VITASOY HAS completed the construction of production plants in Foshan city, which commenced operation in October 2011. The HKD$5 billion investment could increase Vitasoy’s maximum production capacity by an extra of 160,000 tonnes per annual.

It is expected that more significant revenue growth can be achieved with the new capacity. In addition, the operating margin is expected to improve mainly due to the absence of one-off pre-operation expenses for the new production plant.

Despite facing production bottlenecks since March 2011, Vitasoy has reported profit growth, though minor, in its interim report. the six months ended Sept 30 last year, revenue rose 14% YoY to HKD$1,946 million.

Gross profit was up 12% at HK$948 million. The overall margin slightly decreased to 48.4% due to the rise in selling price not fully offseting the rise in cost of raw materials.

Net profit dropped by 5% YoY to HK$178 million, with the net gearing ratio standing at 41%.

"China’s EBIT margin fell by 5.1ppt yoy, as marketing expenses for brand building and channel expansion have been front‐loaded before the operation of the new capacity. We believe that its China market will be back to its high growth era following the expansion; hence, we project volume of 30% p.a. for the next two years," according to Jacqueline Ko, analyst from Kim Eng.

With the newly installed capacity, Vitasoy can now kick start more aggressive marketing efforts to meet the strong demand growth from PRC customers.

The beverage market in China has changed rapidly in recent years. As people pursue healthy living, high quality soy milk is increasingly favoured by consumers.

Vitasoy soybean products contain rich protein and are cholesterol free, and its nutrition value is as rich as milk.

The No. 1 brand in soy milk market in the PRC has been achieved CAGR of 34% in revenue from its Mainland China business between 2008 and 2010.

The Hong Kong-based soy milk producer has always insisted on the use of domestically produced natural non-genetically modified soybeans in its production for over 70 years. It has highlighted the importance of quality control and brand building in its sales growth strategy.

“Most soy milk producers are competing on price, but at the same time they are insecure and their products are less nutritious. The quality is difficult to guarantee,“ said Yuan Jie, Managing Director of Vitasoy (China).

“Industry data shows that as early as 2009, Vitasoy accounted for 42% of the market share in the mainland soy milk market, becoming the No.1 brand in China. In addition, market research survey shows that Vitasoy was clearly in the lead in the Southern and Eastern China markets, including Guangzhou, Shenzhen and other major cities with the repeat purchase rate at 60 percent. This indicates a high degree of consumer loyalty as well as recognition of Vitasoy’s nutritious quality and enjoyment.”

The importance of product quality was heightened by the recent news on aflatoxin poisoning in milk products. Sales of certain milk products dropped 50% - 60% in a single day.

On the other hand, sales of branded soy milk have increased dramatically, according to several supermarket staff.

“Every time milk products incur negative news, inevitably it would lead to a shift toward domestic consumption of soy milk, and we would receive a lot of telephone enquiries from customers about the nutritional value of soy milk. This will definitely increase the awareness of healthy drinks and safety issues for the beverage market," added Mr. Yuan.

Would the shift in consumer demand be maintained?

“In developed regions and countries in the world, soy milk has a broad consumer base. For example, in Hong Kong, Singapore, Japan, the United States, Australia and other countries, the consumption level of packaged soy milk per capita is ten times more than the current level of mainland China’s,” said Mr. Yuan.

The China soy milk market certainly has become one of the key revenue drivers for Vitasoy. Currently the China market accounts for 31% of the company’s total revenue. Management believed the figure could increase to 35% to 40% in the coming 3 to 5 years.

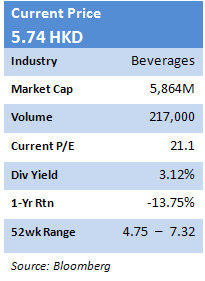

Vitasoy shares recently traded at HK$5.74. The average target price of three analysts (KimEng, Wing Fung, HoiTong) is HKD$6.41.