Banyan's current project, which began construction in 2024 with phases over 5-10 years. Banyan's current project, which began construction in 2024 with phases over 5-10 years.Hospitality group Banyan Tree does not release quarterly results, only half-yearly and full-year numbers. But its 86%-owned Thai-listed subsidiary, Laguna Resorts & Hotels, does, and its 3Q numbers tell an encouraging story. The residential sales in their Laguna Phuket integrated resort is really driving profits for the Banyan Group. Laguna is selling beach and lakefront homes to high-net-worth buyers, with Russia being the #1 country of origin. Buyers from China, Thailand and Singapore are among the rest of the flock. Visit Phuket, and especially the Laguna Phuket area, and one cannot help but encounter Russians and shop signages in Russian. Laguna is planning to release another 5,000 residential units over the next few years, while it also operates seven world-class hotels and premium facilities in the Laguna Phuket integrated resort. |

A recent Laguna Phuket advert on Facebook

A recent Laguna Phuket advert on Facebook

Property sales have significantly contributed to Banyan Tree's overall results in FY23 and FY24, as shown in the table:

|

S$ Mil |

Hotel Investments |

Residences |

Fee-Based Segment |

|||

|

|

FY24 |

FY23 |

FY24 |

FY23 |

FY24 |

FY23 |

|

Revenue |

196.9 |

180.7 |

104.1 |

87.3 |

79.6 |

59.9 |

|

Expenses |

(151.4) |

(148.1) |

(81.7) |

(68.2) |

(61.9) |

(49.0) |

|

Core Operating |

45.5 |

32.6 |

22.4 |

19.1 |

17.7 |

10.9 |

The residences segment is still in the early stages of monetising a landbank acquired in the 1980s at a fraction of today’s value.

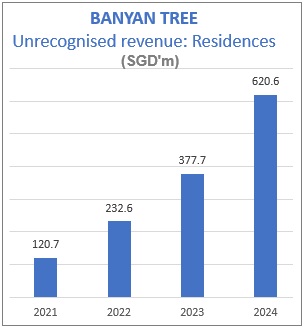

It's a surging business, as the table on unrecognised revenue from property projects shows: Significant contributions will come, according to Banyan's 2024 annual report, from Phuket projects such as Laguna Lakelands (S$93.6 million), Laguna Beach Residences Bayside (S$79.8 million), Laguna Beachside/Seaside (S$74.8 million), Angsana Oceanview Residences (S$49.1 million), Garrya Residences (S$16.3 million), and Laguna Lakeside (S$12.2 million).

Significant contributions will come, according to Banyan's 2024 annual report, from Phuket projects such as Laguna Lakelands (S$93.6 million), Laguna Beach Residences Bayside (S$79.8 million), Laguna Beachside/Seaside (S$74.8 million), Angsana Oceanview Residences (S$49.1 million), Garrya Residences (S$16.3 million), and Laguna Lakeside (S$12.2 million).

In 9M2025, Laguna recognized revenue from property development of Baht 1,479 million (about S$59 million).

That's a tiny net rise of Baht 8 million over the same period last year.

There was a Q3 drought -- ie zero property handovers. Revenue is booked only when units are handed over, so it's lumpy by nature.

Now, an exciting part: new property bookings.

Laguna raked in Baht 3,214 million in fresh contracts in 9M2025.

That translates into a net increase in the property sales backlog of Baht 1,735 million, so by September's end, the backlog stood at Baht 17,248 million (around S$690 million).

|

Figure |

Value |

Source |

|

Beginning Backlog (as at 31 Dec 2024) |

Baht 15,525 million |

Banyan Tree Holdings FY2024 Results Briefing Deck (Pg 15) |

|

Ending Backlog (as at 30 Sep 2025) |

Baht 17,248 million |

Laguna Resorts & Hotels Q3 2025 announcement (Pg 1) |

|

Net Increase in Backlog |

Baht 1,735 million |

(Baht 17,248 million - Baht 15,525 million) |

|

Property Bookings (9M 2025) |

Baht 3,214 million |

9M recognized revenue + Net increase in backlog (Baht 1,479 million + 1,735 million). |

But the backlog will see a big drawdown in 4Q2025 as completed properties are handed over to buyers.

In a Feb 2025 PowerPoint deck (page 15), Banyan Tree guided that S$262.3 million (Baht 6,457 million) revenue would be recognised in the residences segment in 2025.

Recall that only Baht 1,479 million (ie 23%) has been recognised in 9M2025.

It's unknown what 4Q property bookings that Laguna will chalk up, if any.

In 4Q2024, it was Baht 1,097 million (S$31 million).

Assuming only this amount is repeated, then Laguna will end 2025 with 14% lower backlog than 2024 (ie 17,248 - 4,978 + 1,097 = Baht 13,367 million).

The Phuket residential property segment's a winner, reflecting Banyan Tree's brand appeal pulling in high-net-worth folks looking for luxurious direct beach or lake frontage homes. Property profits could well overtake hotel profits probably for the first time in the group’s history.

|

→