Aquariums

@ Shanghai Ocean Aquarium. NextInsight file photo.Q1 SOA and UWX figures (with % change in brackets):

@ Shanghai Ocean Aquarium. NextInsight file photo.Q1 SOA and UWX figures (with % change in brackets):

2007: 201,000

2008: 326,000 (62%)

2009: 373,000 (14.4%)

2010: 336,000 (-10%)

2011: 374,000 (11%)

2012: 407,000 (8.8%)

2013: 498,000 (22.36%)

2014: 608,000 (22%)

Q2:

2007: 309,000

2008: 466,000 (50.8%)

2009: 466,000 (0%)

2010: 490,000 (5%)

2011: 550,000 (12%)

2012: 603,000 (9.6%)

2013: 686,000 (13.8%)

2014: 840,000 (22.4%)

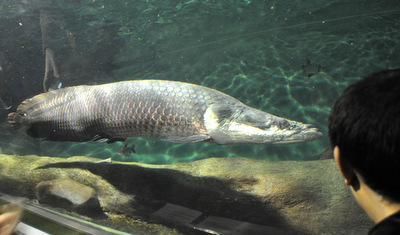

The arapaima fish @ Shanghai Ocean Aquarium. The fish originated in the rivers and lakes of the Amazon basin and is one of the largest freshwater fish in the world. NextInsight file photoQ3:

The arapaima fish @ Shanghai Ocean Aquarium. The fish originated in the rivers and lakes of the Amazon basin and is one of the largest freshwater fish in the world. NextInsight file photoQ3:

2007: 414,000

2008: 658,000 (59%)

2009: 650,000 (-1%)

2010: 1,073,000 (65%)

2011: 869,000 (-19%)

2012: 947,000 (9%)

2013: 1,260,000 (33%)

2014: 1,650,000 (30%)

Q4:

2007: 313,500

2008: 384,000 (22.5%)

2009: 371,000 (-3%)

2010: 465,000 (25%)

2011: 454,000 (-2.3%)

2012: 506,000 (11.4%)

2013: 590,000 (16%)

2014: 609,000 (3%)

Q3 accounted for a huge proportion of revenue and you can see the crazy growth there in comparison to the other quarters. In the past 2 years, intra-China tourism took off in a big way and has been a good thing for Straco. The Q4 change in visitors was very small but as you can see from the data you cannot draw a conclusion that just because this quarter the result was lukewarm, the next few quarters will be as such too.

Competition in China

We are not sure whether the purchase of the Flyer is a response but competition looks to be heating up. Perhaps at the end of the year, Disneyland Shanghai Phase 1 would be ready. The management seems cool about this, and they felt that this would be beneficial to Straco by attracting more tourists to Shanghai. The Disneyland tickets are estimated to be priced at HK$300, while SOA’s prices should come up to HK$180.

There is the prevalent thought that, there is no competition since people would want to go to the Star Attraction, plus there are more things to do.

Haichang Group, which recently got listed HKSE, will build their Ocean Theme Park in Shanghai, which is scheduled to be completed in 2017. Haichang group runs a few theme parks in China and the location chosen is rather far from SOA. SOA happens to be very much at the heart of many popular Shanghai tourism spots such as the Bund (No. 1 rank on TripAdvisor) and Pearl Tower.

If there is one theme attraction that should be more worrying, it has to be the current attraction in Shanghai -- Happy Valley. It is ranked No. 17 on TripAdvisor (as compared to SOA which is ranked 33).

I think that Disneyland will attract more tourists to Shanghai and this would be complementary to SOA. However, the positive impact would be balanced off by losing some of the crowd to these more interactive places.

|

Straco currently trades at a market cap of $631 mil. Based on a net profit of $37.7 + $1.89 mil = $39.6, the PE is 16 times. That’s hardly cheap and does not provide a margin of safety. Whether we can purchase it at this point very much boils down to the growth rate (stagnant, 5% or 10%) and the performance of the Flyer. I like to think that with the moves being made, which were cited in the last report, and the positive numbers we see here, together with the rent improvement, we may be able to see a 5% growth in aquarium profits and a $12 mil full year contribution in GOW profits. This puts forward net income at $54 mil. This works out to a PE of 11.7 times. Valuation does not look extended. However, should Disneyland become a threat, then a sell decision seems a more suitable course of action. |

Previous story: Kyith Ng: "My take on STRACO's purchase of Singapore Flyer"

FY2014

Segment PBIT

Aquariums - 62,694

GOW - (598)

Others - 1,198

total - 63,294

PBIT as P&L - 57,641

Diff - 5,653

FY2013

Segment PBIT

Aquariums - 49,010

Others - 2,668

total - 51,678

PBIT as P&L - 50,270

Diff - 1,408

Go figure where are those one off items being recorded in segment P&L.

Straco pretty much shout out where they dump those number.

Straco group structure say it might more than just a simple carry trade.