Under both JV agreements, Chuan Hup contributed the land and Finbar contributed the working capital necessary for the development. There should thus be no further foreseeable capital requirements for Chuan Hup going forward for these JVs. Profits from both developments will only be recognised upon physical completion and settlement of sold apartments.

Based on information from Finbar's website to date, Toccata has sold 68% of its units while Concerto's sales is at 46% (104 of 226 units) since marketing commenced in March and August 2014 respectively. Unison on Tenth has sold 32% of its units (54 of 167) since marketing commenced in early FY2015.

With a book value carried at cost of just US$33.5 million ($45.4 million) for both Symphony City and Unison, Finbar’s impressive track record, we expect positive contributions from these two projects over the next 3 years despite the current challenging conditions in the Western Australia real estate market. For illustration, Chuan Hup registered a profit before tax of US$19.4 million over FY2013 and FY2014 for its property development segment primarily due to completion of Adagio.

Other significant assets:

• A 32.5% stake in Security Land Corporation (SLC), a property developer in Philippines. SLC is majority controlled by Security Bank Corporation of Philippines, a US$ 2.1 billion company listed on the Philippines Stock Exchange, and has a joint venture agreement with Robinsons Land Corporation to construct a high-end condominium within the Makati financial district in Manila. Tower 1 and Tower 2 of the project, named Signa Designer Residences, were 84% and 44% sold respectively as at September 2014. SLC also owns an adjacent office block through which it derives regular rental income.

• Office units in GB building in Shenton Way, Singapore, acquired in November 2014 for $31.7 million as long term investments.

|

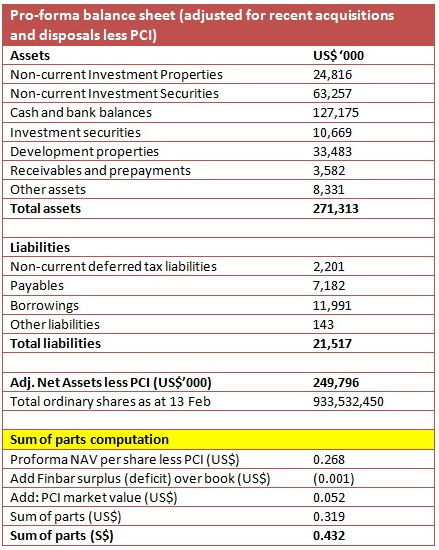

Recommendation We believe there is deep value embedded in Chuan Hup which should appeal to long term value investors. In addition, Chuan Hup's shareholders could also benefit in the short term should sales proceeds from the disposal of CHO shares be paid out as special dividends in a repeat of the disposal to Scomi Marine in 2005. The shares are currently trading at a 29.4% discount to its intrinsic conservative SOTP value of $0.432 per share with good downside protection provided by its adjusted net cash per share of $0.226 as well as a decent dividend yield of 3.3%. We are buyers at this price. |

Key Risks

The strengthening US dollar against both the Australian and Singapore dollar has resulted in Chuan Hup being hit by significant foreign currency related losses in recent quarters. We think that this could be a key concern going forward. The weakening Western Australian real estate market could also pose challenges to both its Australian JVs, although this is mitigated by the Australian JVs being carried on its books at cost.

(All preceding amounts in SGD unless stated, USD:SGD X-rate of 1.3550 and AUD:SGD X-rate of 1.0520 assumed)

I was supposed to but had could not leave my work commitments in the end.

How did it go? Was there any talk about how they intend to use the proceeds from CH Offshore sale?