?

Drinda’s H-shares were priced at HK$22.15, representing a steep 49.5% discount to its A-share price on the Shenzhen Stock Exchange (trading at around RMB41.18, or HK$43.9 equivalent at time of pricing).

For investors, that’s a rare chance to buy in at almost half price, which explains the huge demand.

The IPO raised HK$1.4 billion (US$180 million), with about 63.43 million shares issued.

The Hong Kong public tranche was 3.5 times oversubscribed, reflecting significant retail enthusiasm.

The international placement attracted long-only funds and ESG-focused investors, including sovereign wealth and green-themed institutional buyers.

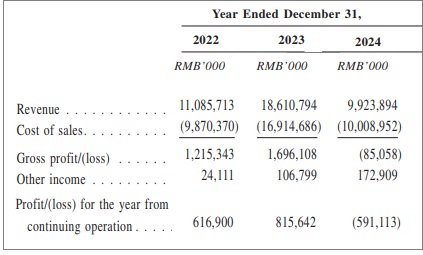

The current market cap of the H shares: ~HK$1.6 billion. Primarily due to industry-wide continued decrease in PV cell price, Hainan Drinda incurred a net loss of RMB591 million for 2024.

Primarily due to industry-wide continued decrease in PV cell price, Hainan Drinda incurred a net loss of RMB591 million for 2024.

Massive Production, Global Ambitions

As of late 2023, Drinda’s annual production capacity for high-efficiency solar cells exceeded 25GW, and it's on track to hit 55GW by the end of 2025.

This positions the Company among the largest and most technologically advanced solar cell manufacturers globally.

Its ability to mass-produce TOPCon cells at scale sets it apart in a competitive field.

What’s Next for the Money Raised?

Proceeds from the IPO will be deployed toward further capacity expansion and R&D in next-gen cell technologies like HJT (heterojunction) and IBC (interdigitated back contact), as well as smart manufacturing upgrades and supply chain localization strategies in target markets.

The world is doubling its dependence on clean energy.

Installed global solar capacity is expected to rise about 14% to 580GW in 2025, according to Frost & Sullivan and N-type cells are projected to account for over half of new capacity additions due to their superior performance metrics.

Policy boosts — like the U.S. Inflation Reduction Act, EU Green Deal, and India’s Production Linked Incentive Scheme for solar—are also nudging buyers toward top-tier, high-efficiency products.

Drinda’s early-mover advantage in mass-producing N-type TOPCon positions it well to capture these premium markets.

In addition, in an era of growing geopolitical trade frictions, Drinda’s ambitions to build plants outside China could mitigate exposure to export barriers while enabling local-for-local production in key regions.

The Company’s client base is diverse, spanning Europe, the Middle East, South America, and India.

Nearly 24% of revenues in 2024 were derived from overseas markets.

|

A Sweet Spot for Investors

Oversupply in the PV industry is easing due to intense competition, which has eliminated outdated capacity and forced many lower-tier firms out.

For investors looking for exposure to solar, green energy, or China’s next-generation manufacturers, we believe Drinda (02865.HK) offers a rare blend of growth and momentum. |

The IPO prospectus is here.