| The next couple of weeks will see the Bald Hill project of Alliance Mineral Assets (AMA) advance to the production of lithium concentrate, a milestone reached in one of the shortest time frames (less than a year) in the history of mining in Australia. Along the way, AMA, the only lithium play listed on the Singapore Exchange, gained 322% last year (from 9 cents to 38 cents in 2017). Investors' appetite for lithium miners everywhere, not just AMA, has been whipped up by the prospect of a global shift to electric vehicles in the years and decades ahead. The revolution has Elon Musk as the pre-eminent individual visionary while China is way ahead of nations globally in legislating for electric vehicles to become mainstream.  @ Bald Hill project of AMA and Tawana joint venture, which is set to be the next producer of lithium concentrate globally. Photo: Company @ Bald Hill project of AMA and Tawana joint venture, which is set to be the next producer of lithium concentrate globally. Photo: Company |

The Australian Stock Exchange offers many lithium plays, ranging from a handful of producers to a larger pool of juniors that have no revenue yet and are quite some time from production.

Yet almost without exception, a fire has been lit under their stocks, as you can see in the first table featuring lithium miners with market caps above A$100 m.

What multi-baggers they have been!

|

Company |

End-Dec 2015 stock price |

End-Dec 2017 stock price |

Market cap |

Gain (Dec 2015 – Dec 2017) |

|

Galaxy Resources |

A$0.57 |

A$3.83 |

A$1.57 b |

572% |

|

Pilbara Minerals |

A$0.32 |

A$1.11 |

A$1.89 b |

247% |

|

Altura Mining |

A$0.05 |

A$0.40 |

A$721 m |

700% |

|

Kidman Resources |

A$0.09 |

A$1.88 |

A$660 m |

1,989% |

|

Neometals |

A$0.17 |

A$0.44 |

A$239 m |

159% |

|

Lithium Power |

A$0.20* |

A$0.57 |

A$149 m |

185% |

|

Alliance Mineral Assets |

S$0.12 |

S$0.38 |

S$208 m |

217% |

|

Tawana Resources |

A$0.03 |

A$0.46 |

A$234 m |

1,433% |

|

*Lithium Power IPO in June 2016. |

||||

The second table features miners of lower market caps (A$100 m and below) with speculative upside potential but carry higher risks as investments for a multitude of reasons.

One, or more, of the following, apply to some of the miners:

♦ not having explored and drilled sufficiently to prove the extent of their lithium resources,

♦ not having sufficient cash for opex and capex, and thus will need to do seriously dilutive capital raising, etc

♦ execution risks.

|

Company |

End-Dec 2015 stock price |

End-Dec 2017 stock price |

Market cap |

Gain (Dec 2015 – Dec 2017) |

|

Core Exploration |

1 c |

7.8 c |

A$39 m |

680% |

|

Liontown Resources |

1.8 c |

4.4 c |

A$44 m |

144% |

|

Lithium Australia |

17 c |

20.0 c |

A$69 m |

18% |

|

Novo Litio |

6 c |

5.1 c |

A$19 m |

-15% |

|

PepinNini |

1 c |

8.2 c |

A$40 m |

720% |

|

Sayona Mining |

2 c |

7.0 c |

A$103 m |

363% |

|

Data: Yahoo! |

||||

Notes on 3 of the stocks. (For more info, check out their respective websites).

1. Sayona Mining has the highest market cap (A$103 m) after making good progress towards being a producer.

Following a rights issue in Nov 2017, Sayona has A$5 million cash, and it signed a MOU for a "strategic alliance" with leading China-based battery manufacturer Huan Changyuan Lico Co Ltd, a subsidiary of Fortune 500 company China Minmetals Group.

Australia's Independent Investment Research in Dec 2017 set a target price of 10.2 Aussie cents for the stock (click here for report).

Referring to its Authier lithium mine in Canada, Corey Nolan, CEO of Sayona, commented in a Dec 2017 press release: "The Company is very pleased to be progressing to the DFS (Definitive Feasibility Study) stage. Authier is one of the more advanced lithium hard rocks projects in the world and has the potential to be in production in 2019/2020. |

||||||

2. Novo Litio sticks out as a terrible underperformer but it did spike up -- from 4 cents to about 9 cents -- in 2H2017 but subsequently slid over an ownership dispute between itself and the vendor of a mine.

However, Novo Litio has plans to explore lithium in other locations (such as Sweden) while pursuing its rights in the ownership dispute over a mine in Portugal.  Liontown Resources' Buldania project is just tens of kilometres away from the Bald Hill and Mt Marion lithium mines in Western Australia.

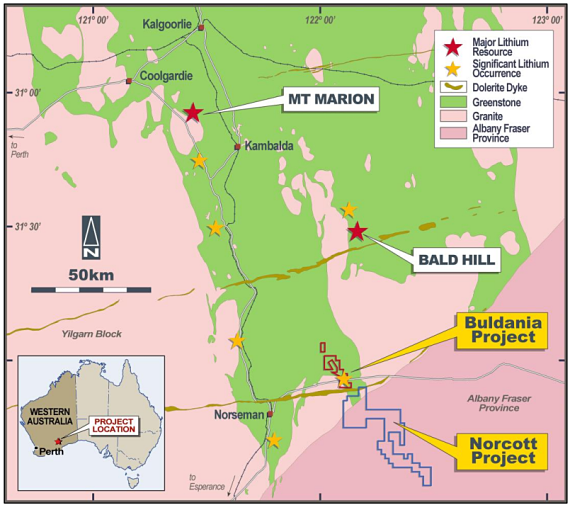

Liontown Resources' Buldania project is just tens of kilometres away from the Bald Hill and Mt Marion lithium mines in Western Australia.

3. Liontown Resources' project is, most interestingly, located in a "region well known for hosting significant lithium deposits including Mt Marion and Bald Hill," according to Liontown's website.

Liontown is progressing toward drilling and establishing the lithium resources in its so-called Buldania project. Positive findings will certainly cause the stock price to escalate. Stay tuned.

Lithium giant Albemarle contradicts Morgan Stanley on electric vehicle growth

Article also has high marks for Liontown Resources: Note Buldania project, where pre-drill rock chip sampling returned results of up to 4.2% lithium.