|

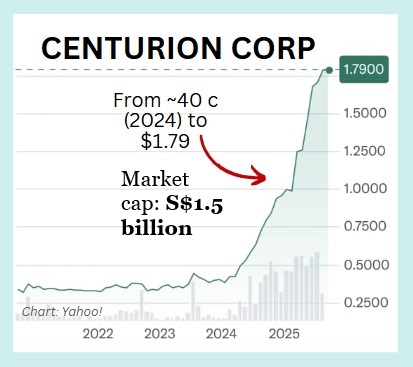

Centurion Corp is about to hit a big milestone next month (Sept 2025) -- it's spinning off Centurion Accommodation REIT (CAREIT) on the SGX Mainboard.

|

| Centurion's 1H25 numbers |

Solid core profits, folks.

Core PATMI jumped 19% year-on-year to about S$58 million, thanks to rental reversions across the board.

|

S$ mn |

1H25 |

1H24 |

YoY (%) |

Comments |

|

Revenue |

140.7 |

124.4 |

13.1% |

Positive rental revisions |

|

Gross Profits |

108.6 |

94.1 |

15.4% |

|

|

PATMI |

73.9 |

118.2 |

-37.5% |

S$63mn reduction in fair value gains |

|

Adj. PATMI |

57.8 |

48.5 |

19.2% |

Excl. fair value |

|

Adj. PATMI margins |

41.1% |

39.0% |

2.1% |

|

|

Dividend - Interim (cents) |

2.0 |

1.5 |

33.3% |

|

|

Source: Company, PSR |

||||

Centurion's worker dorms in Singapore are basically full at 99% occupancy – sixth straight quarter – with rents up around 10% amid a bed shortage.

Big projects like Changi Terminal 5 and Intergrated Resort expansions are fueling demand.

Over in the UK and Australia, student spots are hot too and look sustainable going by some key events: UK visa applications surged 32% in 1Q2025, and Australia's foreign student cap rose 9% to 295k for 2026.

Overall PATMI dipped 38% to S$74 million due to a S$63 million reduction in net fair value gains on investment properties, but analysts say ignore that noise – it's not core ops.

Both Phillip Securities and CGS International issued fresh reports, and they're bullish on Centurion.

| Big buzz: REIT |

Looking ahead, the big buzz is CAREIT's spin-off.

Phillip Securities analyst Ben Yik values Centurion's 45% stake at S$697 million in their SOTP model.

CGS analysts William Tng and Tan Jie Hui see it as a capital recycling play to grow assets under management (AUM), eyeing Aussie PBSA expansions like two Epiisod projects (over 1,300 beds by 2027).

Malaysia's PBWA holds steady, and Singapore's Westlite Mandai redevelopment could add 1,700 beds by FY27.

Phillip ups its target to S$2.01 (from S$1.88), maintaining its "Accumulate" recommendation on a 17x FY26 PE on non-REIT assets.  Security gantry at Westlite Ubi. Photo: Company Security gantry at Westlite Ubi. Photo: CompanyBottom line: Centurion's riding favorable supply-demand waves, with the REIT magic unlocking growth. If you're into steady yields from essential real estate, this could be a stock to consider for the long run. Centurion shares at S$1.79 recently have room to climb 12-14.5% in the near term, according to analysts. |