|

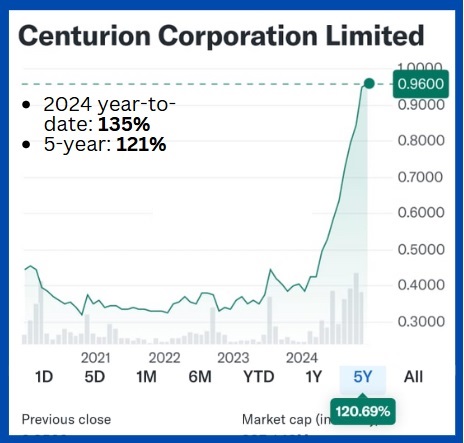

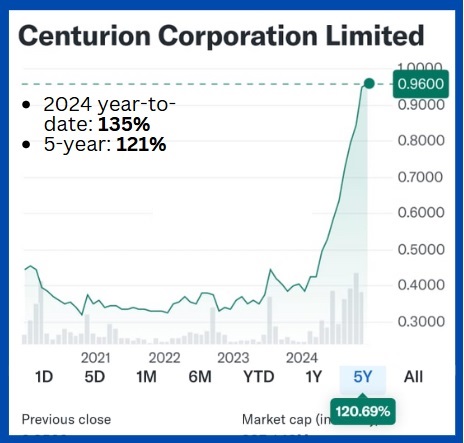

• The chart shows Centurion Corp stock went nowhere for 4 years and then, this year, made a strong sprint. It shot up from 41 cents at the start of 2024 to 96 cents now, a 135% gain.

• Its Purpose-Built Workers Accommodation (PBWA) and Purpose-Built Student Accommodation (PBSA) have enjoyed higher occupancies and higher rental rates upon renewal.

• After Centurion's 3Q2024 results, CGS International and UOB KH raised their target prices, to $1.00 and $1.11, respectively, which means the stock sprint is slowing down.

Centurion management at 1H2024 results briefing (L-R): Ho Lip Chin, Chief Investment Officer – Accommodation Business | CEO Kong Chee Min | CFO Foo Ai Huey | Head of Corp Communications David Phey. File photo: Company Centurion management at 1H2024 results briefing (L-R): Ho Lip Chin, Chief Investment Officer – Accommodation Business | CEO Kong Chee Min | CFO Foo Ai Huey | Head of Corp Communications David Phey. File photo: Company

• Beyond organic growth by increasing rental spaces, Centurion (market cap: S$810 million) has been embarking on an asset-light strategy and prioritising "unlocking value", as CEO Kong Chee Min said in a 3Q business update.

• There have been value unlocking through capital recycling initiatives, such as sale-and-leaseback agreements, and a 2015 plan (since aborted) for a REIT spin-off.

Centurion operates not just in Singapore but also Malaysia, the UK, the US, Australia, and China.

For UOB Kay Hian's latest take on the company, read excerpts below...

|

Excerpts from UOB Kay Hian report

Analyst: Adrian Loh

Centurion Corporation (CENT)

A Stock To Accommodate Growth-Minded Investors

CENT reported stronger-than-expected 9M24 revenue growth of 25% yoy to S$186.5m, driven by continued strong occupancies and positive rental revisions across both of its business segments.

|

CENTURION

|

|

Share price:

$0.96

|

Target:

$1.11

|

The company remains busy on the business development front by expanding into China in the build-to-rent space as well as bolstering its position in its Australian PBSA segment.

We upgrade our 2024-26 EPS by 2-11%.

Maintain BUY. Target price raised to S$1.11. |

WHAT’S NEW

• Handily beating expectations again. Centurion Corp (CENT) reported strong 9M24 revenue of S$187m (+25% yoy) which formed over 82% of our full-year revenue estimate.

Like its 1H24 results, the company’s strong performance was attributed to strong occupancy rates and healthy rental revisions across its portfolio of Purpose-Built Workers Accommodation (PBWA) and Purpose-Built Student Accommodation (PBSA) assets with revenue growths of 27% and 20% yoy respectively.

ASPRI-Westlite Papan: This Centurion worker accommodation is strategically located near Jurong Island, home to more than 100 global energy and chemical companies.

ASPRI-Westlite Papan: This Centurion worker accommodation is strategically located near Jurong Island, home to more than 100 global energy and chemical companies.

• Solid growth outlook from a healthy pipeline – guidance remains bullish. As seen in the chart overleaf, CENT should see around 16% volume growth in both its PBWA and PBSA segments during 2H24-2H26.

On our estimates, around 66% of the growth will come from PBWAs in Singapore.

In addition, the company commented that it is currently exploring opportunities for a potential development of around 7,000 beds in Iskandar, Johor, which we believe depends on the progress of the Special Economic Zone.

• Consistent insider buying this year. In a positive sign of the company’s near- to medium term outlook, we note that its CEO and its co-chairman have consistently bought the company’s shares this year.

Between them, they have purchased 2.39m shares at prices of S$0.40-0.74/share between Mar and Sep 24.

• Potential for higher dividend payout. Recall that during its 1H24 results, CENT declared a dividend of S$0.015, implying a 26% dividend payout based on EPS of S$0.0577 from its core business operations.

We have maintained our current forecast dividend of S$0.03 for the full year, but we believe that there is a high likelihood of an upside to S$0.035 given the better-than-expected earnings, implying a 2024 yield of 3.6% based on yesterday’s closing share price.

VALUATION/RECOMMENDATION

|

• Maintain BUY with a higher PE-based target price of S$1.11 (previously S$0.85) because of our earnings upgrades outlined above.

Adrian Loh, analystIn addition, we have raised our target PE multiple to 8.7x (previously 7.0x) which is 0.5SD above the company’s long-term average PE multiple of 6.9x (excluding 2019 which was affected by COVID-19). Adrian Loh, analystIn addition, we have raised our target PE multiple to 8.7x (previously 7.0x) which is 0.5SD above the company’s long-term average PE multiple of 6.9x (excluding 2019 which was affected by COVID-19).

In our view, our target PE multiple is undemanding given the company’s earnings growth over the next two years.

We believe that the company’s current metrics are inexpensive, trading at 2025F PE of 8.1x and 0.8x P/B.

Ytd, CENT’s 135% share price increase easily outperformed the STI’s total return, and we expect continued outperformance in the next 12 months.

SHARE PRICE CATALYST

• Capacity expansion involving JVs which are more asset light and require less capital intensity; higher dividends in the year-end results.

|

Full report here.