ALL FIVE participants in our $100,000 ‘stock challenge’ game, which began five weeks ago, have experienced a turnaround in their portfolios as of last Friday (May 9).

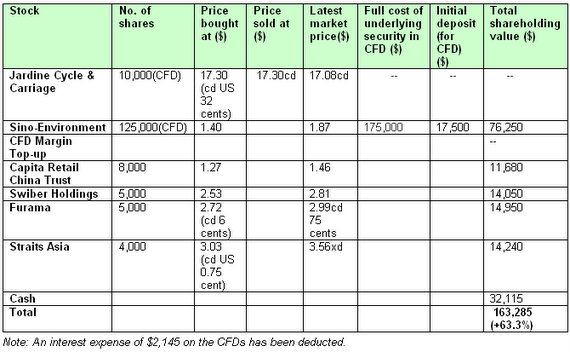

Leading the pack is Sebastian Chong with a whopping 63% gain, thanks largely to the use of Contracts for Difference (CFD) for his purchase of Sino-Environment.

Without the use of CFD for Sino-Environment, his gain would be 12.6%. (See Sebastian's working below)

Details:

Sebastian Chong has invested actively in equities since the 1970s. He is managing director of Financial Info Analysis Pte Ltd, a company he founded after he retired as an accounting professor at the National University of Singapore. He now runs his popular investing website, www.shareowl.com

Sebastian says:

Jardine Cycle & Carriage (CFD) was sold since the near term sentiment was dampened by uncertainties surrounding the Indonesian economy and motor vehicle sales. The long-term fundamentals of this stock remain excellent but since this was purchased under CFD, I have decided to reduce the overall risk of the portfolio by selling it off. Indeed, this moment represents a buying opportunity for long-term investors.

However, I am mindful that this stock game has only 5 months left. As for the CFD on Sino Environment, the loss of $10,000 three weeks ago turned into a profit of $58,750 as the share price surged from $1.34 to $1.87 during that short period owing to announcements of large denitrogenation contracts and the good progress on the execution of desulphurization contracts.

As the profit of $58,750 was reaped from an initial investment of only $17,500, the percentage gain in 5 weeks is 335.7%. Every further increase of 10 cents in the share price would mean an additional profit of $12,500. A CFD typically has a leverage of 10 times the initial deposit (of 10% of the value of the underlying shares). I have therefore maintained a large cash deposit of $34,260 to cover margin calls just in case the share price crashes.

The fundamentals of Sino Environment may look very good but if the Dow and STI were to suffer very steep plunges, the value of the CFD will most likely crash and lead to large margin calls because of the high gearing involved. Just like fire, a CFD can be a good servant but a bad master.

As for the ungeared investments in specific stocks, they chalked up the following percentage gains in shareholder value (capital gains plus dividends) since the inception of the stock game:

Straits Asia: 17.5%

Capita Retail China Trust: 15%

Furama: 12.1%

Swiber: 11%

All the above stocks outperformed the STI by a wide margin. With a careful selection of ungeared investments in stocks in different industries, there is no need to go overboard with CFDs. Note how the portfolio strikes a balance between CFDs, ungeared stocks, and cash.

Cash balance is arrived at after adding dividend receivable when the share price goes ex-dividend and after deducting interest charge of $2,145 on CFD initial underlying value i.e. JC&C $173,000 for 3 weeks at 8% p.a. = $799 and Sino-Env $175,000 for 5 weeks at 8% p.a. = $1,346.

If the $17,500 were invested in Sino-Env shares rather than CFD, the market value of the investment would have been $23,375 instead of $76,250. The portfolio value would have been $112,555 instead of $163,285. In other words, a gain of 12.6% rather than 63.3%.

Without CFD and interest charge, the cash balance would be $34,260. Without CFD, I would not be providing for contingent margin calls. I would be investing most of the $34,260 cash in shares.

|

Stock |

No. of shares |

Price bought at $ |

Latest market price |

Value of shareholding ($) |

|

Inchem |

425,500 |

0.235 |

0.275 |

117,013 (+17%) |

Audi Wong, 35, is a commercial pilot who has invested very successfully in stocks and properties, especially in recent years. He graduated from the University of New South Wales with a bachelor’s degree in aviation.

Audi says:

Inchem has recently announced a 14-cent-a-share payout from the impending sale of its businesses to Sherwin-Williams.

As an update (May 14), I have just sold Inchem at $0.285 for a 21% gain.

In view of the remaining time left for this stock game, I'll rather walk away with a 21% gain and re-invest it elsewhere rather than waiting for the cash payouts, even though there is still value for anyone with a longer term perspective on Inchem.

I'll sit on cash for the moment while I analyse some of my favorite companies for their Q1 performance. My emphasis remains strong on a competitive moat and pricing power in this sort of inflationary environment.

Inchem's May 8 announcement on SGX, here.

|

Stock |

Number of shares |

Price bought at ($) |

Price sold at $ |

Value of shareholding ($) |

Noble |

25,000 |

2.36 |

2.71 |

|

|

Ho Bee |

50,000 |

0.995 |

1.05 |

|

|

Cash |

|

|

|

109,000 |

|

Total |

|

|

|

109,000 (+9%) |

Aileen Goh, 31, has been a trading representative at Phillip Securities for the past eight years since she graduated with an accounting and finance degree from Monash University. She has a mix of investing approaches: long-term fundamentals-based investing coupled with short-term trading, depending on the circumstances.

She says:

Noble - After it announced a great set of results, I took profit at $2.71 as the stock has moved up quite a bit ahead of the results. Technically, it looks a little stretched.

Ho Bee - Took profit on Ho Bee at $1.05 for same technical reasons.

|

Stock |

Number of shares |

Price bought at ($) |

Latest market price $ |

Price sold at $ |

Value of shareholding ($) |

Yanlord |

10,000 |

2.59 |

|

2.75 | |

Yanlord |

5,000 |

2.45 |

|

2.75 | |

|

Brothers |

100,000 |

0.225 |

|

0.26 | |

| Dutech | 200,000 | 0.23 | 0.23 |

46,000 | |

|

Cash |

|

|

|

60,600 |

|

|

Total |

|

|

|

106,600 |

Mephisto is a 30-something investor who says he is a simple man who enjoys his bak ku teh with Chinese tea every weekend morning. Having gone through the 1987-2007 booms and busts, he has a great deal of respect for Mr Market. Nevertheless, he enjoys pitting his wits against the market, which is by itself a learning experience, he says.

Mephisto says:

Took profit on Yanlord and Brothers. Bought 200,000 Dutech at 23 cents. It is giving 2 cents a share in dividend, or 8.9% yield.

My somewhat lengthy analysis of Dutech is published separately on this website.

Click here.

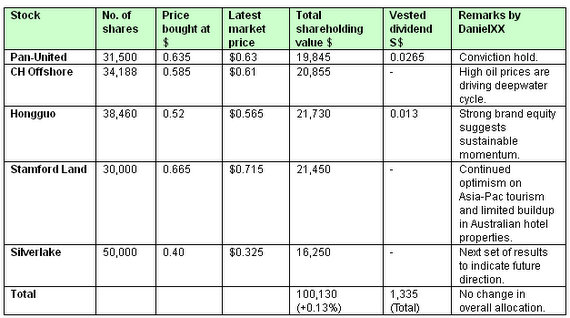

DanielXX is a 30-something investor who is well-known in certain online investing forums as well as for his blog, where his writings on investing reflect depth of thought and analysis.

The next portfolio update is in 3 weeks' time on June 2.

Previous NextInsight stories:

STOCK CHALLENGE: Results range from 0% to -6.1% after 2 weeks