Translated by Andrew Vanburen from a Chinese-language piece in NBD

THE BATTLE FOR China’s lucrative fruit juice market is squeezing the pool of competitors down to two Hong Kong-listed heavyweights.

It is a coveted position China Huiyuan Juice Group (HK: 1886) has held for several years.

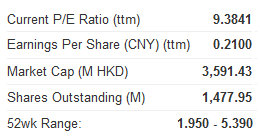

But the Chinese firm, who rejected a takeover bid from Coca-Cola recently, is seeing its leading market share under threat from a rival with Taiwanese roots – Shanghai-based Uni-President China Holdings (HK: 220).

And if full-year 2011 results are to be used as the absolute measuring stick in this heavyweight bout, then Huiyuan may have already thrown in the towel.

On Wednesday, Huiyuan announced that its 2011 profit rose 56.6% year-on-year to 310 million yuan.

On the surface, this would appear to most casual market watchers to be a very vibrant performance.

But that doesn’t mesh with the reaction from shareholders, who responded to Huiyuan’s financial results with a 5.5% share price selloff the day of the announcement.

The reason for the counterintuitive fall is the nature of the beverage giant's sales over the past year.

At the same time, Huiyuan’s formidable rival Uni-President had announced the previous day that its juice sales last year had surpassed three billion yuan, and revenue from this product category alone was creeping closer to Huiyuan’s overall operating revenue last year of 3.8 billion yuan.

Meanwhile, Huiyuan’s operating revenue last year was only a slight increase over its 2010 total of 3.7 billion yuan.

Furthermore, Huiyuan’s cost of sales rose to around 2.8 billion yuan last year from just 2.35 billion in 2010.

Industry insiders say that Huiyuan’s core products are generally focused on very crowded sectors laden with bottlenecks, and they further expect the PRC juice market in 2012 see this situation exacerbated making it harder for the firm to stay on top for long.

Impure Achievement

Huiyuan’s raw bottom line growth is impressive by any measure.

Photo: Uni-President

Its net profit growth of 56.6% to 310 million yuan would ordinarily be enough to cheer shareholders.

But investors often read between the bottom lines, and in this case, they didn’t like what they saw as Huiyuan’s cost of sales increase of nearly 20% far outpaced the operating revenue rise of just 3.2%.

Even more worrying was that Huiyuan’s full year 2011 gross profit of 1.3 billion yuan produced a gross margin of just 26.9%, far below the 36.7% figure recorded the previous year.

That is the primary reason behind the counter’s post-announcement daily fall of 5.5% on the Hong Kong stock market.

But those not familiar with the juice market may still wonder why a firm with such a strong bottom line performance can be tossed off so casually just after releasing such results.

First of all, on Huiyuan’s latest earnings statement, one item is of particular importance – the number of shares available for corporate bond conversion at “fair value consideration.”

In 2010, this category totaled 70 million yuan, but it jumped precariously to 340 million the following year.

This is surely an indication that the investing public believes Huiyuan’s recent share price levels are over-inflated, and the post-results selloff was a natural reaction to this sentiment, said a market watcher with First Shanghai.

If the shares locked up in this above-mentioned category are not factored in, the company’s profit would have actually fallen last year by 79.6% to 36.9 million yuan.

Furthermore, Huiyuan’s operating revenue last year was nearly flat on a year-on-year basis, but the cost of sales rose at an alarming rate.

This is contrasted against Uni-President’s 35% sales jump last year.

At this rate, it is no wonder that market watchers are saying that it may not be too long until Mainland China’s fruit juice market has a new President in power.

See also:

JUICED UP: CHINA TIANYI Crushing Peers In PRC Orange Juice Market

DUKANG: 2Q2012 Net Profit Up A Whopping 55% At Rmb 94.4m

VITASOY: Stronger Revenue/Profit Growth Expected From 1Q12 Onwards

FOOD FOR THOUGHT: WANT WANT, TINGYI Noodle Blue-Chip Bound