Joshua Wu, a private investor, had also attended the briefing and contributed an article to NextInsight last Friday: RIVERSTONE: "A Wonderful Company At A Fair Price"

Riverstone's share price ($1.185) has tripled in value in the last two years or so.

Riverstone's share price ($1.185) has tripled in value in the last two years or so. Chart: FT.com

STRONG SALES, favourable USD/RM forex rates, and tax incentives helped Riverstone Holdings soar to a record high profit of RM71 million last year -- and it proposed a final dividend of 4.55 sen.

With record profits come record dividends.

Considering the interim dividend of 2.35 sen already paid, the total dividend of 6.90 sen a share for FY2014 is a record high for the Malaysian-based glove manufacturer.

However, because of a sharp rise in the share price over the past two years, the trailing dividend yield currently stands at only about 2.2%. (See chart)

After the results briefing: Analysts and investors speak with management or discuss among themselves. Photo by Leong Chan Teik

After the results briefing: Analysts and investors speak with management or discuss among themselves. Photo by Leong Chan TeikSeveral takeaways from the recent 2014 results briefing:

1. Trade receivables: As at end-Dec 2014, they stood at RM86.7 million, up from RM62.5 million a year earlier.

Reason: Riverstone's new factory in Taiping, Perak, started production in Nov 2014, resulting in higher sales. Credit terms of about 60 days remained unchanged.

2. Tax incentives: The income tax expense in 4Q2104 amounted to only RM46,000 (compared to RM4.2 million in 4Q2013) despite 4Q2014 profit before tax being RM22.4 million (11.1% higher year-on-year).

Reason: There was a tax incentive (known as Reinvestment Allowance) on the RM63 million capex (not including land cost) for the new 1-billion capacity factory .

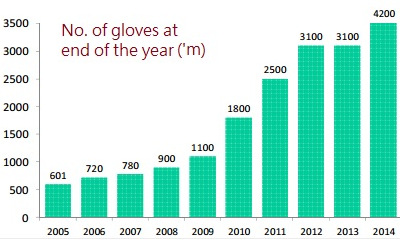

Riverstone has steadily expanded its production capacity of gloves. This year another factory with 1-billion glove capacity will come onstream. The same tax incentive will apply to another new 1-billion capacity factory which will be completed by the end of this year.

Riverstone has steadily expanded its production capacity of gloves. This year another factory with 1-billion glove capacity will come onstream. The same tax incentive will apply to another new 1-billion capacity factory which will be completed by the end of this year.The tax incentive on capex of RM50 million (not including land cost) is expected to be recognised in the 4Q of this year.

Riverstone plans to start building another factory in 3Q this year with a similar 1-billion capacity for RM80 million capex. When completed in 2016, it would raise its total production capacity to 6.2 billion gloves.

3. Selling prices: Gross profit margins have stayed constant but as raw material prices dipped, Riverstone passed on the savings to its healthcare glove customers owing to stiff competition in this business. Selling prices were adjusted on a monthly basis.

However, selling prices for cleanroom gloves were negotiated on a half-yearly, or yearly, basis.

Riverstone has benefitted from the strengthening of the USD agains the ringgit.

70-80% of its sales are recorded in USD while only 30-40% of raw material costs are paid in USD.

4. Cleanroom gloves: Riverstone produces premium grade gloves for use in cleanrooms. It has introduced new lines of gloves (branded as Cleancare and A Clean) which are priced slightly lower so as to defend the 'RS' premium brand image.

Reflecting its strong hold on the high-end cleanroom glove sector, Riverstone enjoyed about 12% growth in volume last year, and expects double-digit growth again this year.

The growth drivers are the mobile phone and tablet sectors while the hard disk drive sector is flattish.

Executive chairman and CEO Wong Teek Son (center, in white shirt) and CFO Lim Sing Poew (far right, in white shirt) speak with attendees after the results briefing. Photo by Leong Chan TeikRiverstone "is a significant leader in ESD (electrostatic discharge) technology and we have teams that work with the customers to customise cleanroom gloves."

Executive chairman and CEO Wong Teek Son (center, in white shirt) and CFO Lim Sing Poew (far right, in white shirt) speak with attendees after the results briefing. Photo by Leong Chan TeikRiverstone "is a significant leader in ESD (electrostatic discharge) technology and we have teams that work with the customers to customise cleanroom gloves."Another barrier to entry for competitors is the fact that the audit process for potential suppliers is relatively more stringent than for healthcare gloves.

"So far, none of our customers have gone to our competitors, and we are in fact getting new orders," said Mr Wong Teek Son, chairman and CEO of Riverstone.

"Through our marketing studies, we found that there's a big gap between our competitors and us."

Riverstone reckons that for high-end cleanroom gloves (Class 100 and Class 10), it has a market share of about 60%.

It ships its gloves directly to customers, mostly in Asia-Pacific, unlike for healthcare gloves where it deals with distributors all over the world who on-sell to customers such as hospitals.

5. Revenue/volume split: In terms of revenue, cleanroom and healthcare gloves had a 50-50 split. In terms of volume, it was 30-70, reflecting the higher selling prices of cleanroom gloves.

@ Riverstone's new plant in Taiping, adjacent to which Riverstone is building another 1-billion capacity plant.

@ Riverstone's new plant in Taiping, adjacent to which Riverstone is building another 1-billion capacity plant. NextInsight file photo.These proportions are expected to stay constant for this year.

6. Utilisation rate: All of Riverstone's production lines are taken up, running 24/7.

But because of the time needed to prepare production lines to change over to produce products according to various customers' requirements (in terms of the weight and other properties of the gloves), the actual factory utilistion rate is about 90%.

"Even if customers come to us with more orders, we cannot accept them. That's why we have to speed up the second phase of our current factory expansion," said Mr Wong.