|

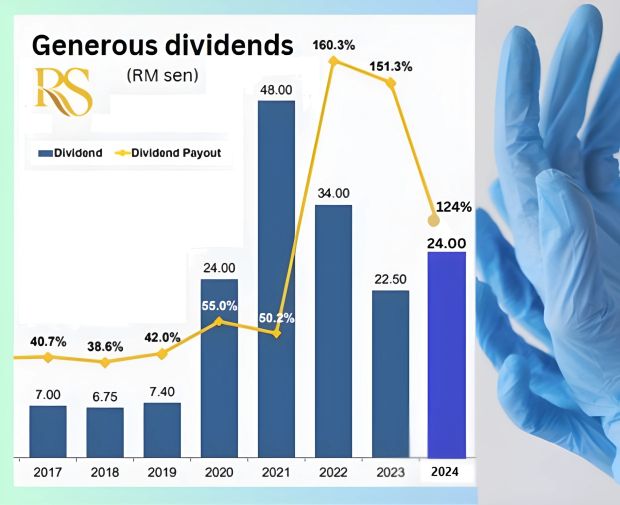

If there's one thing that strikes investors about Riverstone Holdings, it's the high dividend yield. |

Q: Could you share insights into Riverstone’s long-term journey and lessons learned over the years?

CEO Wong Teek Son: One of the most important lessons is the need for continuous innovation. For example:

- Cleanroom Gloves: We started in 1995 (or slightly earlier), and the technology for cleanroom gloves has changed significantly since then. We’ve had to develop new products to meet market requirements, such as improving contamination control, electrostatic discharge properties, and surface finishes.

We also needed to understand how users operate with gloves and develop products that enhance efficiency during production. - Healthcare Gloves: When we started this segment in 2008, we focused heavily on nitrile gloves. At that time, competition was less intense.

However, now everyone can produce nitrile gloves, leading to significant competition.

- The healthcare glove market includes various categories. The highest-volume products are standard gloves ( 3.2g and 3.4g), which many manufacturers target with high-efficiency production lines. While this is beneficial during periods of high demand, it has become highly competitive now.

- To address this, Riverstone focuses on specialty and differentiated products. This requires flexible production lines capable of switching between different product types.

- The healthcare glove market includes various categories. The highest-volume products are standard gloves ( 3.2g and 3.4g), which many manufacturers target with high-efficiency production lines. While this is beneficial during periods of high demand, it has become highly competitive now.

Q: What are the hardest parts of managing the supply chain in your business?

CEO Wong Teek Son: The most critical challenge is staying aligned with market changes. Even though healthcare gloves may seem like a standardized product, there have been many changes in recent years, especially post-COVID. Customers now demand:

- Cleaner gloves with fewer chemical residues.

- More comfortable gloves with better elongation and durability.

- Improved fitting tailored to specific needs.

To meet these demands, we must maintain constant communication with the market and continuously innovate to stay competitive.

|

Q: Why are Riverstone’s margins and profitability higher than competitors like Top Glove and Hartalega?

This approach fosters strong customer loyalty and confidence in our track record. Cleanroom customers prioritize reliability over pricing. |

See CGS's report here