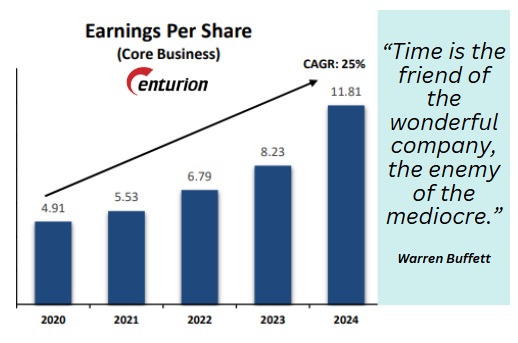

| There is a chart in the presentation deck of Centurion Corporation which shows the strong 25% CAGR growth of its earnings in the past 5 years. It brings to mind a quote from legendary investor Warren Buffett which we have juxtaposed with the chart (see below).

|

At Centurion results briefing: David Phey (standing), head of corporate communications, and Foo Ai Huey (on his right), CFO. Photo: Shivam Saraf

At Centurion results briefing: David Phey (standing), head of corporate communications, and Foo Ai Huey (on his right), CFO. Photo: Shivam Saraf

During its FY24 results briefing, the company’s management shared insights into its growth strategies across purpose-built worker accommodation (PBWA), purpose-built student accommodation (PBSA), and the emerging build-to-rent (BTR) segment.

They also addressed the outlook for their key markets.

Centurion's Growth Plans

1. Expanding Core Segments

Centurion has been a dominant player in offering accommodation for two specific categories of tenants (workers and students), with 37 operating assets across six countries, including Singapore, Malaysia, the UK, and Australia.

The company plans to further expand its bed capacity, which stood at nearly 70,000 as of 2024. The growth plans include:

- Worker Accommodation: It is redeveloping two key sites in Singapore—Westlite Toh Guan and Westlite Mandai—to add nearly 5,500 beds by 2026.

- Student Accommodation: Centurion operates 17 PBSA assets globally.

Demand for student housing remains strong, especially in the UK and Australia, and supply very short. In Australia, up to 1,900 extra beds are being planned.

Centurion's "dwell-branded" student accommodation property in Manchester offers close to 1,000 beds, the largest capacity in its UK portfolio of nearly 2,800 beds for students.

Centurion's "dwell-branded" student accommodation property in Manchester offers close to 1,000 beds, the largest capacity in its UK portfolio of nearly 2,800 beds for students.

2. Venturing into Build-to-Rent (BTR)

Recognising affordability challenges among young couples and professionals, in 2024, Centurion ventured into BTR through 2 joint ventures in China involving two properties with 1,500 apartments in aggregate.

"This segment is interesting because we see growing demand from residents who prefer long-term rentals over home ownership," explained David Phey, the head of corporate communications.

3. Embracing an Asset-Light Strategy

Centurion is adopting an asset-light approach (without owning all properties outright) to scale its portfolio efficiently, through joint ventures, for example.

4. Exploring a REIT Spin-off

The company is exploring shifting selected assets -- worker accommodation and student accommodation -- into a separate entity (a real estate investment trust, or REIT).

Some units in the proposed REIT held by Centurion will be distributed to shareholders. CEO Kong Chee Min (extreme right) speaks with Kelvin Teo, Chief Operating Officer -- Accommodation Business. With them is Ho Lip Chin, Chief Investment Officer – Accommodation Business. Photo: Shivam Saraf

CEO Kong Chee Min (extreme right) speaks with Kelvin Teo, Chief Operating Officer -- Accommodation Business. With them is Ho Lip Chin, Chief Investment Officer – Accommodation Business. Photo: Shivam Saraf

Riding Favourable Market Trends

1. Worker Accommodation

The demand for PBWA remains robust across Centurion’s markets.

- Singapore: The government mandates that construction, marine, and shipyard workers reside in approved accommodations with specific standards.

This creates a captive customer base of around 443,000 workers. However, supply is constrained as temporary dormitories reach lease expiry without renewal. - Malaysia: The enforcement of Act 446 on worker housing standards is driving demand for professionally managed accommodations.

Employers are increasingly moving workers into compliant facilities like Centurion's. - Hong Kong: Centurion recently entered this market with two operational assets catering to cross-border workers from mainland China.

2. Student Accommodation

Demand continues to outstrip supply in key markets like the UK and Australia.

- UK: Centurion's assets achieved a financial occupancy rate (the percentage of available units that are generating rental income) of 98% in 2024 versus 93% the year before.

Rental reversions (ie adjustments in rental rates when leases are renewed or new tenants move in) contributed to a 20% year-on-year revenue growth to S$40.2 million. - Australia: Occupancy rose from 88% in 2023 to 96% in 2024 across Centurion’s two assets.

The chronic undersupply of student housing presents a strong growth opportunity.

|

Financial Performance and Outlook Centurion delivered robust financial results in FY2024:

Looking ahead:

|

The FY2024 presentation deck is here.