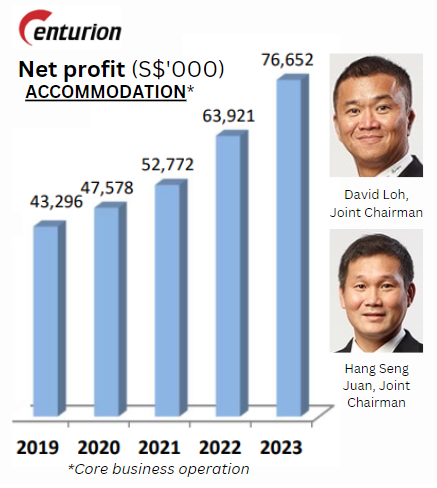

• Two of UOB Kay Hian's alpha picks turned from being lazy to supercharged in July 2024. They are Civmec and CSE Global. • Civmec (+18.9% m-o-m) and CSE Global (+18.8% m-o-m) were flattish for the most of 2024. UOB KH says Civmec outperformed on continued order wins and a change of domicile to Australia while CSE Global rose higher due to its upcoming attractive 1H24 dividend. • Meanwhile, in a 1 Aug update, the broker kept its portfolio virtually unchanged -- just adding SingPost and removing SIA Engineering. • One of the remaining alpha picks is Centurion Corporation, a S$538-million market cap company.  ASPRI-Westlite Papan: This Centurion worker accommodation is strategically located near Jurong Island, home to more than 100 global energy and chemical companies. ASPRI-Westlite Papan: This Centurion worker accommodation is strategically located near Jurong Island, home to more than 100 global energy and chemical companies. Centurion's accommodation profit had been turning up even through the pandemic.Its stock has gained 60% since the beginning of the year (from 40 cents to 64 cents), as its FY23 results continued a long-running profit streak (see chart). Centurion's accommodation profit had been turning up even through the pandemic.Its stock has gained 60% since the beginning of the year (from 40 cents to 64 cents), as its FY23 results continued a long-running profit streak (see chart). As the largest Purpose-Built Workers accommodation (PBWA) provider in Singapore and Malaysia, Centurion is riding on high demand for foreign workers' living quarters. See: CENTURION: Homes for workers can't be built fast enough, so this company is enjoying a rental boom UOB Kay Hian has a target price of 77 cents for the stock. Read on ... |

Excerpts from UOB Kay Hian report

Analyst: Adrian Loh

Centurion Corporation (CENT)

• Strong growth from its Singapore portfolio. Centurion’s positive 1Q24 business update saw its key Purpose-Built Workers’ Accommodation (PBWA, 76% of revenue) segment witnessing a 31% yoy revenue increase due to its Singapore assets which saw slightly higher occupancy rates (1Q24: 99%).

With its ability to pass on inflation and higher costs, it would appear that profit margins have easily been maintained or even expanded, in our view. |

||||

| Student accommodation – full steam ahead |

Similar to its PBWA assets, the company’s Purpose-Built Student Accommodation (PBSA, 24% of revenue) segment saw a material 25% yoy increase given the seasonality of student entries into its Australian assets.

As a result, financial occupancy at its UK and Australian PBSA assets were 99% and 90% respectively.

Both geographic segments continue to witness robust pre-bookings for the forward academic years, and rental increases have tracked at 8-10% yoy.

| Maintain BUY with a target price of S$0.77 |

• Maintain BUY with a target price of S$0.77, which is based on a target PE multiple of 7.9x and in line with Centurion’s average PE over the past 10 years.

SHARE PRICE CATALYSTS

• Events:

a) Successful capital recycling efforts or capacity expansions involving JVs could result in a more asset-light business model that thus requires less capital intensity, and

b) higher-than-expected dividend payout in 2024.

• Timeline: 6-12 months

Full report here.