| It was a post-pandemic phenomenon waiting to happen. Visitors have been returning in droves to Straco Corporation's flagship asset, the Shanghai Ocean Aquarium -- and its Singapore Flyer. The Singapore-listed company has just reported that 3Q2023 profit hit S$16.3 million. "The return of crowds during the summer holidays in China was one of the major contributing factors," said Straco, for whom 3Q has historically been the busiest. "There were no business disruptions during the quarter and the transition to the post Covid-19 phase since the last quarter of 2022 has been positive."  Shanghai Ocean Aquarium: Sited adjacent to the Oriental Pearl Tower, it is well primed to serve visitors in Shanghai’s bustling financial district of Lujiazui in the Pudong New Area. Shanghai Ocean Aquarium: Sited adjacent to the Oriental Pearl Tower, it is well primed to serve visitors in Shanghai’s bustling financial district of Lujiazui in the Pudong New Area. |

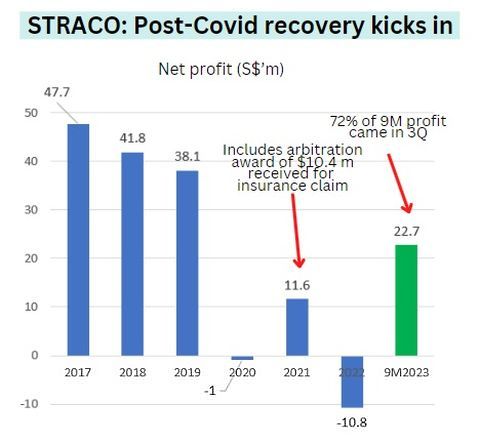

1H2023 profit: S$6.4 million. 3Q2023: S$16.3 million. Thus, total for 9M2023: S$22.7 million.

1H2023 profit: S$6.4 million. 3Q2023: S$16.3 million. Thus, total for 9M2023: S$22.7 million.

|

|

|

Stock price |

47.5 cents |

|

52-week range |

39.5-51.5 c |

|

Market cap |

S$406 m |

|

PE (ttm) |

-- |

|

Dividend yield |

2.1% |

|

P/B |

1.7 |

|

Shares outstanding |

855 m |

Straco's attractions regained their cash-generative prowess: Net cash generated from operating activities amounted to a solid $25.3 million in 3Q2023, compared to $4.3 million in 3Q2022.

Straco said it ended 3Q with net cash holdings of $165.92 million, up from S$143 million as at end-2022.

This augurs well for not just a final dividend for FY2023 but a higher payout than the 1-cent/share distributed during the three Covid years (even when Straco was operationally loss-making).

The 1-c/share dividend amounted to just S$8.6 million a year in absolute dollars.

Will Straco hand out 2.5 cents/share (as it did in FY2019, before Covid broke out) for FY2023, which it can well afford?

|

Straco: Dividends |

|||||

|

Period |

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

|

SGD cent |

3.5 |

2.5 |

1 |

1 |

1 |

While its 3Q2023 was highly profitable, it was still below pre-Covid years when 3Q profit ranged between S$19 million and S$23 million.

That's perhaps because the spending power of consumers in China, in particular, has yet to fully recover after being hit by the pandemic.

Consider also that the admission ticket prices to Straco's key attractions are not exactly cheap:

| • Shanghai Ocean Aquarium: RMB160 (S$30) for adults and RMB110 (S$21) for children. These prices have not been revised for many years. If and when they are revised, the impact on Straco's bottomline is likely to be significant. • Singapore Flyer (inclusive of Time Capsule): S$40 and S$25 for adults and children, respectively. |

(Straco's secondary attractions are the Lixing cable car service at Mount Lishan in Shaanxi province and the Underwater World Xiamen).

What will 4Q2023 look like?

In FY17 and FY18, Straco reported S$6 million net profit for 4Q.

That fell sharply to S$1.8 million in FY19 owing to disruptions to the operations of the Singapore Flyer as well as higher expenses. (Note: Straco bought over the Flyer in Dec 2014).

Let's exclude the Covid years' performance from consideration. Thus, this year's 4Q may bring a profit higher than S$1.8 million but not likely to exceed S$6 million.

Thus, a possible full-year 2023 range: S$25 - 29 million.

Assuming the above, Straco trades at roughly 10X PE on this year's earnings after deducting its cash.

Check out this video on the aquarium: