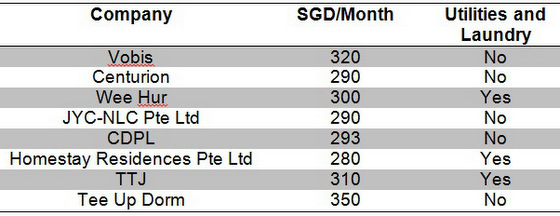

| Centurion has minimal competitive advantage Construction companies, which have the highest dependency ratio across industries, have been facing intense cost pressures in recent years due to rising labour costs. In an industry with a cost-conscious clientele, the differing factor between accommodation operators will inevitably center on price and prices offered are extremely competitive.  Location is a moot point as dormitories are located in similar suburban areas based on URA’s zoning plans. Centurion has little competitive advantage over its peers. Consequently, I do not forsee Centurion gaining market share over its competitors – future growth will be contingent on macro level factors. |

Singapore dormitory supply to increase by 43.4%, size of workforce to remain flat

There are currently 42 approved dormitories providing a total of 230,000 beds. 9 new purpose-built dormitories, providing about 100,000 beds will be constructed over the coming two years (2015-16) which will increase industry supply by 43.4%. Will the new supply be sufficiently absorbed by demand?

Consider this – according to statistics from the Ministry of Manpower, there are 768,000 work permit holders (excluding foreign domestic workers) as of December 2014. This figure has only nudged up 1.1% y-o-y from 2013 and has a 5 year CAGR of 3.2%.

Clearly, sufficient absorption of new supply tethers on a shift in accommodation type of existing workers, rather than broad-based growth in number of workers. Indeed, levy rates for work permit and S-pass holders (Appendix 3) are expected to increase in 2016 and 2017, resulting in a tighter foreign labour market.

According to the White Paper 2013, non-resident workforce (excluding foreign domestic workers) is expected to grow between 1-2% up till 2020; in contrast to the 5.5% CAGR achieved over the last 6 years. Given such circumstances, it would be reasonable to expect muted demand growth for the industry and Centurion.

Regulatory changes insufficient for growth

On 20 January 2015, Foreign Employee Dormitories Bill 2014 provided additional regulations and licensing requirement for the operators of larger dormitories with 1,000 and more beds. The new regulations act as barriers of entry for new and inexperienced dormitory operators, which bode well for the Group. However, it would be naïve to believe that such regulations will simply hand over market share to Centurion on a silver platter. Remember, there are 21 other operators with more than 1,000 beds.

The living conditions and recreational activities for workers have come under scrutiny ever since the Little India Riots in December 2013. According to an MOM statement, the Government’s view is that in the longer term, it would be better to house work permit holders (WPHs) in Purpose-Built Dormitories (PBDs), where there are self-contained facilities to meet their social and recreational needs outside work. This has culminated in numerous regulatory changes.

URA revised guidelines in Nov 2014; no new ancillary and secondary worker’s dormitories will be allowed in certain industrial areas.

From 1 May 2015, workers in the marine and process sectors will no longer be allowed to be housed in HDB flats. In all, these regulations primarily affect workers in the marine, process and manufacturing (who are situated in industrial zones) sectors.

Will these regulations cause 100,000 workers to be shifted to purpose-built dormitories? It seems highly unlikely considering the following proposition.

The service sector has a total employment of 2,585,300 as of June 2015. We can estimate the number of foreign service workers based on the minimum permitted dependency ratio of 10%.

Is it possible that the affected segment (manufacturing workers in the 12 industrial zones as well as marine and process workers who currently live in HDB flats) constitute 53.3% of the entire marine, process and manufacturing worker population? This article was recently published on Value Edge and is republished with permission. Yeo Sui Chuan (left) has been featured in the Sunday Times and the Business Times' Young Investor.

This article was recently published on Value Edge and is republished with permission. Yeo Sui Chuan (left) has been featured in the Sunday Times and the Business Times' Young Investor.