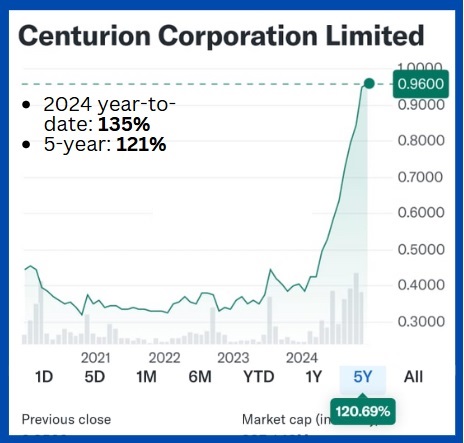

| Centurion Corporation, whose stock has turned hot of late, took part in an online webinar hosted by Phillip Securities. Read excerpts of the Q&A session below.... |

Q: For the Singapore commercial dormitories, the valuation outputs from the FY22 report went from 586 million to 720 million in the FY23 report. The valuation technique was expanded to include a Discounted Cash Flow (DCF) approach in addition to the Income Capitalisation approach.

Was the FY23 valuation done by the same valuer as FY22? Is there any particular reason for the broadening of the valuation technique?

A: The same valuer was used for both the FY22 and FY23 valuations. The company broadened their valuation techniques to include both DCF and income capitalisation methods because they believe it provides a more fair valuation compared to relying on just one method.

This change was made after the company delisted from the Hong Kong Stock Exchange. The Hong Kong Stock Exchange only uses the income capitalisation approach and does not recognise DCF.

Q: For the Singapore Purpose-Built Worker Accommodation (PBWA) market, can you share how the overall market supply will look like once the entire market transitions to the new regulatory requirements? Can you also remind us of the defined regulatory requirements?

A: The Singapore government announced two changes regarding regulatory requirements for worker dormitories.

First, new dormitories being built must comply with the new standards. This includes providing 4.2 sq m of living space per resident, including an ensuite toilet.

Existing dormitories will also be required to comply with revised standards, which were developed for existing properties built in the past 10 years.

This revised standard requires dormitories to provide 3.6 sq m of space per resident.

Existing properties must comply with the revised standard by 2030, while all dormitories must comply with the new standard by 2040. Centurion has proactively invested in their properties to ensure they meet the new standards ahead of the 2040 deadline.

Q: How are the initial inquiries on your new Westlite dormitory at Ubi and what are the advertised rates?

A: Advertised rental rates are in the range of 550 to 600 Singapore dollars. The dormitories are located in the east of Singapore where pricing is different to the west. The company believes the rates are competitive.

Q: What are the reasons for students to use your dormitories? Is it just proximity to university and lack of rental housing nearby?

A: Proximity to university is a major factor in student choice of accommodation, however, students also prefer options that are located closer to city centres.

Some dormitories cannot be built near universities due to space constraints. Centurion is careful in its selection of locations for their dormitories to ensure they meet student needs.

For example, the company has more than one dormitory in Melbourne, which serves students attending RMIT University, the University of Melbourne and other universities.

Another factor that makes Centurion dormitories attractive is the amenities provided, including study rooms, gyms and recreation rooms.

Security is also a big factor, and the company believes their resident care and activity programme, known as 'resi life', is a big differentiator compared to its competitors. This programme offers events, activities, onboarding and orientation to help students adjust to university life and socialise. Centurion manages all of its student accommodation, unlike some companies who engage third party managers.

Q: Have you seen any impact from the freezing of international student intake in Australia? When do you think supply of student accommodations in Australia will meet demand especially after the restrictions?

A: It is not yet clear whether the proposed cap on international student intake will be implemented in Australia, as there is strong opposition within the government and from universities.

Officially, the cap is being proposed to ensure students choose to stay in Purpose-Built Student Accommodation (PBSA), rather than private rental accommodation, which would compete with local housing needs and push up rental rates.

A 2022 study found that Australia has the largest shortage of PBSA compared to other markets, like the US and UK. Despite efforts to increase supply, there is still a large gap in Australia and this gap will continue into the future.

Q: For the Build-to-Rent (BTR) accommodation in China, have you done any analysis between BTR and PBSA? Who are the targeted tenants for these rental housings? Who are your key competitors in this segment?

Answer: Centurion conducted analysis of the Chinese BTR market and identified a gap in high-quality, affordable housing. The targeted tenants for Centurion's BTR properties are working adults with 1 to 5 years of work experience after graduating from university.

The market in China is not easy, as it is not a tier 1 market, and so Centurion took a cautious approach by partnering with a local company that has been operating in the industry for many years. This partner currently has 16,000 beds in operation and a high occupancy rate, which provides confidence for the success of Centurion's planned 1,500 beds.

|

Q: When do you think the supply of local accommodation will meet demand in Singapore? A: There are many different types of worker accommodation in Singapore, including PBWA, Factory Converted Dormitories (FCD), onsite dormitories and private residential properties that are approved to house migrant workers. |

Q: How will the additional 11,000 accommodation beds built by JTC next year affect your pricing and competitive dynamics? Is there any difference between your dormitories and JTC's?

A: The new dormitories being built by JTC will be competition, particularly in the areas surrounding the new dormitories. However, Centurion's marketing strategy and strong performance in dormitory management will help to mitigate the effects of this increased competition.

Note that some existing dormitories will see their leases expire as the government requires the land for other purposes. This will help to balance the supply of beds coming online next year. There were two dormitories built by JTC, one with 16,000 beds and another one in Tuas.

The dormitory with 16,000 beds was intended to be temporary, but the government extended the lease due to a shortage of supply. The Tuas dormitory was suspended during construction due to changes in building standards, but construction has recommenced and will be progressively completed next year.

Q: What are your future plans for UK PBSA since there are no expansion plans announced?

A: The UK is a good market for PBSA, however, high interest costs and compressed yields make it difficult to acquire existing assets. As such, the company has suspended plans for acquisition in the UK market.

Centurion is exploring other strategic options for growth in the UK, including management contracts, master leases and development projects. The company prefers development projects for better yields. The company is pursuing similar opportunities in Australia, as highlighted by the development in Melbourne City and a new project in Sydney.

The PowerPoint deck is here.