Shares of Straco Corp (52.5 cents) were up by as much as 6 cents (+12.9%) this morning following the company's announcement that it would report a "substantial net profit" for FY2023.

Straco, which operates the Shanghai Ocean Aquarium and the Singapore Flyer, attributed the FY2023 profit jump to:

1) Higher visitor numbers for its China attractions as domestic tourism recovered strongly post-Covid; 1) Higher visitor numbers for its China attractions as domestic tourism recovered strongly post-Covid;2) Higher visitor numbers for Singapore Flyer as international tourist arrivals recovered strongly; and 3) Lower exchange losses recorded in FY2023 compared to exchange losses of $5.37 million in FY2022. |

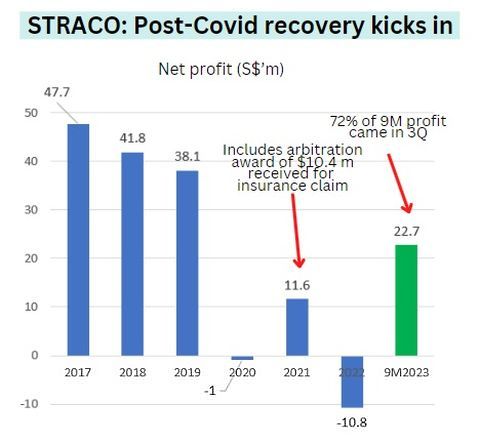

In an earlier article, we had flagged that Straco (current market cap: ~$445 million) looks to be a turnaround story after its 3Q2023 net profit came in at S$16.3 million.

It ended that quarter with net cash of $165.92 million, up from S$143 million as at end-2022.

The high cash levels augurs well for a higher payout than the 1-cent/share distributed in each of the three Covid years (even when Straco was operationally loss-making).

The 1-c/share dividend amounted to just S$8.6 million in absolute dollars.

|

Straco: Dividends |

|||||

|

Period |

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

|

SGD cent |

3.5 |

2.5 |

1 |

1 |

1 |

Straco said it would report its FY2023 results on Feb 29.