Morgan Stanley: CHOW SANG SANG Initiated ‘Overweight’

Morgan Stanley said it is beginning coverage of Chow Sang Sang (HK: 116) with an “Overweight” recommendation and a target price of 24.6 hkd, based on a 2013E P/E of 12.0x (recent share price 21.05 hkd).

“We expect valuation to re-rate as sales momentum recovers from a cyclical trough,” Morgan Stanley said.

The research house said it expects earnings growth to rebound from -15% YoY in 2012E to +49/26% in 2013/14 on 22%/15% sales growth and 136bps/ 58bps higher operating margin in 2013/14, respectively.

Better positioned than peers for short-term rebound

“In our view, Chow Sang Sang is well positioned for an earnings rebound as sales recover, given its: (1) higher fixed costs, thus stronger operating leverage than peers; and (2) higher exposure to coastal/higher-tier cities, which we expect will see a stronger recovery following a bigger slowdown in 2012.”

Morgan Stanley added that Chow Sang Sang’s network is still at an early stage of development, and it sees upside from a clustering effect.

“CSS’ China network is still young with 8% of its China POS being standalone stores within their respective cities (vs. 4-6% for peers), and 50% of POS are in clusters of 5-or-fewer (vs. peers’ 29-38%).

“This offers more clustering potential for its POS, especially as CSS plans to open 70-80% of POS in already penetrated cities.”

The clustering effect could improve its SSSG and margins from 1) increased brand awareness, 2) SG&A cost sharing, 3) better inventory utilization, 4) better staff recruiting.

Lower-risk business model

Longer term, Morgan Stanley said it thinks CSS’ business model presents less risk than others, given that its: (1) stores are all self-operated, which eliminates the channel and brand dilution risks of franchised models; (2) mid/high-end brand positioning, separating itself from a crowded mass market; (3) prudent management and long listing track record; and (4) limited saturation risk because of its low store count in China (but this could become a negative if it falls significantly behind its peers in network size).

Catalysts and risks

Morgan Stanley said it expects monthly SSSG to improve steadily starting January 2013 as the YoY base declines from a high of >35% in 4Q12 to 15% in 1Q13, further helped by a CNY calendar shift (18 more days between 1-Jan and CNY in 2013).

Why 'Overweight'?

Stronger earnings rebound potential on operating leverage from higher fixed costs and larger exposure to higher-tier cities should allow CSS to recover more quickly than peers informed its recommendation, the research house said.

Chow Sang Sang also has a higher store growth potential, given its smaller network than peers.

“The jewelry retailer has a lower-risk business model, having more focused brand management vs. peers given its self-operated retail model.”

See also:

Goldman Sees CHOW SANG SANG Growth

GOLDEN OPPORTUNITIES? CHOW SANG SANG Jewelry ‘Outperform’; RETAIL Upbeat

CHOW SANG SANG Target Hiked

CHOW SANG SANG’S Sparkling Review; LENOVO Aiming For Clouds

Morgan Stanley: HENGDELI Initiated ‘Equal-weight’

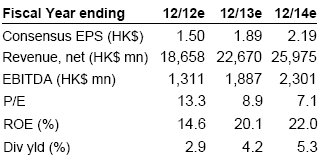

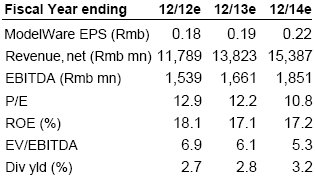

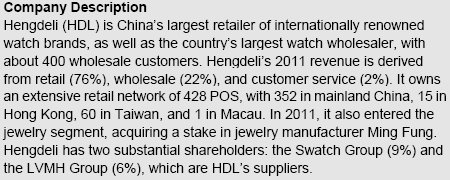

Morgan Stanley said it is beginning coverage of luxury retailer Hengdeli (HK: 3389) with an “Equal-weight” recommendation and a target price of 3.3 hkd, based on a 14.0x midcycle FY2014E P/E (recent share price 2.96 hkd).

Hengdeli’s stock price has increased 38% since early Oct 2012 (vs. 9% for HSI), pricing in early signs of recovery in high-end watches.

“But we believe it is premature to conclude demand for large ticket price items has returned, and remain cautious given scrutiny on watch gifting,” Morgan Stanley.

The research house said it expects earnings to grow 6%/12% YoY in 2013/14 on a high 2012 base boosted by one-off gains.

Bright growth prospects in lower-tier cities

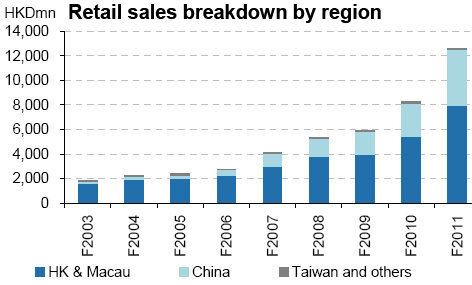

Hengdeli is the largest watch retailer and wholesaler in China, which Morgan Stanley expects to only get bigger if it continues to acquire smaller competing retailers.

“This is helped by: (1) its unparalleled information access into 1,000+ smaller retailers through its wholesale arm, and (2) strong backing by two of the world’s largest watch suppliers (Swatch, LVMH).

“These allow HDL to expand more quickly into lower-tier cities, which we expect to fuel its growth and margin expansion potential.”

The research house said it holds a wait-and-see approach on the sustainability of a high-end watch sales recovery (we estimate 30% of high-end watch sales, or 10-15% of HDL’s sales, is related to gifting).

“Recent public controversies over media reports of expensive watches worn by government officials could lead to more caution and scrutiny over luxurious gifting.

“We like that its shareholding structure has counterbalancing forces in Swatch and LVMH.”

See also:

Heart Of Gold: MING FUNG JEWELLERY Hosts Olympics Fundraiser

Gucci Watches Doubling, Jewelry Shining For HK-Listed MING FUNG

MING FUNG JEWELLERY: Domestic Sales Surge On China Gold Rush