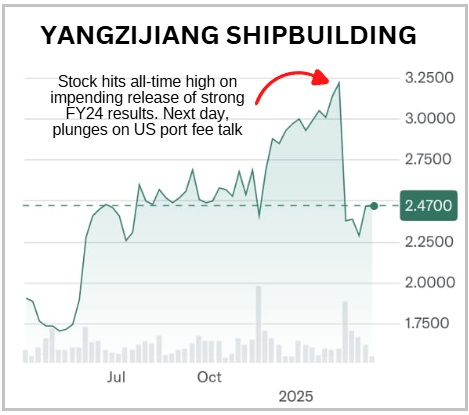

• Yangzijiang Shipbuilding's stock rose 5.6% last Friday ( 21 Mar) to $2.47 (chart below). Was it a dead cat bounce or something else? • The stock is a long way down from its $3.22 peak in Feb 2025. It crashed the day after news of a US Trade Representative (USTR) proposal to slap huge fees on Chinese-built ships calling at US ports in order to fight against the dominance China has in shipbuilding. Chinese shipyards booked 74% of global newbuilding orders in 2024.  • Lots of people are on the edge of their seats waiting to see what'll happen at a public hearing today (24 Mar) on the proposal by the USTR and then the Trump administrations's response. • There's a huge opposition to it from industry players. An article on Splash247.com reports that "in the more than 150 submissions sent in, a considerable number have hit out at the unfair, blanket nature of the penalties for container shipping in particular." The article quoted a case of a typical COSCO ship being potentially charged US$3.5m per port call or US$10.5m for each voyage involving three west coast ports. "With ten 35-day voyages per year, that would translate into US$105m in annual fees just for that one COSCO vessel." • Meanwhile, below are excerpts from a 27 Feb analyst report recommending a 'buy' on Yangzijiang. |

Excerpts from CGS International report

Analyst: Lim Siew Khee

Yangzijiang Shipbuilding

Confident of FY25F US$6bn order win target

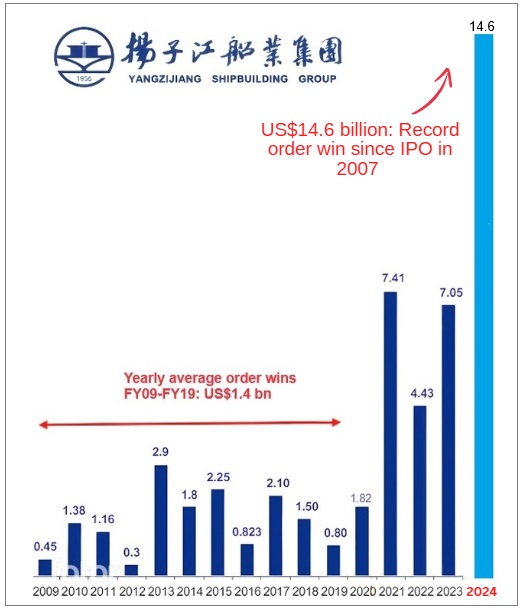

| ■ Net profit of Rmb3.58bn in 2H24 (+17% hoh) was driven by half-on-half gross margin expansion in shipping (+5.5% pts) and shipbuilding (+3.8% pts) segments. ■ Management is confident of achieving its FY25F order win target of US$6bn, based on yard availability and industry demand. ■ While enquiries have slowed, we think this is not a concern as existing order wins have filled out its yard capacity till 2027F, according to management. ■ Proposed dividend of 12Scts (payout ratio: 39%) vs. 6.5Scts (34%) in FY23. Reiterate Add with an unchanged TP. |

Current orderbook comprises mainly container ships and bulk carriers for delivery up to 2030. Eco-friendly vessels account for about 74% of the total orders.

Current orderbook comprises mainly container ships and bulk carriers for delivery up to 2030. Eco-friendly vessels account for about 74% of the total orders.

| Confident of US$6bn order wins in 2025F despite slowing enquiries |

● YZJSB targets to win orders worth US$6bn in FY25F, in line with our expectations.

|

Yangzijiang |

|

|

Share price: |

Target: |

In YZJSB’s analyst briefing today, management said it is confident of achieving the target based on yard availability and industry demand.

While enquiries have slowed as liners are yet to make fleet decisions following large orders made in 2024, we think this is not a concern as existing order wins have filled out its yard capacity till 2027F, according to management.

● Management said it has not seen any knee-jerk reactions (such as order cancellations or delays) arising from the service fees proposed by the United States Trade Representative (USTR) on maritime operators who operate and order China-built vessels.

Management intends to keep the payment schedule unchanged.

We estimate YZJSB collects 20-30% of contract values as deposits.

● However, earlier delivery slots (6 months ahead of YZJSB) and price cuts by Korean shipyards could move some potential customers towards the Korean yards in the near term, management said.

YZJ has slots for 2028F deliveries, and some even for 2027F.

● We expect FY25F revenue to remain relatively stable yoy as FY25F workloads should remain similar to FY24’s given YZJSB’s yards are operating at maximum capacity.

Project Hongyuan (Xinfu yard) is scheduled to start first delivery in 2027F while Project Runze (new capacity for the construction of large LNG carriers and dual-fuel containerships) is in the planning stage, according to management.

|

Full report here.