|

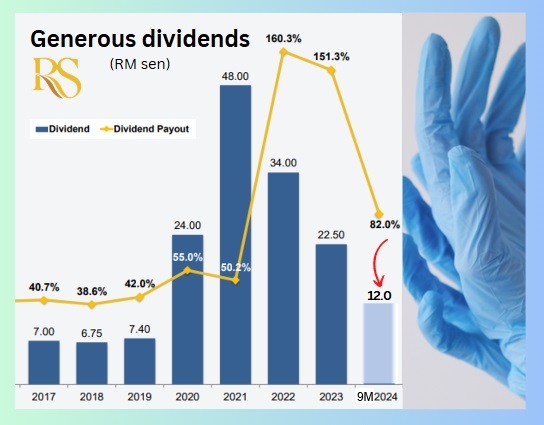

If there's one thing that strikes investors about Riverstone Holdings, it's the high dividend yield.

|

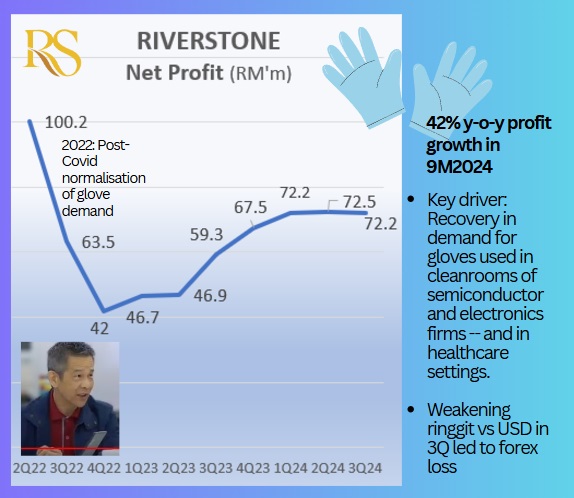

Here are highlights of the company's 3Q24 and how it relates to 1H24 performance:

Revenue and Profit Growth

After a 7% year-on-year increase in revenue in 1H2024, driven by demand recovery in both cleanroom and healthcare gloves, revenue in 3Q grew 33.9% yoy.

3Q net profit increased by 22% yoy, with the cleanroom segment seeing a 10% qoq increase in volume due to higher demand from the electronics and pharmaceutical sectors. Inset: Wong Teek Son, CEO.

Inset: Wong Teek Son, CEO.

Gross Margin Expansion

In 1H2024, Riverstone's gross margin expanded by 12 percentage points (ppt) yoy, driven by lower raw material costs and higher-margin cleanroom glove sales.

By 3Q2024, despite some margin compression due to higher input costs, the company maintained a healthy gross profit margin of 34.7%, with a strong overall margin of 37.8% for 9M24.

Capacity Expansion

Riverstone's ever ongoing capacity expansion will see, by end 2024, six new production lines for cleanroom gloves, along with three lines for customized healthcare gloves.

This expansion will increase total capacity from 10.5 billion to 11.9 billion gloves by 2025, positioning the company for future growth.

Dividend Payout

Riverstone increased its dividend payout significantly in 1H2024 -- from 5.0 sen in 1H2023 to 8.0 sen.

For 3Q2024, the company declared a third interim dividend of 4.0 sen, bringing the total payout ratio for 9M24 to 82%.

Riverstone's robust balance sheet boasts cash balances of RM790 million as at end-3Q24 (1H24: RM761 million).

| Conclusion Overall, Riverstone Holdings has seen significant positive developments, including strong revenue and profit growth, expanded production capacity, higher dividends, and continued strength in its cleanroom glove segment. These gains were partially offset by challenges such as margin compression from rising input costs and forex losses, as well as competitive pressures on healthcare glove prices. Despite these headwinds, Riverstone's financial position remains solid, supported by robust cash flow and an attractive dividend yield. |

See UOB KH's report here