|

Centurion Corporation said it was exploring an SGX‐listed REIT as of early January 2025, with DBS Bank and UBS advising on the plan. |

They start by carving out a proposed REIT that would house Centurion’s most stable assets—primarily its Singapore purpose-built worker accommodation (PBWA) portfolio along with freehold student beds in the UK and Australia.  Using cap rates of 7.5% for the PBWA segment in Singapore and 6% for purpose-built student accommodation (PBSA) overseas, they back into valuations on a per-bed basis.

Using cap rates of 7.5% for the PBWA segment in Singapore and 6% for purpose-built student accommodation (PBSA) overseas, they back into valuations on a per-bed basis.

(“cap rate,” is a key metric in real estate that expresses the annual return on an income‐producing property as a percentage of its current market value)

For example, the analysts value each Singapore PBWA bed at about $44,688 and UK PBSA beds at around $194,940.

Next, they apply occupancy and income assumptions.

Multiplying these inputs by the total bed count in each geography gives an RNAV slice for each segment.

|

|

Beds |

Rent ($/mth) |

Occ. (%) |

NPI Margin (%) |

Cap Rate |

Val’n/ |

Val'n 100% stake |

|

UK PBSA |

2,786 |

2,052 |

95 |

50 |

6.0 |

194,940 |

543 |

|

US |

663 |

1,620 |

95 |

50 |

6.0 |

153,900 |

102 |

|

AU PBSA |

897 |

1,488 |

95 |

50 |

6.0 |

141,360 |

127 |

|

SG PBWA |

36,436 |

420 |

95 |

70 |

7.5 |

44,688 |

1628 |

|

MY PBSA |

28,053 |

75 |

95 |

70 |

8.0 |

7,489 |

210 |

UK = United Kingdom, US = United States, AU = Australia, SG = Singapore, MY = Malaysia

That slice for the REIT platform comes to about $1.16 per Centurion share.

The remaining business—covering Malaysia PBWA, China Build-To-Rent and other segments—is valued at about $0.91 per share, bringing the total RNAV to $2.07.

They also bake in Centurion’s development pipeline, which includes new beds coming on stream by 2026 in Singapore, Johor and Australia.

Spending of roughly $120 million on upcoming projects adds another roughly $180 million to the overall portfolio value.

This ensures the RNAV reflects not just today’s assets but the near-term growth story as well.

Centurion’s near-term development pipeline adds ~7,060 beds by 2026:

|

Asset |

Additional Beds |

Est. Completion |

|

Westlite Toh Guan (SG) |

1,764 |

End 2025 |

|

Westlite Mandai (SG) |

3,696 |

2026 |

|

Westlite Johor Tech Park (MY) |

870 |

4Q 2025 |

|

Macquarie Park PBSA (AU, 25% stake) |

732 |

Nov 2025 |

The RNAV of Centurion hits $2.07, and the analysts apply a 20% discount, which brings the fair value down to $1.72.

|

Component |

RNAV/Share (SGD) |

Notes |

|

REIT platform |

1.16 |

$0.80 cash + $0.36 sponsor stake |

|

Remaining business |

0.91 |

Malaysia PBWA, China BTR, other segments |

|

Total RNAV |

2.07 |

Sum of slices before discount |

|

Discount to RNAV |

20% |

Reflects possible post-spin-off trading discount |

|

Fair Value per share |

1.72 |

Implies c.21% upside from $1.42 close |

The REIT listing itself is estimated to unlock up to $1 billion in cash for Centurion, giving it fresh ammunition for further bed growth or special dividends to shareholders.

Post-listing, DBS analysts expect Centurion to step up its Australia PBSA expansion and explore new PBWA markets, leveraging the firepower from the spin-off to replicate the rapid bed growth seen since its 2011 pivot into lodging.

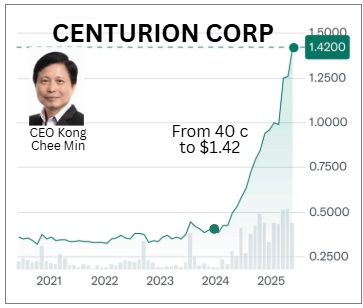

| Bottom line: DBS’s valuation hinges on slicing Centurion into a cash-rich, fee-light REIT and a growth-oriented sponsor. By valuing each slice on established cap rates, occupancy and rent assumptions, then applying a sensible discount to that combined RNAV, the analysts arrive at $1.72 per share—suggesting about 21% upside from recent levels if the spin-off goes ahead. |

The DBS report is here.