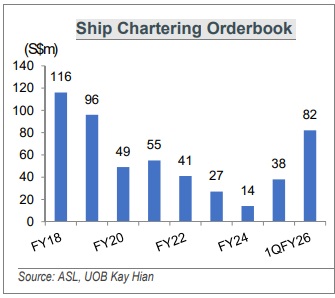

• After years in the doldrums, ASL Marine is starting to look like one of those amazing comeback stories. The group has slogged through debt issues and a tough offshore cycle, but its latest numbers confirm that chapter has finally closed. • In 1Q FY2026, ASL Marine saw a sharp recovery in ship repair and shipbuilding.  Ang Kok Tian, Chairman, MD & CEO of ASL Marine. File photo.• Stronger margins and better utilisation in the chartering division, supported by about S$82 million of fresh contracts, added extra fuel to the rebound. Ang Kok Tian, Chairman, MD & CEO of ASL Marine. File photo.• Stronger margins and better utilisation in the chartering division, supported by about S$82 million of fresh contracts, added extra fuel to the rebound. • And management is staying on track to deleverage after the last heavy year of loan amortisation in FY25. • With demand emerging from major Singapore infrastructure and coastal protection projects, UOB Kay Hian has kept a “BUY” call on the stock and nudged the target price up to S$0.35. • For more, read excerpts of UOB Kay Hian's report below ... |

Excerpts from UOB Kay Hian report

Analyst: Heidi Mo

| Highlights • ASL’s 1QFY26 earnings formed 30% of our full-year estimates and beat our expectations, lifted by stronger ship repair and shipbuilding contributions.

• Recovery momentum is backed by higher day rates, S$82m of new chartering contracts, a S$83m shipbuilding orderbook and S$55m of vessel-sale contracts. |

||||

Analysis

• Results beat. ASL Marine (ASL) reported revenue of S$94m (+12% yoy) and net profit of S$8m (1QFY25: S$0.5m), forming 24% and 30% of our full-year forecasts respectively.

The outperformance was driven by stronger ship repair and shipbuilding contributions, improved chartering margins and substantially lower finance costs of S$4m, offsetting the impact of the Oct 25 incident.  • Ship chartering: Margin uplift on greater utilisation. While revenue was stable yoy, we expect chartering gross margin to have risen meaningfully toward the mid-teens, supported by the deployment of more vessels at higher day rates.

• Ship chartering: Margin uplift on greater utilisation. While revenue was stable yoy, we expect chartering gross margin to have risen meaningfully toward the mid-teens, supported by the deployment of more vessels at higher day rates.

With S$82m of new contracts secured in Oct 25, chartering margins are expected to remain in the 10-15% range as utilisation improves throughout FY26.

• Ship repair: Core earnings driver remains strong. Ship repair continues to deliver a healthy volume growth on tight regional drydock capacity across Singapore and Batam.

| Stock price | 26 cents |

| 52-week range | 5-28 cents |

| Market cap | S$267 m |

| PE (ttm) | 17 |

| Dividend yield (ttm) | 0.9% |

| Source: Yahoo! | |

Margins remain robust, supported by sustained demand across maintenance and repair jobs. The upcoming third floating dock, scheduled for completion in early-FY27, provides additional medium term upside.

• Shipbuilding: Orderbook supports FY26. Shipbuilding revenue improved yoy on higher vessel completions. The orderbook remains anchored by the previously disclosed S$83m (31 vessels) as of end-FY25 for deliveries scheduled up to 3QFY26.

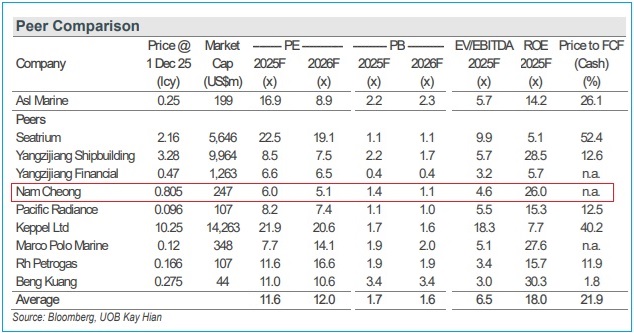

Nam Cheong has the lowest PE in 2025 and 2026 among peers.

Nam Cheong has the lowest PE in 2025 and 2026 among peers.

• AGM takeaways. Management reiterated a clearer strategic focus on ship repair and ship chartering, which offer more resilient, service-based recurring income compared with the cyclical and capital-intensive shipbuilding business.

The recent S$82m in coastal-protection and reclamation-related chartering contracts aligns with this direction and supports utilisation throughout FY26.

Management also highlighted that recent vessel disposals were part of a deliberate deleveraging effort, while confirming that FY25 marked the final year of significant non-cash loan amortisation, paving the way for lower finance costs ahead.

All ship repair activities and yard operations remain fully insured under annual revenue-based policies, ensuring comprehensive operational risk coverage.

• Singapore infrastructure pipeline provides long-term visibility. Singapore’s S$100b coastal protection plan, including the Tuas Mega Port (Phases 3 & 4) and Long Island Reclamation Project, provides long-term demand visibility for ASL’s marine services.

Historically, ASL has participated in key national projects such as the Jurong Island Road Link and Pulau Tekong reclamation. This track record reinforces ASL’s positioning as a preferred partner for Singapore’s ongoing and future maritime development projects.

• Maintain BUY with a 6% higher target price of S$0.35 (S$0.33 previously).  Heidi Mo, analystOur target is pegged to 11.6x FY26F PE, in line with its peers. Heidi Mo, analystOur target is pegged to 11.6x FY26F PE, in line with its peers. ASL currently trades at 9x FY26F PE, implying a 25% discount to peers despite a clear earnings recovery. With utilisation improving and deleveraging on track, we see scope for ASL’s valuation to narrow toward peer levels. |

→ See the full UOB KH report.

→ See the full UOB KH report.

→ See an overlooked stock:DBS Research initiates coverage, calling company an "Undervalued Gem, Ready to Set Sail"