|

Investors and analysts did not miss out on questions about the impact of the Trump tariffs on Riverstone Holdings. A: In fact, there's no impact so far. Shipment is as usual. All our healthcare gloves are sold under FOB, so the price is fixed based on FOB, and the buyer has to settle the rest. A: Because we are selling FOB, we don't have much discussion with our customers from the healthcare gloves side. A: No change because it's very clear the tax is not in our pricing formula. Q: Did they raise their prices to pass on to their customers? A: We do not know. |

Production Ramp Hit by Gas Shortage

The company has ambitious plans to boost production capacity to 10.5 billion gloves a year, with six new cleanroom glove lines ready to go.

However, a shortage of gas supply is holding things back, delaying the ramp-up until at least July.

But management expects things to improve in the second half of the year once the gas issue is sorted out.

For 2025, the company is targeting around 10% volume growth, with capex set at about RM50 million, mainly for facility upgrades

Riverstone's 2H performance is expected to improve if gas supply normalizes.

The company targets about 10% volume growth for 2025. Gross profit margin on a blended basis is expected to remain around 32%, but the US dollar remains a key variable.

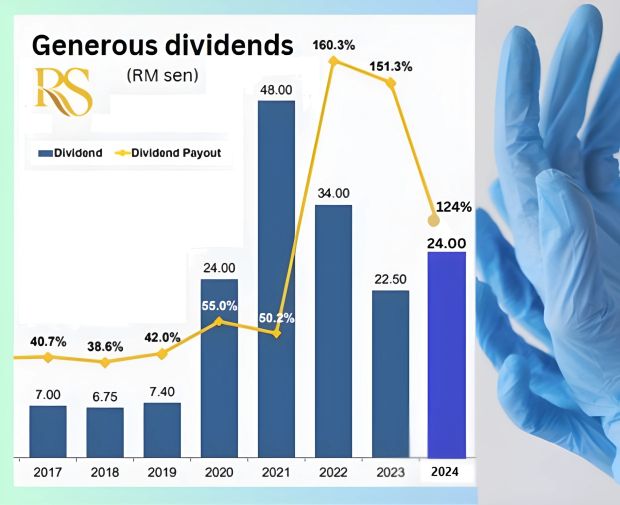

Financials and Dividends

The first quarter of 2025 saw a dividend of 3 sen per share, which was a hefty 78% of the quarter’s earnings.

Riverstone's balance sheet is strong, and the company is expected to keep up a healthy dividend payout.

Analysts project yields at 5–6% over the next few years.

The 1Q2025 dividend was 3 sen/share, which was 78% of the quarter's earnings.

The 1Q2025 dividend was 3 sen/share, which was 78% of the quarter's earnings.

|

What UOB Kay Hian analysts Heidi Mo and John Cheong said: |